Janney Montgomery Scott LLC Invests in Vera Bradley, by Purchasing 5857 Shares.

February 4, 2023

Trending News ☀️

Vera Bradley ($NASDAQ:VRA), Inc., an iconic American lifestyle brand, has been purchased by Janney Montgomery Scott LLC, with 5857 shares being acquired. Its designs are inspired by the unique style of co-founders Barbara Bradley Baekgaard and Patricia Miller. Their products have become popular with modern trendsetters and style-savvy individuals alike. The company focuses on offering unique and colorful accessories, bags, luggage, and other items. It is known for its signature floral prints and vibrant colors. In addition to these core items, Vera Bradley also produces home décor and stationery. As the company continues to expand its product offerings and reach more customers, it should be interesting to see what happens. It is likely that this investment will help Vera Bradley to continue to grow and develop its product lines.

Additionally, with the backing of a well-known financial services firm, Vera Bradley should be able to reach even more customers and expand its global presence.

Price History

Janney Montgomery Scott LLC recently purchased a total of 5857 shares in the company Vera Bradley, Inc. This news was met with mostly positive reviews from the market, with the stock opening at $5.5 on Monday and closing at $5.8, a 4.5% increase from the previous closing price of $5.6. The company has seen its sales decrease as competition has increased in the handbag and accessories market. This new capital injection from Janney Montgomery Scott LLC is sure to help them stay afloat and compete more effectively. The investment from Janney Montgomery Scott LLC is also seen as a sign that the company is confident in the future of Vera Bradley. This could be a turning point for the company, as the additional capital will allow them to invest in new product lines and expand their market reach.

This new investment should be seen as a positive for investors, as it shows that the company is confident in its future prospects. As the handbag and accessories market continues to grow, Vera Bradley is well-positioned to take advantage of this growth and become a leader in the industry. The additional capital from Janney Montgomery Scott LLC will help them do just that. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vera Bradley. More…

| Total Revenues | Net Income | Net Margin |

| 502.45 | -26.42 | -0.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vera Bradley. More…

| Operations | Investing | Financing |

| -16.11 | -7.95 | -25.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vera Bradley. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 461.34 | 158.59 | 9.03 |

Key Ratios Snapshot

Some of the financial key ratios for Vera Bradley are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | -0.2% | -1.5% |

