Deckers Outdoor Intrinsic Stock Value – Ronald Blue Trust Increases Investment in Deckers Outdoor Co. with $196000 Stock Position

December 31, 2023

☀️Trending News

Deckers Outdoor ($NYSE:DECK) Co., a leading American footwear and apparel company, has seen an increased interest in its stock position from Ronald Blue Trust Inc. The trust has recently invested a whopping $196000 in the company, showing their confidence in Deckers’ ability to generate returns. DECKERS OUTDOOR specializes in providing consumers with innovative, versatile and stylish shoes and apparel that has increased in popularity amongst various demographics. Its product range includes fashion-forward casual shoes and clothes, luxury apparel and outdoor gear. Committed to developing quality products, its selection is designed to last and is available to customers at competitive prices. The interest shown by Ronald Blue Trust Inc. in DECKERS OUTDOOR stock suggests that many investors consider the company to be a promising investment opportunity.

With their capital injection, they are hoping to increase its potential for future growth and profits. This move could also open up further opportunities for Deckers Outdoor Co. and ultimately benefit all of its shareholders.

Share Price

In response to this news, Deckers Outdoor Co.’s stock opened at $692.4 and closed at $688.0, a decrease of 0.8% from the prior closing price of 693.7. This decrease is likely due to the uncertainty in the market given the ongoing coronavirus pandemic. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Deckers Outdoor. More…

| Total Revenues | Net Income | Net Margin |

| 3.9k | 612.55 | 15.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Deckers Outdoor. More…

| Operations | Investing | Financing |

| 895.8 | -114.16 | -373.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Deckers Outdoor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.85k | 1.05k | 69.77 |

Key Ratios Snapshot

Some of the financial key ratios for Deckers Outdoor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.7% | 24.8% | 20.5% |

| FCF Margin | ROE | ROA |

| 20.0% | 27.8% | 17.5% |

Analysis – Deckers Outdoor Intrinsic Stock Value

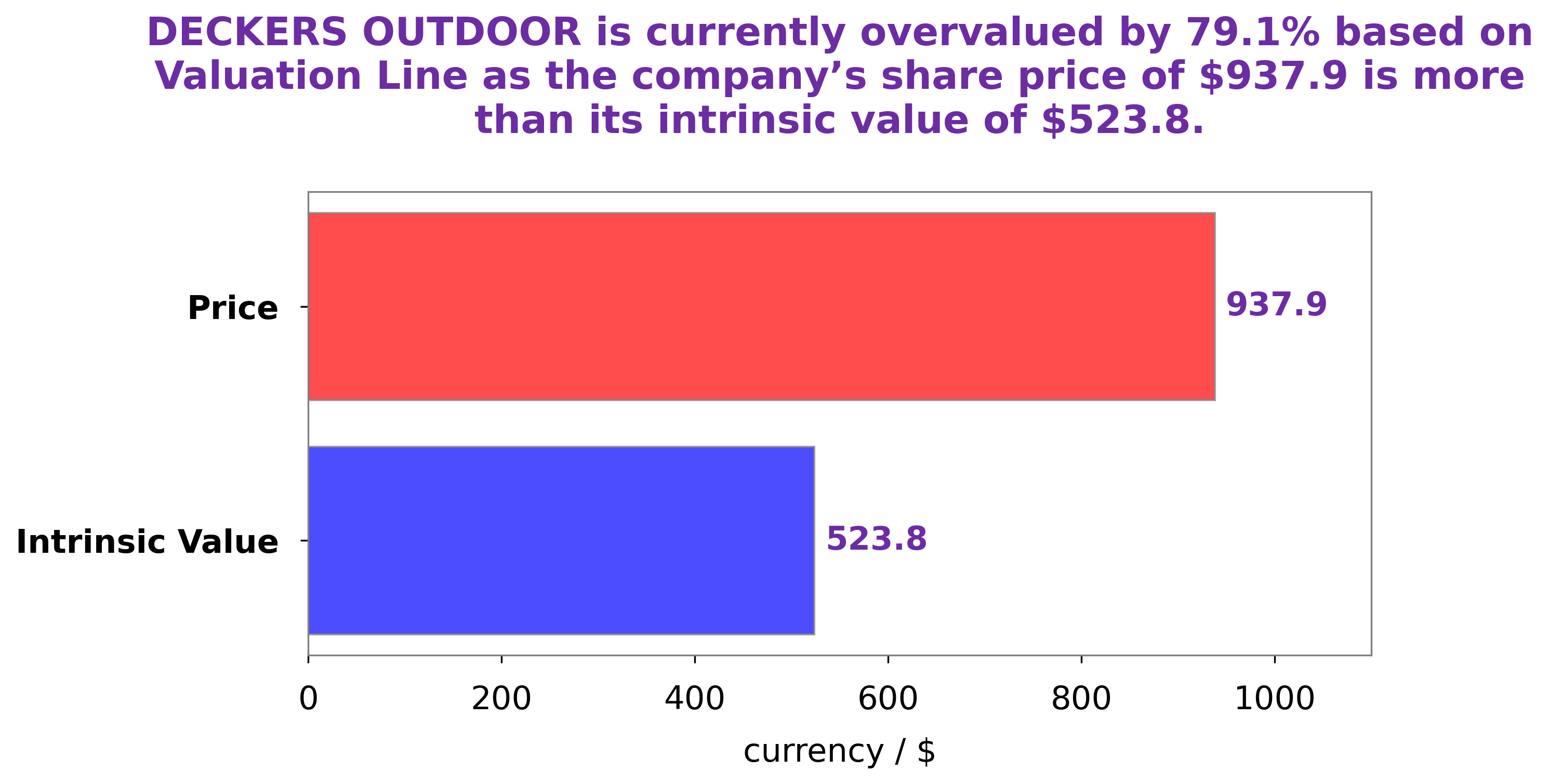

GoodWhale has conducted an analysis of DECKERS OUTDOOR‘s financials, and our proprietary Valuation Line indicates that the fair value of DECKERS OUTDOOR share is roughly $486.9. However, the current market price of DECKERS OUTDOOR stock is at $688.0, which means that it is overvalued by 41.3%. Investors who purchase the stock at these levels may want to be aware that it may be overvalued, and they should consider other investment options to diversify their portfolio. More…

