Short Interest in Vera Bradley, Decreases by 45.1%!

February 21, 2023

Trending News ☀️

The recent news that the amount of short interest in Vera Bradley ($NASDAQ:VRA), Inc. has decreased by 45.1% is certainly encouraging! This significant decrease indicates that investors may be developing more confidence in the company and its stock. This confidence is likely motivated by several recent developments that could make Vera Bradley, Inc. an even more successful player in the fashion industry. Vera Bradley, Inc. recently announced their agreement with Amazon Fashion to bring their products to the booming digital marketplace. This is a major step forward for the company as it vastly increases their potential customer base.

Additionally, Vera Bradley is working to expand their digital presence and have been marketing heavily on many popular social media platforms. Finally, the company has a strong brand presence, which has enabled them to launch several successful partnerships with well-known companies like Disney and Lady Gaga. These collaborations have further expanded Vera Bradley’s reach and solidified their status as a major fashion brand. All of this considered, it is no surprise that investor confidence in Vera Bradley, Inc. has grown over the past several months. With their brand presence, successful partnerships, and increasing digital presence, it’s easy to see why their stock may be more attractive to investors at this moment in time.

Share Price

Investors in Vera Bradley, Inc. (NASDAQ:VRA) were pleasantly surprised when the company announced that short interest decreased by 45.1% as of the end of October. This is a positive sign because it suggests that the majority of investors are expecting the stock to increase in value in the near future. Additionally, news coverage of the company has mostly been positive, and on Monday, VERA BRADLEY stock opened at $5.3 and closed at $5.6, up by 2.2% from last closing price of 5.4. Looking ahead, this encouraging development will likely have a positive impact on investor sentiment as short interest continues to decline. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vera Bradley. More…

| Total Revenues | Net Income | Net Margin |

| 502.45 | -26.42 | -0.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vera Bradley. More…

| Operations | Investing | Financing |

| -16.11 | -7.95 | -25.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vera Bradley. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 461.34 | 158.59 | 9.03 |

Key Ratios Snapshot

Some of the financial key ratios for Vera Bradley are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | -0.2% | -1.5% |