| FCF Margin | ROE | ROA |

| -4.9% | -1.7% | -1.0% |

Analysis

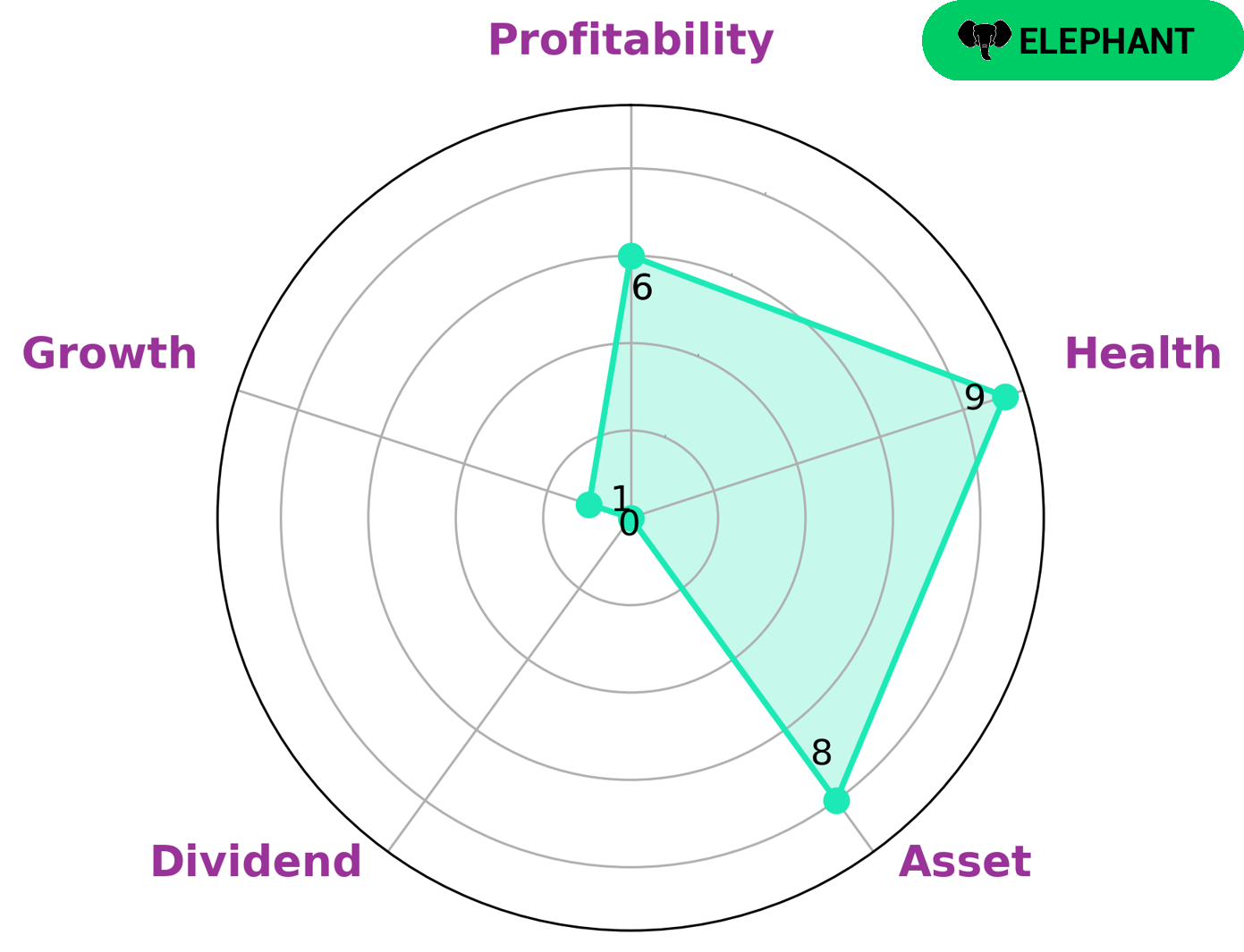

GoodWhale conducted an analysis of VERA BRADLEY‘s financials, and based on the Star Chart, VERA BRADLEY has a high health score of 9/10 with regard to its cashflows and debt, indicating that the company has the capability to safely ride out any crisis without the risk of bankruptcy. In terms of performance, VERA BRADLEY is strong in asset, medium in profitability and weak in dividend, growth. Such a company may be attractive to investors who value stability and security. Investors looking for capital appreciation may be attracted to the steady asset growth. Moreover, those who focus on dividend yield may see potential in the company as it has medium profitability and some dividend, although it is weak in growth. Value investors may also be drawn to VERA BRADLEY as the company’s strong asset base may indicate potential for undervaluation. Overall, VERA BRADLEY’s financials indicate a company with good health and potential for long-term growth. The company’s strong asset base, medium profitability and some dividend payments may make it attractive to various types of investors. More…

Peers

The competition between Vera Bradley Inc and its competitors, Puma SE, Deckers Outdoor Corp, and C Banner International Holdings Ltd, is fierce. All four companies are vying for a share of the global market in the fashion and accessories industry, offering unique products and designs that appeal to different consumer segments. Despite the intense competition, Vera Bradley Inc has managed to stand out and become one of the leading players in the industry.

– Puma SE ($LTS:0NQE)

Puma SE is a leading sports apparel and lifestyle brand that designs and manufactures products for professional athletes and everyday consumers. The company has a market cap of 8.14B as of 2022, reflecting the strong financial performance of the company. Puma SE also has an impressive Return on Equity (ROE) of 17.11%, demonstrating the company’s ability to generate profit from its investments. This indicates that the company is making effective use of its resources, and has strong prospects for future growth. With its strong financial performance, Puma SE is well-positioned to continue its success in the global market.

– Deckers Outdoor Corp ($NYSE:DECK)

Deckers Outdoor Corp is a global leader in designing and marketing lifestyle footwear, apparel, and accessories. Founded in 1973, Deckers Outdoor is headquartered in Goleta, California and has achieved a market cap of 10.35 billion as of 2022. Additionally, the company has a Return on Equity of 23.76% which reflects the company’s financial health and ability to generate profits from its shareholders’ investments. Deckers Outdoor Corp has become a leading designer and marketer of lifestyle footwear, apparel, and accessories for both men and women. The company has established a strong presence in the U.S. and International markets and is poised for continued growth.

– C Banner International Holdings Ltd ($SEHK:01028)

Banner International Holdings Ltd is a Hong Kong-based investment holding company that operates in the property and hotel industry. The company’s market cap of 386.32M as of 2022 reflects the impressive financial performance and growth potential it has demonstrated in recent years. Banner International Holdings Ltd has also demonstrated strong Return on Equity (ROE) of 0.93%, indicating that the company is using its assets and equity efficiently to generate profits and returns for its shareholders.

Summary

Vera Bradley, Inc. recently saw a major investment from Janney Montgomery Scott LLC when they purchased 5857 shares. This news has had a positive impact on the stock price, which has risen since the announcement. Analysts have noted that this could be the start of an uptrend for the company, as investors have become more confident in their prospects. Going forward, investors should continue to monitor the stock price and other developments related to Vera Bradley, Inc. to ensure they are making the most informed decisions when it comes to investing in the company.

Recent Posts