Graphic Packaging Holding Exceeds Q1 Expectations and Updates FY23 Outlook

May 3, 2023

Trending News 🌥️

Graphic Packaging Holding ($NYSE:GPK) Company (NYSE: GPK) recently reported its Q1 financial results and made revisions to its FY23 outlook. The company exceeded its Q1 top and bottom line expectations, likely due to the strength of its newly acquired business operations that are now fully integrated into its operations. Graphic Packaging Holding Company is a leading provider of packaging solutions for a wide range of products. The company’s innovative packaging solutions help producers and marketers of consumer goods to safely and effectively transport, store, and market their products.

As a result of the strong performance in Q1 and the successful integration of its newly acquired business operations, Graphic Packaging Holding Company has revised its FY23 outlook. The company now expects to generate revenue growth in the high-single-digit to low-double-digit range. This revised outlook reflects the company’s confidence in its ability to successfully execute its long-term strategy and deliver strong financial results.

Market Price

The stock opened at $25.3 and closed at $25.4, up by 3.2% from the previous closing price of $24.6. Investors have responded positively to the news, as the stock has risen 3.2% from its previous closing price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for GPK. More…

| Total Revenues | Net Income | Net Margin |

| 9.44k | 522 | 6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for GPK. More…

| Operations | Investing | Financing |

| 1.09k | -435 | -666 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for GPK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.33k | 8.18k | 7 |

Key Ratios Snapshot

Some of the financial key ratios for GPK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 21.9% | 9.7% |