Peers

Deckers Outdoor Corp, together with its subsidiaries, engages in the design, manufacture, and marketing of footwear, apparel, and accessories for casual lifestyle use and high performance activities. Its principal brands include UGG, Koolaburra, HOKA ONE ONE, and Teva. The company sells its products to retailers in the United States and 180 countries through its direct-to-consumer channels and third-party distributors. As of December 31, 2018, it operated 310 UGG stores, including full-price, factory, and outlet stores; and e-commerce Websites. The company was founded in 1973 and is headquartered in Goleta, California. Puma SE, together with its subsidiaries, designs, develops, markets, and distributes athletic and casual footwear, apparel, and accessories. The company operates through two segments, Wholesale and Retail. It offers performance and sport-inspired lifestyle products in categories, such as football, running, training, golf, and motorsports. The company sells its products to shoe stores, sporting goods stores, department stores, golf pro shops, tennis specialty stores, mass market retailers, and its own Internet Websites and direct-to-consumer stores. As of December 31, 2018, it operated 1,478 company-owned stores. Puma SE was founded in 1948 and is headquartered in Herzogenaurach, Germany. Vera Bradley, Inc. designs, manufactures, markets, and retails functional accessories for women under the Vera Bradley brand name. The company offers a range of products, including handbags and totes, wallets and wristlets, travel and leisure items, stationery and gifts, eyewear and sunglasses, shoes, baby items, fragrance collections, and home products. It offers its products through its Vera Bradley retail stores; direct-to-consumer channels comprising Vera Bradley direct Website; company-owned outlet stores; company-owned factory outlet stores; independent specialty retailers; national chains; college bookstores; and other retailers. Vera Bradley, Inc. was founded in 1982 and is headquartered in Roanoke, Indiana. Steven Madden, Ltd. designs, sources, markets, licenses, and sells fashion footwear and accessories for women, men, and children worldwide. The company operates through three segments: Wholesale Footwear, Retail, and Licensing. It designs and sources footwear for women under the Steve Madden Women’s Wholesale Footwear, Madden Girl Wholesale Footwear, Freebird by Steven Wholesale Footwear, Betsey Johnson Wholesale Footwear, Dolce Vita Wholesale Footwear, Mad Love Wholesale Footwear, Steven by Steve Madden Wholesale Footwear, Superga Wholesale Footwear, Report Signature Wholesale Footwear, Maurice Mallet Wholesale Footwear, Greyson Wholesale Footwear, BB Dakota Wholesale Footwear, Blondo Wholesale Footwear, Big Star Vintage Wholesale Footwear, Wild Diva Lounge Wholesale Footwear, Bamboo Wholesale Footwear, Betseyville Wholesale Footwear, DVDO by Steve Madden Wholesale Footwear, Cejon Wholesale Footwear, Steve Madden Men’s Wholesale Footwear, De Blossom Collection Wholesale Footwear, Steven by Steve Madden Kids’ Wholesale Footwear, Brian Atwood Wholesale Footwear, Blondo Kids’ Wholesale Footwear, and Betsey Johnson Kids’ Wholesale Footwear brands.

– Puma SE ($OTCPK:PUMSY)

Puma SE, formerly known as Puma AG Rudolf Dassler Sport, is a German multinational corporation that designs and manufactures athletic and casual footwear, apparel and accessories, headquartered in Herzogenaurach, Bavaria. As of 2022, Puma SE has a market cap of 6.88B and a Return on Equity of 16.63%. The company operates in more than 120 countries and employs over 13,000 people worldwide. Puma is the third largest sportswear manufacturer in the world. The company was founded in 1948 by Rudolf Dassler.

– Vera Bradley Inc ($NASDAQ:VRA)

Vera Bradley Inc is a designer and marketer of accessories for women. The company operates through three segments: Direct, Indirect, and Other. The Direct segment offers products through the company’s owned retail stores and website. The Indirect segment provides products to department stores, specialty retailers, and national chains. The Other segment includes licensing and corporate-owned outlets. Vera Bradley Inc was founded in 1982 and is headquartered in Roanoke, Indiana.

– Steven Madden Ltd ($NASDAQ:SHOO)

Steven Madden, Ltd. is a leading designer, marketer and distributor of fashion footwear and accessories for women, men and children. The Company’s wholesale business is engaged in the design, sourcing and marketing of footwear for young women, men and children. The Company’s retail business is engaged in the operation of specialty retail stores and e-commerce Websites, as well as the sale of its products to department store and other retailers. The Company’s products are marketed under a variety of brands, including Steve Madden, Freebird by Steven, Steven by Steve Madden, Grace, Betsey Johnson, Brian Atwood, Blondo, David Tate, Dolce Vita, DV by Dolce Vita, ENZO ANGIOLINI, Mad Love, L.A.M.B., Big Buddha, Report, Wild Diva, CeCe, Betseyville by Betsey Johnson and Superga.

Summary

Deckers Outdoor Corporation (DECK) is an attractive stock for investors right now. Analysts have reported increased earnings over the past year, signaling the potential for future growth. Overall, Deckers Outdoor looks like a great option for long-term investors looking for a stable stock with potential for growth and appreciation.

Recent Posts