Rocky Brands Stock Fair Value Calculator – ROCKY BRANDS Reports Q1 Revenue of $110.4M, Missing Market Estimate of $124.5M

May 24, 2023

Trending News 🌧️

Rocky Brands ($NASDAQ:RCKY), Inc. reported its revenue for the first quarter of 2021 as $110.4 million, which is below the estimated $124.5 million from the analysts. ROCKY BRANDS is a company that designs and manufactures outdoor lifestyle and work-related footwear and apparel. The company is headquartered in Nelsonville, Ohio, and provides its products under several brands such as Durango, Georgia Boot, Rocky, Laredo, and Creative Recreation. It primarily sells its products through retail stores, online, and independent dealers. The company has seen a sharp decline in revenue due to the effects of the pandemic, as well as supply chain issues that have limited production and shipping of product. While the decline in revenue is not desirable for the company, it is also not a surprise considering the current market conditions.

Moving forward, the company will need to adjust its strategy and focus on improving its production capacity in order to recover from its losses. Overall, ROCKY BRANDS reported its revenue for the first quarter of 2021 as $110.4 million, which is below the estimated $124.5 million from the analysts. The company will need to make adjustments to its strategy in order to recover from this decline in revenue.

Earnings

In its latest earning report for Fiscal Year 2023 (Q1) as of March 31, 2023, ROCKY BRANDS reported a total revenue of $110.44M USD and a net income of -$0.4M USD. This is significantly lower than the market estimate of $124.5M USD, and 33.9% lower than the previous year’s total revenue. In addition, this quarter has seen a 105.4% decrease in net income compared to the same time last year.

However, despite this downturn in results, ROCKY BRANDS has still seen considerable growth over the last three years. Total revenue has increased from $87.67M USD to $110.44M USD. This demonstrates that the company is still capable of achieving consistent growth over time.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rocky Brands. More…

| Total Revenues | Net Income | Net Margin |

| 558.89 | 12.73 | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rocky Brands. More…

| Operations | Investing | Financing |

| 19.12 | -1.23 | -18.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rocky Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 538.98 | 324.69 | 29.17 |

Key Ratios Snapshot

Some of the financial key ratios for Rocky Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.0% | 22.4% | 6.3% |

| FCF Margin | ROE | ROA |

| 2.2% | 10.2% | 4.1% |

Stock Price

On Tuesday, ROCKY BRANDS reported a Q1 revenue of $110.4 million, missing the market estimate of $124.5 million. This news caused the company’s stock to open at $19.6 and close at $19.2, down by 1.3% from the previous closing price of 19.5. The underwhelming revenue result has caused investors to take a step back and re-evaluate the company’s standing in the market going forward. Live Quote…

