Midea Group to Commence Operations at Anqing Plant in Anhui Province this October

January 13, 2023

Trending News 🌥️

Midea Group ($SZSE:000333) is one of the largest home appliance makers in China, offering a range of products from air conditioners to refrigerators and washing machines. The new Anqing, Anhui province plant is set up to produce auto parts for new energy vehicles, to meet the increasing demand for such products. It is part of Midea Group’s strategy to expand into new markets and move up the value chain. The first phase of the plant will become operational in October, and the company says it will be driving technological innovation, as well as creating jobs in the region. The Anqing plant will be the first of its kind in Anhui province, and Midea Group hopes that it will become a model for other plants of its kind in the region. Midea Group has invested heavily in the project and has employed some of the best engineers and designers available to ensure that the plant will be able to meet the highest quality standards.

Midea Group is also working closely with local businesses and government authorities to ensure that the plant not only meets quality and safety standards, but also meets local environmental regulations. The company is confident that it can achieve this goal and that the plant will be an important part of Anhui province’s economy. The launch of the Anqing plant marks a significant milestone for Midea Group, as the company looks to expand its reach into new markets and move up the value chain. The plant is expected to become a model for other plants of its kind in the region, and will be a key driver of technological innovation and economic growth in Anhui province.

Market Price

Midea Group, a leading electrical appliance manufacturer in China, announced that it plans to begin operations at their Anqing plant in Anhui Province this October. The news has been met with largely positive media coverage. The Anqing plant will be Midea Group’s sixth production facility in the Anhui Province and is expected to create thousands of new job opportunities. The Anqing plant will also produce a variety of home appliances such as air conditioners and refrigerators. On Friday, MIDEA GROUP stock opened at ¥55.0 and closed at ¥54.0, down by 1.6% from previous closing price of 54.9. Despite the price drop, analysts remain optimistic that the commencement of operations at the Anqing plant will have a positive impact on the company’s stock prices in the long run.

With the addition of the Anqing plant, Midea Group will be able to produce more products to meet increasing demand. The new facility is expected to increase production capacity and help Midea Group remain competitive in the market. Midea Group has also taken steps to ensure that their operations comply with environmental regulations. The company has implemented a strict waste management system and is using clean energy sources for production. The company is looking forward to the new opportunities that this plant will bring and is confident that it will be a great addition to their portfolio. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Midea Group. More…

| Total Revenues | Net Income | Net Margin |

| 352.19k | 29.59k | 8.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Midea Group. More…

| Operations | Investing | Financing |

| 36.31k | -11.79k | -4.71k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Midea Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 417.45k | 268.59k | 19.89 |

Key Ratios Snapshot

Some of the financial key ratios for Midea Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.4% | 5.5% | 10.5% |

