JD.com Reports Record-Breaking Q1 Results, Surpassing Expectations by $0.19 and $560M Respectively

May 12, 2023

Trending News ☀️

JD.COM ($NASDAQ:JD): The company reported non-GAAP Earnings Per Adjusted Diluted Share of $0.69, surpassing Wall Street estimates by $0.19, while its revenue of $35.4 billion exceeded projections by $560 million. The company has also diversified its services with the launch of its AI Catapult, a machine learning-based technology platform, and its financial arm JD Digits, which provides lending services and digital payments. These new initiatives have been key drivers of JD.com‘s growth over the past year and will likely continue to drive the company forward into the future.

Earnings

The reports showed record-breaking results, surpassing expectations with total revenue of 295.45 billion CNY, a 7.1% increase from the previous year, and 3.03 billion CNY in net income, a 158.7% decrease from the previous year. These impressive results clearly demonstrate JD.COM’s successful business strategy and commitment to excellence.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jd.com. JD.com_Reports_Record-Breaking_Q1_Results_Surpassing_Expectations_by_0.19_and_560M_Respectively”>More…

| Total Revenues | Net Income | Net Margin |

| 1.05M | 10.38k | 0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jd.com. JD.com_Reports_Record-Breaking_Q1_Results_Surpassing_Expectations_by_0.19_and_560M_Respectively”>More…

| Operations | Investing | Financing |

| 57.82k | -54.03k | 1.18k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jd.com. JD.com_Reports_Record-Breaking_Q1_Results_Surpassing_Expectations_by_0.19_and_560M_Respectively”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 595.25k | 321.13k | 136.08 |

Key Ratios Snapshot

Some of the financial key ratios for Jd.com are shown below. JD.com_Reports_Record-Breaking_Q1_Results_Surpassing_Expectations_by_0.19_and_560M_Respectively”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.9% | 35.8% | 1.5% |

| FCF Margin | ROE | ROA |

| 3.4% | 4.7% | 1.7% |

Share Price

On Thursday, the company opened at $36.4 and closed at $37.6, rising 7.2% from the prior closing price of $35.1. The impressive results highlight JD.com’s strength in China’s e-commerce market, as well as its ability to ensure sustainable growth amid the pandemic. The company has seen strong growth in its core businesses, including retail, marketplace and logistics.

Investors were also pleased with the company’s decision to expand its cloud computing business and launch new services to support its growing customer base. Investors will be watching to see if JD.com can maintain this momentum in the coming quarters. Live Quote…

Analysis

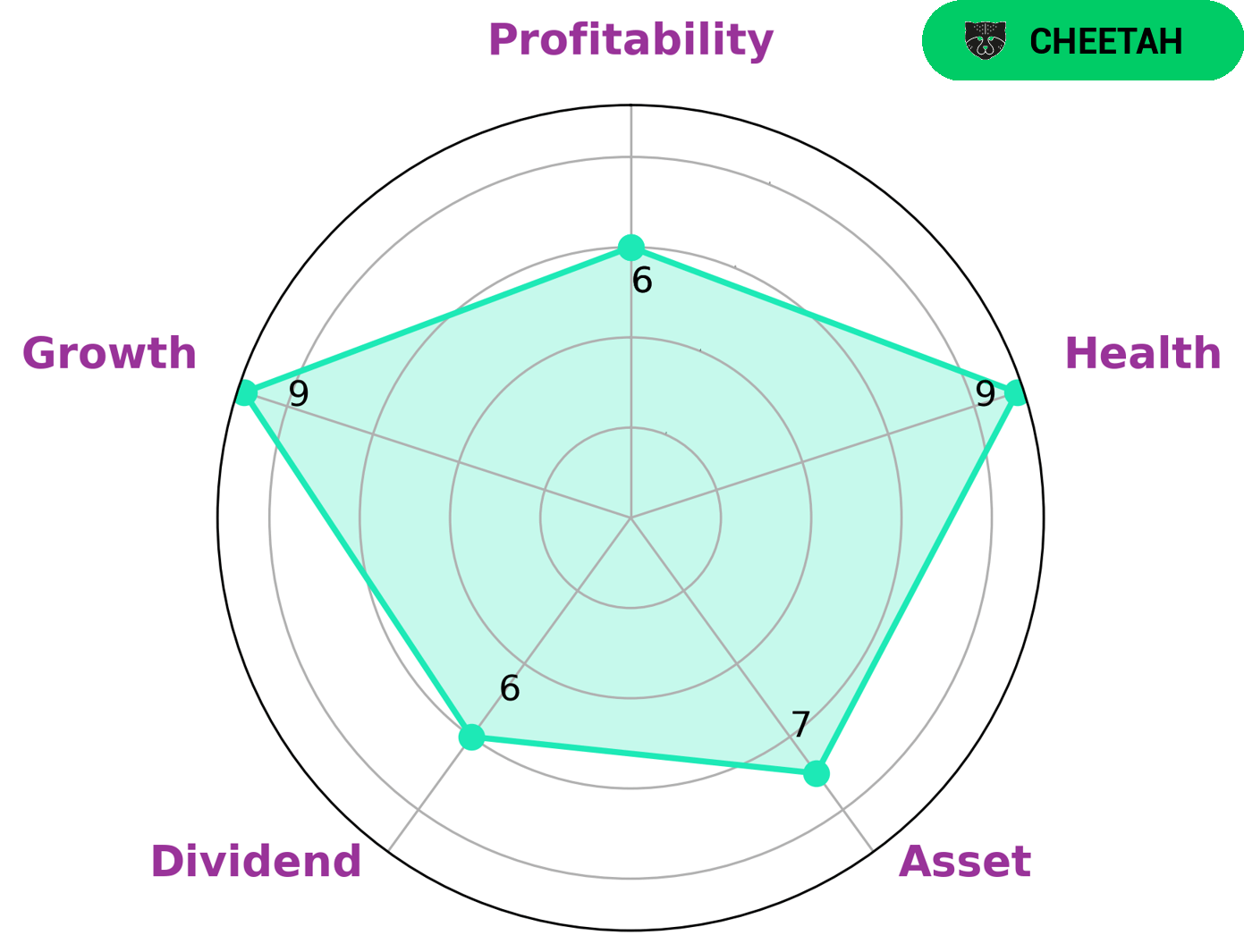

GoodWhale recently conducted an analysis of JD.COM’s wellbeing. During our research, we found the Star Chart to be highly indicative of the company’s strengths. According to the chart, JD.COM is strong in asset, growth and medium in dividend and profitability. This led us to classify JD.COM as a ‘cheetah’ – a term we gave to companies that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given JD.COM’s profile, we believe that the company may be attractive to a certain type of investor – those interested in high growth companies, but who may be willing to accept the higher levels of risk associated with it. This is especially true considering the company’s high health score of 9/10 with regard to its cashflows and debt, which shows that JD.COM is capable to pay off debt and fund future operations. JD.com_Reports_Record-Breaking_Q1_Results_Surpassing_Expectations_by_0.19_and_560M_Respectively”>More…

Summary

JD.com is an attractive investment opportunity due to its strong financial performance. These results were further bolstered by a corresponding increase in the company’s stock price on the same day, indicating investor confidence in JD.com’s future prospects. The company is well-positioned to capitalize on growth opportunities in the e-commerce market, and investors should consider adding JD.com to their portfolio.

Recent Posts