Embecta Corp Intrinsic Stock Value – EMBECTA CORP Blows Past Q1 Expectations, Updates FY23 Outlook

May 13, 2023

Trending News 🌥️

Embecta Corp ($NASDAQ:EMBC), an industry-leading technology and services provider, has blown past expectations for their first quarter results of FY23. Both the top and bottom line results exceeded expectations and the company was able to revise its outlook for the year to be even stronger. The company’s stellar performance is due in part to its long-term commitment to providing innovative solutions and services to its customers. This commitment is exemplified in its focus on building powerful technology platforms, as well as its dedication to providing world-class customer service. Embecta has also made significant investments in research and development to stay ahead of the competition. The strong Q1 results have rekindled investor confidence in the company and its ability to grow.

Embecta’s stock price has surged in response, reaching new highs and continuing to perform well in the markets. The company’s leadership team is confident that their strategy of focusing on innovation and customer service will continue to propel them forward in the year ahead. Embecta’s revised outlook for FY23 predicts further growth and success for the company. It remains committed to providing innovative solutions and services that meet the changing needs of its customers, and investors are optimistic about the future of the company. With a strong commitment to staying ahead of the competition and a focus on delivering customer value, Embecta looks poised to soar in the coming year.

Market Price

EMBECTA CORP has had a great start to their fiscal year, blowing past expectations for Q1. On Friday, their stock opened at $31.4 and closed at $30.7, representing a 6.1% rise from the last closing price of 28.9. This increase is a clear sign that investors have confidence in the company’s ability to build on its success.

The company also updated their outlook for FY23, in which they are predicting solid growth. With the stock showing such strong performance and an improved outlook, it appears that EMBECTA CORP is well-positioned to continue its success moving forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Embecta Corp. More…

| Total Revenues | Net Income | Net Margin |

| 1.12k | 160 | 18.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Embecta Corp. More…

| Operations | Investing | Financing |

| 333.8 | -24.4 | 80.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Embecta Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.2k | 2.03k | -14.61 |

Key Ratios Snapshot

Some of the financial key ratios for Embecta Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -9.8% | 24.0% |