| FCF Margin | ROE | ROA |

| 8.9% | 17.2% | 5.5% |

VI Analysis

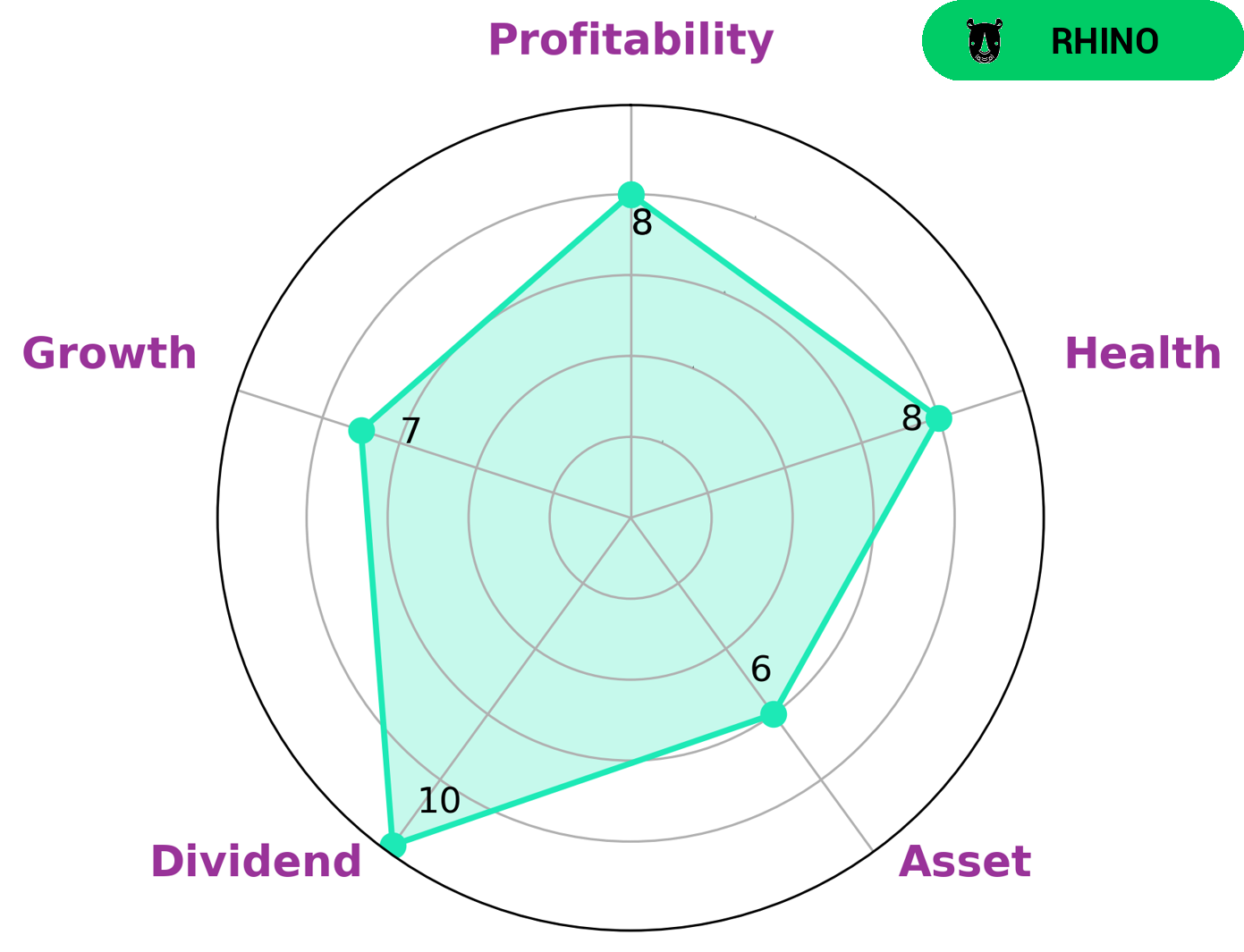

The VI app provides a simple overview of the company’s performance across a range of factors. In particular, the VI Star Chart indicates that MIDEA GROUP is strong in dividend, growth, profitability and medium in asset. The company’s health score of 8/10 indicates that it is well-positioned to weather any economic storms without the risk of bankruptcy. MIDEA GROUP is classified as a ‘rhino’, a company that has achieved moderate revenue or earnings growth. This type of company may be of interest to investors looking for steady returns with limited risk. Such investors may also appreciate the strong dividend prospects and profitability the company offers. Additionally, its mid-level assets point to a company with moderate growth potential, making it attractive to investors looking for a combination of capital appreciation and dividend income. More…

VI Peers

The competition between Midea Group Co Ltd and its competitors such as Hisense Home Appliances Group Co Ltd, Changhong Meiling Co Ltd, and Johnson Controls – Hitachi Air Conditioning India Ltd is intense. All of these companies are vying to be the top player in the market of home appliances and air conditioning, making it a highly competitive environment. Each company is striving to outdo the other, offering innovative solutions and cutting-edge technology.

– Hisense Home Appliances Group Co Ltd ($SZSE:000921)

Hisense Home Appliances Group Co Ltd is a Chinese appliance manufacturer specializing in the production of home appliances such as washing machines, refrigerators, air conditioners, and televisions. With a market cap of 19.28B as of 2023, the company is well positioned to remain competitive in the industry and capitalize on emerging markets. In addition to its sizable market cap, Hisense Home Appliances Group Co Ltd boasts a strong return on equity of 19.38%, indicating that the company is efficiently utilizing its capital and generating high returns for shareholders.

– Changhong Meiling Co Ltd ($SZSE:000521)

ChangHong Meiling Co Ltd is a Chinese electronics manufacturer that produces refrigerators, air conditioners, washing machines, microwave ovens and other appliances. The company has a market cap of 4.23 billion dollars as of 2023, reflecting its financial stability and success. The return on equity (ROE) of 2.29% indicates that the company is achieving higher returns on its investments than the average for other companies in the same industry. ChangHong Meiling Co Ltd is a well-established company with a long history of producing quality products that meet the needs of consumers.

– Johnson Controls – Hitachi Air Conditioning India Ltd ($BSE:523398)

Based in India, Johnson Controls – Hitachi Air Conditioning India Ltd is a global leader in the air conditioning and climate control business. With a market cap of 30.7 billion as of 2023, the company has seen considerable growth in its market value over the years. Johnson Controls – Hitachi Air Conditioning India Ltd has a return on equity (ROE) of -1.38%, indicating that it is not generating profits from its investments. The company offers a variety of air conditioning solutions, ranging from residential to commercial, and its products are used in homes, offices, hospitals, and other public areas. The company is committed to providing quality solutions to its customers and maintaining its position as a leader in the air conditioning industry.

Summary

Midea Group is an international company that manufactures a wide range of products, including home appliances, robotics, and industrial automation. The company is planning to expand its operations in Anqing, Anhui Province this October. This expansion is likely to bring significant growth opportunities for the company. Investors should take note of this news and consider investing in Midea Group. The company has been well-received by the market and has been receiving positive media coverage.

With its strong presence in the global market, Midea Group is expected to experience increased sales and profits in the long-term. Moreover, the company’s investments in new technologies and research & development are likely to further enhance its competitive edge in the industry. Investors should keep Midea Group on their watchlist.

Recent Posts