| FCF Margin | ROE | ROA |

| 5.7% | 27.8% | 5.5% |

Analysis

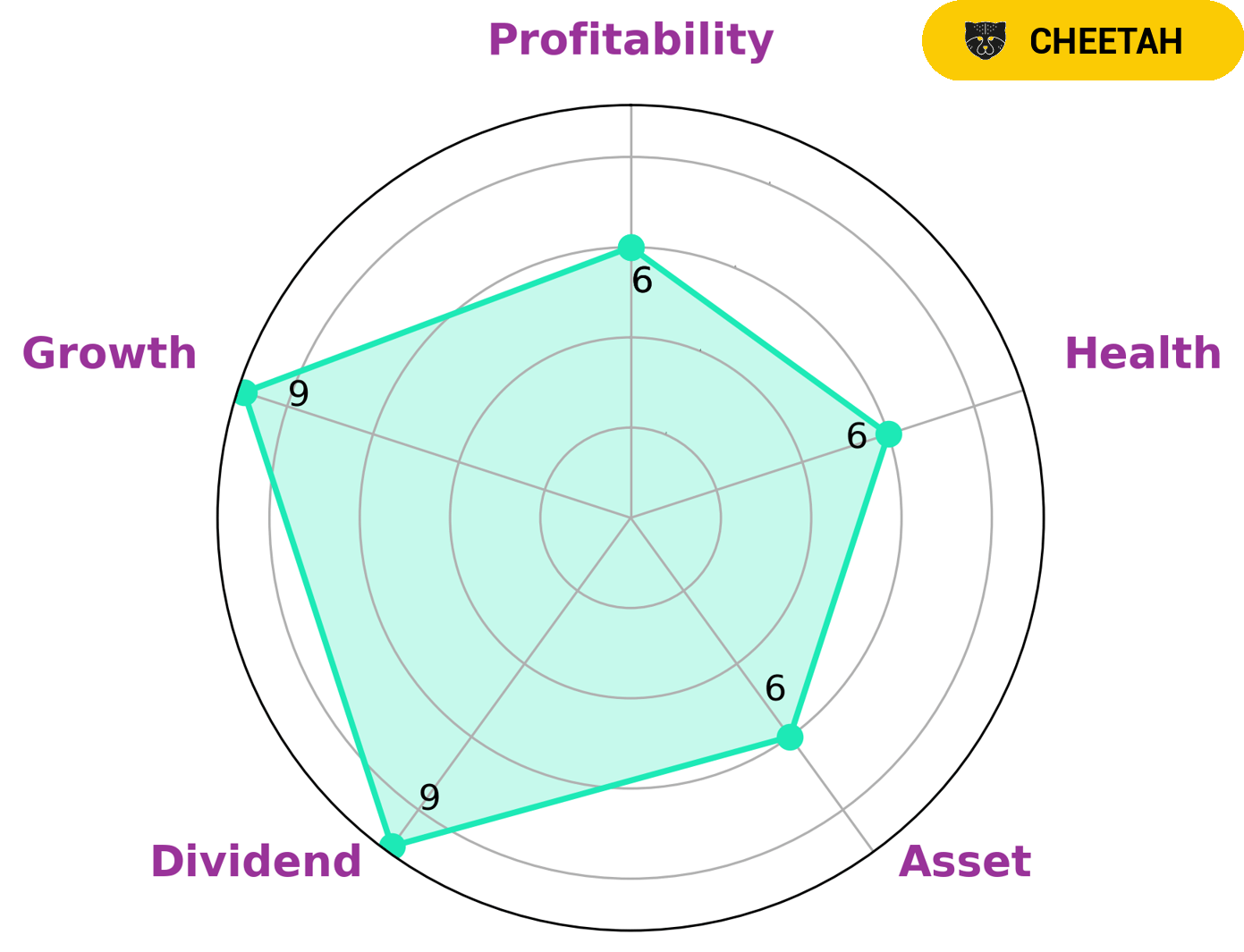

GoodWhale has conducted a review of GRAPHIC PACKAGING HOLDING’s fundamentals. Our Star Chart shows that GRAPHIC PACKAGING HOLDING is classified as ‘cheetah’, meaning the company has achieved high revenue or earnings growth, but it is considered less stable due to lower profitability. Investors who are looking to make a quick profit might be interested in this type of company. We have determined that GRAPHIC PACKAGING HOLDING has an intermediate health score of 6/10 considering its cashflows and debt and should thus be able to sustain future operations in times of crisis. With regards to its other financials, GRAPHIC PACKAGING HOLDING is strong in dividend, growth, and medium in asset and profitability. More…

Peers

The competition in the packaging industry is fierce, with Graphic Packaging Holding Co leading the pack. Its competitors, WestRock Co, International Paper Co, and Sonoco Products Co, are all trying to keep up, but they are struggling to match Graphic Packaging’s innovation and efficiency.

– WestRock Co ($NYSE:WRK)

The company has a market cap of 8.51B as of 2022. The company’s return on equity is 8.61%. The company is engaged in the production of corrugated packaging products and solutions. The company has a diversified customer base, including producers of packaging, consumer and industrial products. The company operates in three segments: Corrugated Packaging, Consumer Packaging and Industrial Packaging. The Corrugated Packaging segment produces corrugated packaging products, including linerboard, medium and recycled medium. The Consumer Packaging segment produces folding cartons, cups, plates and bowls. The Industrial Packaging segment produces a range of packaging products, including containerboard, kraft paper, bleached paperboard and corrugated packaging products.

– International Paper Co ($NYSE:IP)

In 2022, International Paper Company had a market capitalization of 12.11 billion dollars and a return on equity of 11.61%. The company produces paper and packaging products and has operations in North America, Europe, Latin America, Russia, Asia, Africa, and the Middle East. International Paper is one of the world’s largest paper companies and has been in business for over 100 years.

– Sonoco Products Co ($NYSE:SON)

Sonoco Products Company is a global provider of packaging products and services. The company operates in four segments: Consumer Packaging, Industrial Packaging, Display and Packaging Services, and Sonoco Europe. The company’s products include steel and plastic drums, steel and plastic pails, steel and plastic intermediate bulk containers, steel and plastic closure rings and lids, steel and plastic food cans, steel and plastic paint cans, steel and plastic jar lids, steel and plastic tubes, composite cans, flexible packaging, and corrugated containers. The company also provides display packaging products, such as point-of-purchase displays, in-store merchandising displays, and packaging for the retail sector; and packaging services, such as design, prototyping, sourcing, manufacturing, logistics, and warehousing.

Summary

Graphic Packaging Holding Co. (GPK) reported strong first quarter results that exceeded analyst estimates, driven by increased demand in consumer packaging business and higher margin in industrial packaging. The stock price moved up following this news and investors continue to be optimistic about the company’s future growth prospects. GPK is expected to benefit from increasing demand for its consumer packaging products and favorable pricing in the industry. Given its strong fundamentals and positive outlook for growth, GPK is a good investment opportunity for long-term investors.

Recent Posts