| FCF Margin | ROE | ROA |

| 27.7% | -19.4% | 14.0% |

Analysis – Embecta Corp Intrinsic Stock Value

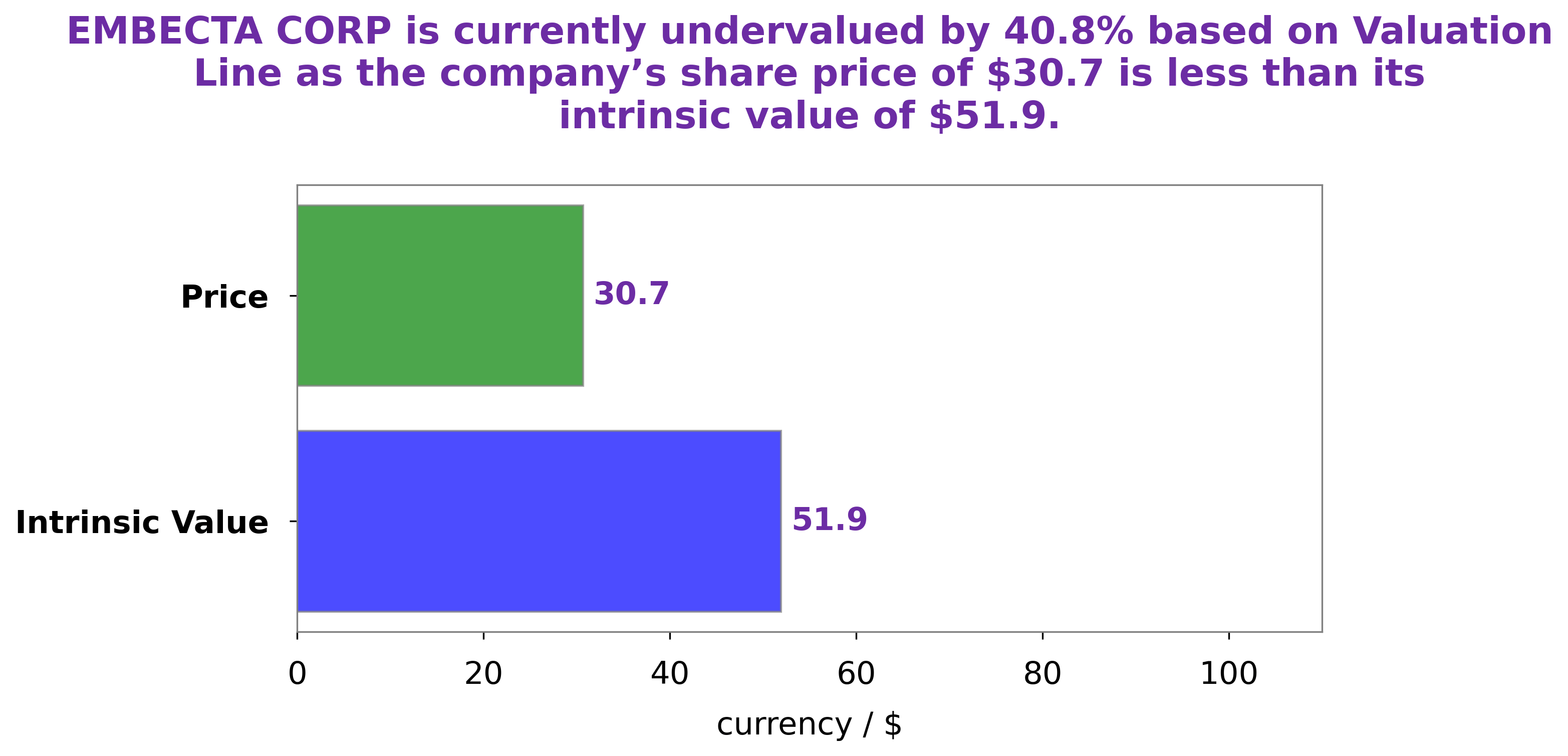

GoodWhale has conducted an analysis of the wellbeing of EMBECTA CORP, and the results are quite positive. Our proprietary Valuation Line has calculated the intrinsic value of EMBECTA CORP’s share to be around $51.9, which means that the stock is currently being traded at $30.7 – thus being undervalued by 40.9%. This is a great opportunity for potential investors to buy in and make a substantial profit in the future. More…

Peers

The company was founded in 1980 and is headquartered in New York, NY. Embecta Corp‘s products include prescription drugs for the treatment of cardiovascular disease, diabetes, and cancer. The company’s competitors include Uluru Inc, RxSight Inc, and Modalis Therapeutics Corp.

– Uluru Inc ($OTCPK:ULUR)

RxSight Inc is a medical device company that develops and commercializes innovative ophthalmic implants that allow ophthalmologists to more precisely treat complex retinal diseases. As of 2022, the company has a market capitalization of 318.4 million and a return on equity of -31.3%.

– RxSight Inc ($NASDAQ:RXST)

Modalis Therapeutics Corp is a biopharmaceutical company that focuses on the development of therapeutics for the treatment of cancer and other diseases. The company has a market cap of 11.21B as of 2022 and a return on equity of -13.14%. Modalis Therapeutics Corp is headquartered in New York, New York.

Summary

EMBECTA CORP, a publicly traded company, recently reported better than expected quarterly results, with both its top and bottom lines exceeding analyst estimates. This news caused the stock price to increase on the same day. For its fiscal year outlook, the company updated its guidance, signaling an optimistic outlook. Overall, investing in EMBECTA CORP looks to be a promising option. The company has proven that it is able to consistently meet or exceed expectations, indicating that it is likely to continue to perform strongly in the future.

Additionally, the company’s updated outlook suggests that it is in a healthy financial position and should remain so in the coming months. With these positive indicators, investors may want to take a closer look at EMBECTA CORP and consider it as an attractive investment opportunity.

Recent Posts