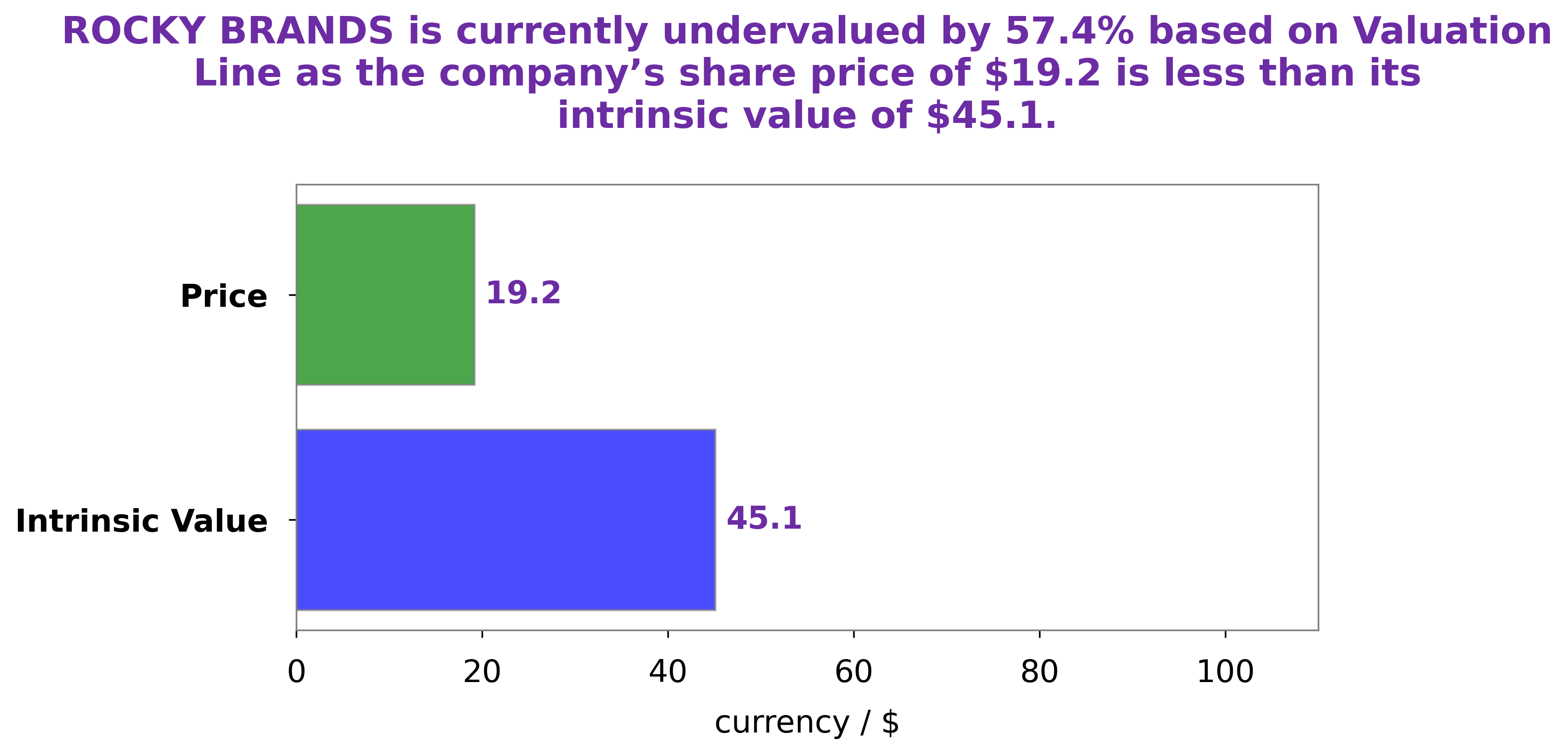

Analysis – Rocky Brands Stock Fair Value Calculator

At GoodWhale, we have conducted an analysis of ROCKY BRANDS‘s fundamentals. We have reached the conclusion that the fair value of ROCKY BRANDS share is around $45.1, calculated by our proprietary Valuation Line. Currently, ROCKY BRANDS stock is traded at $19.2, meaning it is undervalued by 57.5%. This is an ideal opportunity for any investors looking to get into a well-established company with a great long-term outlook. More…

Peers

The company operates in two segments, Wholesale and Direct to Consumer. It offers boots, shoes, and apparel for men, women, and children under the Rocky, Georgia Boot, Durango, Lehigh, Creative Recreation, and licensed Michelin brands. The company also provides footwear for uniformed personnel and civilians under the Original S.W.A.T., Tactical Research by Belleville, and Chippewa brands. In addition, it offers work, western, and hunting footwear for men and women under the Georgia Giant, GeorgiaRomero, Durango, Lehigh, and L.B. Evans brands; and markets footwear for children under the Little Giant brand. Further, the company provides footwear for military, law enforcement, and fire and rescue professionals under the Original S.W.A.T., Tactical Research by Belleville, Chippewa, and Michelin brands. Additionally, it offers licensed products, including T-shirts, hats, belts, wallets, and key chains, as well as outerwear and footwear. The company sells its products through its wholesale customers to department, specialty, and independent stores in the United States; and through company-owned stores and direct mail catalogs, as well as its Website in the United States and Canada. Rocky Brands Inc was founded in 1932 and is headquartered in Nelsonville, Ohio. Some of Rocky Brands Inc’s competitors include Deckers Outdoor Corp, C Banner International Holdings Ltd, and Puma SE.

– Deckers Outdoor Corp ($NYSE:DECK)

Deckers Outdoor Corp is a footwear company that designs, manufactures, and markets footwear and apparel for casual lifestyle use and high performance activities. The company’s products are sold under a portfolio of brands, including UGG®, Koolaburra®, Hoka One One®, Teva®, and Sanuk®. As of 2022, Deckers Outdoor Corp has a market cap of 8.73B and a Return on Equity of 23.76%. The company’s products are available in more than 100 countries worldwide.

– C Banner International Holdings Ltd ($SEHK:01028)

Banner International Holdings Ltd. is a Hong Kong-based company principally engaged in property development, investment and management. The Company’s projects portfolio includes residential, office, retail and hotel properties. It also operates self-storage business. The Company operates its businesses in Hong Kong, Mainland China and Macau.

– Puma SE ($OTCPK:PUMSY)

Puma SE is a German multinational corporation that designs and manufactures athletic and casual footwear, apparel, and accessories, headquartered in Herzogenaurach, Bavaria, Germany. The company was founded in 1948 by Rudolf Dassler. In 1924, Rudolf and his brother Adolf Dassler had jointly formed the company Gebrüder Dassler Schuhfabrik. The relationship between the two brothers deteriorated until the two agreed to split in 1948, forming two separate entities, Adidas and Puma. Both companies are currently based in Herzogenaurach, Germany.

Puma has a market capitalization of 6.91 billion as of 2022 and a return on equity of 17.11%. The company designs and manufactures athletic and casual footwear, apparel, and accessories for men, women, and children.

Summary

ROCKY BRANDS, INC (RCKY) recently announced their first quarter revenue of $110.4 million, which was significantly below Street estimates of $124.5 million. This news has caused investors to question the company’s financial performance and outlook. The company’s stock price has dropped sharply in the aftermath of this announcement, as investors assess the impact to profits.

It is important to note that this figure is still greater than the first quarter of last year, indicating that the company is still growing, despite this revenue miss. Going forward, investors should closely monitor the company’s financial metrics and guidance to help determine whether this earnings report was an anomaly or a sign of more concerning trends.

Recent Posts