| FCF Margin | ROE | ROA |

| -4.9% | -1.7% | -1.0% |

Analysis

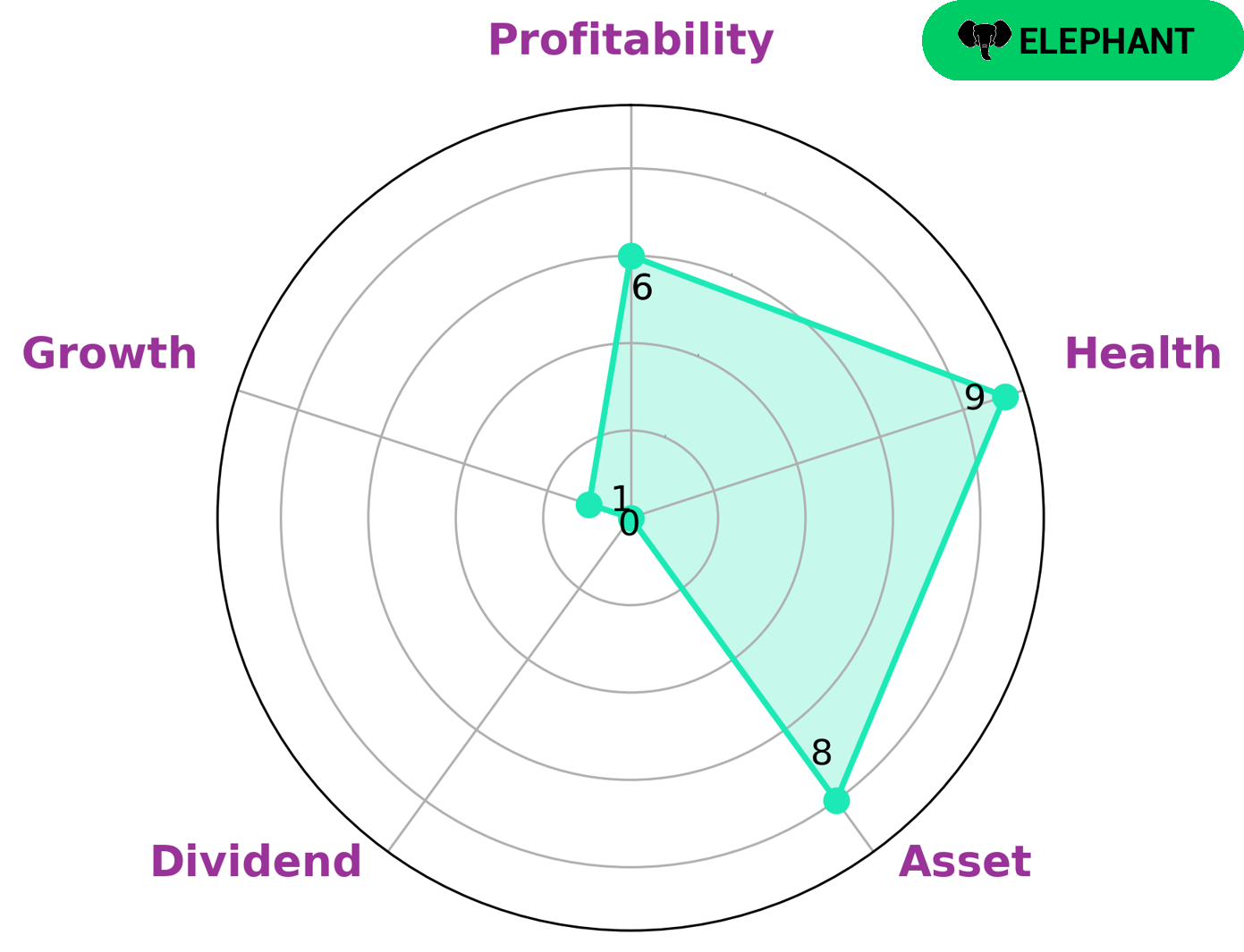

GoodWhale recently analyzed the financials of VERA BRADLEY and performed a Star Chart analysis. This makes it an attractive opportunity for value investors wanting to invest in larger, well-established companies. The Star Chart analysis also indicates that VERA BRADLEY is strong in assets, medium in profitability and weak in dividend and growth. This means that investors looking for stable, long-term investments may be interested in the company. In addition to this analysis, GoodWhale has also conducted a health score analysis on VERA BRADLEY and found that the company has a high health score of 9/10. This is based on its cashflows and debt, which indicates that the company is capable to sustain future operations in times of crisis. Therefore, this company is attractive to value investors looking for a long-term investment with good financial health. More…

Peers

The competition between Vera Bradley Inc and its competitors, Puma SE, Deckers Outdoor Corp, and C Banner International Holdings Ltd, is fierce. All four companies are vying for a share of the global market in the fashion and accessories industry, offering unique products and designs that appeal to different consumer segments. Despite the intense competition, Vera Bradley Inc has managed to stand out and become one of the leading players in the industry.

– Puma SE ($LTS:0NQE)

Puma SE is a leading sports apparel and lifestyle brand that designs and manufactures products for professional athletes and everyday consumers. The company has a market cap of 8.14B as of 2022, reflecting the strong financial performance of the company. Puma SE also has an impressive Return on Equity (ROE) of 17.11%, demonstrating the company’s ability to generate profit from its investments. This indicates that the company is making effective use of its resources, and has strong prospects for future growth. With its strong financial performance, Puma SE is well-positioned to continue its success in the global market.

– Deckers Outdoor Corp ($NYSE:DECK)

Deckers Outdoor Corp is a global leader in designing and marketing lifestyle footwear, apparel, and accessories. Founded in 1973, Deckers Outdoor is headquartered in Goleta, California and has achieved a market cap of 10.35 billion as of 2022. Additionally, the company has a Return on Equity of 23.76% which reflects the company’s financial health and ability to generate profits from its shareholders’ investments. Deckers Outdoor Corp has become a leading designer and marketer of lifestyle footwear, apparel, and accessories for both men and women. The company has established a strong presence in the U.S. and International markets and is poised for continued growth.

– C Banner International Holdings Ltd ($SEHK:01028)

Banner International Holdings Ltd is a Hong Kong-based investment holding company that operates in the property and hotel industry. The company’s market cap of 386.32M as of 2022 reflects the impressive financial performance and growth potential it has demonstrated in recent years. Banner International Holdings Ltd has also demonstrated strong Return on Equity (ROE) of 0.93%, indicating that the company is using its assets and equity efficiently to generate profits and returns for its shareholders.

Summary

Vera Bradley, Inc has seen a steady decline in its short interest, falling 45.1% in the most recent period. This likely indicates that investors have grown more optimistic on the stock and its future prospects. Analysts have taken note of this trend and have largely maintained a positive outlook on Vera Bradley, with news coverage mainly reflecting positivity. Given the current trend in short interest and analyst sentiment, it may be a good time to consider investing in Vera Bradley, Inc. However, investors should always conduct their own research and analyze the risks associated with investing in the company before putting any money down.

Recent Posts