Koppers Holdings Exceeds Expectations in Q1, Confirms FY23 Outlook

May 6, 2023

Trending News 🌥️

Koppers Holdings ($NYSE:KOP), Inc. is a leading provider of treated wood products and services, as well as carbon-based products and chemicals. The company recently reported its first quarter financials, exceeding expectations across both the top and bottom line. The strong results were driven by robust demand across all segments, particularly in the treated-wood and chemical products businesses.

Koppers Holdings’ stock price surged following the positive earnings report, and investors are feeling increasingly optimistic about the company’s future prospects. With strong demand across its business segments and a promising outlook for fiscal year 2023, Koppers Holdings is well-positioned for sustained success in the coming quarters.

Stock Price

Koppers Holdings made a strong start to the year, with its stock opening at $33.6 and closing at $33.2 on Friday, a 5.9% increase from its previous closing price of 31.3. This exceeded investors’ expectations, as well as the company’s own forecasts. The strong results come ahead of Koppers Holdings’ full-year earnings report, which is scheduled to be released in mid-July. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Koppers Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.98k | 63.4 | 3.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Koppers Holdings. More…

| Operations | Investing | Financing |

| 102.3 | -114.8 | 4.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Koppers Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.71k | 1.31k | 17.64 |

Key Ratios Snapshot

Some of the financial key ratios for Koppers Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.8% | -0.4% | 7.1% |

| FCF Margin | ROE | ROA |

| -0.2% | 22.8% | 5.1% |

Analysis

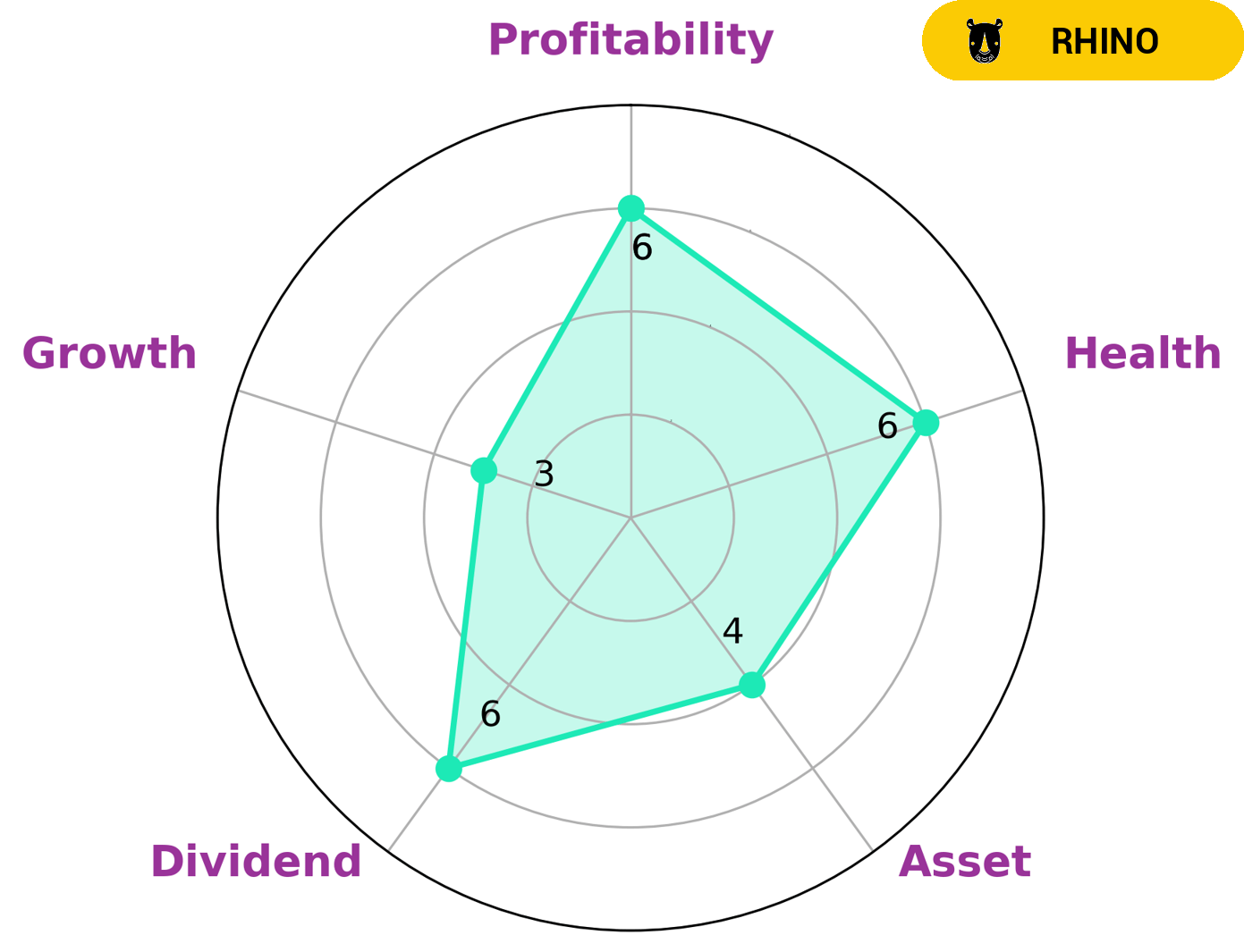

At GoodWhale, we have conducted an analysis of KOPPERS HOLDINGS‘ wellbeing. Our Star Chart shows that the company is strong in asset, dividend and profitability and medium in growth. We classify KOPPERS HOLDINGS as a ‘Rhino’, a type of company that has achieved moderate revenue or earnings growth. Such companies are likely to appeal to investors who are looking for established businesses with reliable performance and steady cashflows. KOPPERS HOLDINGS has an intermediate health score of 6/10 when considering its cashflows and debt, suggesting that it should be able to sustain operations in times of crisis. Nevertheless, potential investors should always be aware of the potential risks associated with any investment and should seek professional advice before making any decisions. More…

Peers

The company operates in North America, Europe, Asia Pacific, and South America. Koppers Holdings Inc. has been in business for over 100 years and has a strong brand presence. The company’s main competitors are Atul Ltd, Shikoku Chemicals Corp, and Ingevity Corp.

– Atul Ltd ($BSE:500027)

Atul Ltd is a market leader in the chemical industry with a market cap of 242.04B as of 2022. The company has a strong focus on R&D and innovation, which has led to a strong portfolio of products and technologies. Atul Ltd has a return on equity of 11.43%. The company has a strong presence in India and Asia Pacific region.

– Shikoku Chemicals Corp ($TSE:4099)

Shikoku Chemicals Corp is a publicly traded company with a market capitalization of $67.38 billion as of 2022. The company has a return on equity of 7.74%. Shikoku Chemicals Corp is engaged in the manufacture and sale of chemicals and chemical products. The company’s products include plastics, resins, dyes, and pigments. Shikoku Chemicals Corp is headquartered in Tokyo, Japan.

– Ingevity Corp ($NYSE:NGVT)

Ingevity is a company that provides products and services based on carbon technology. They have a market cap of $2.49 billion and a return on equity of 22.28%. The company has been in business for over 60 years and has a strong presence in North America, Europe, and Asia. Ingevity’s products are used in a variety of industries, including automotive, construction, and mining.

Summary

Investors are encouraged by KOP’s strong performance in a challenging market, and expect further upside in the stock price this year. As such, KOP is an interesting investment opportunity for those looking to capitalize on the company’s growth prospects.

Recent Posts