Crocs Stock Fair Value Calculation – CROCS: High Demand Outweighs Short Interest, Making Stock Undervalued

April 12, 2023

Trending News ☀️

CROCS ($NASDAQ:CROX), the Colorado-based footwear company, has been experiencing a meteoric rise in demand for their shoes, yet the company’s stock has been overlooked and is undervalued. The company’s stock has a high amount of short interest, with investors betting against them, but the high demand for their product has been able to outweigh the short interest. CROCS have become a popular casual footwear choice, with the foam clog design that is both comfortable and stylish. The iconic shoes have been seen on celebrities on the red carpet and have become the staple of many wardrobes.

With the increasing demand for their shoes, the company’s stock has become highly sought after, leading to stock shortages and an undervalued price. Despite the high amount of short interest, the demand for the company’s product has been able to outweigh it, making the stock undervalued and an attractive investment opportunity.

Share Price

CROCS has seen a high level of demand for its products despite having a short interest in the stock. On Tuesday, the stock opened at $128.2 and closed at $128.1, up by 0.1% from its prior closing price of 128.0. This indicates that the short interest in the stock is still outweighed by the demand for CROCS products. In addition, this steady increase in the stock price supports the fact that the company is currently undervalued, making it an attractive buy. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Crocs. CROCS_High_Demand_Outweighs_Short_Interest_Making_Stock_Undervalued”>More…

| Total Revenues | Net Income | Net Margin |

| 3.55k | 540.16 | 15.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Crocs. CROCS_High_Demand_Outweighs_Short_Interest_Making_Stock_Undervalued”>More…

| Operations | Investing | Financing |

| 603.14 | -2.15k | 1.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Crocs. CROCS_High_Demand_Outweighs_Short_Interest_Making_Stock_Undervalued”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.5k | 3.68k | 13.26 |

Key Ratios Snapshot

Some of the financial key ratios for Crocs are shown below. CROCS_High_Demand_Outweighs_Short_Interest_Making_Stock_Undervalued”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 42.4% | 87.7% | 24.0% |

| FCF Margin | ROE | ROA |

| 14.0% | 73.7% | 11.9% |

Analysis – Crocs Stock Fair Value Calculation

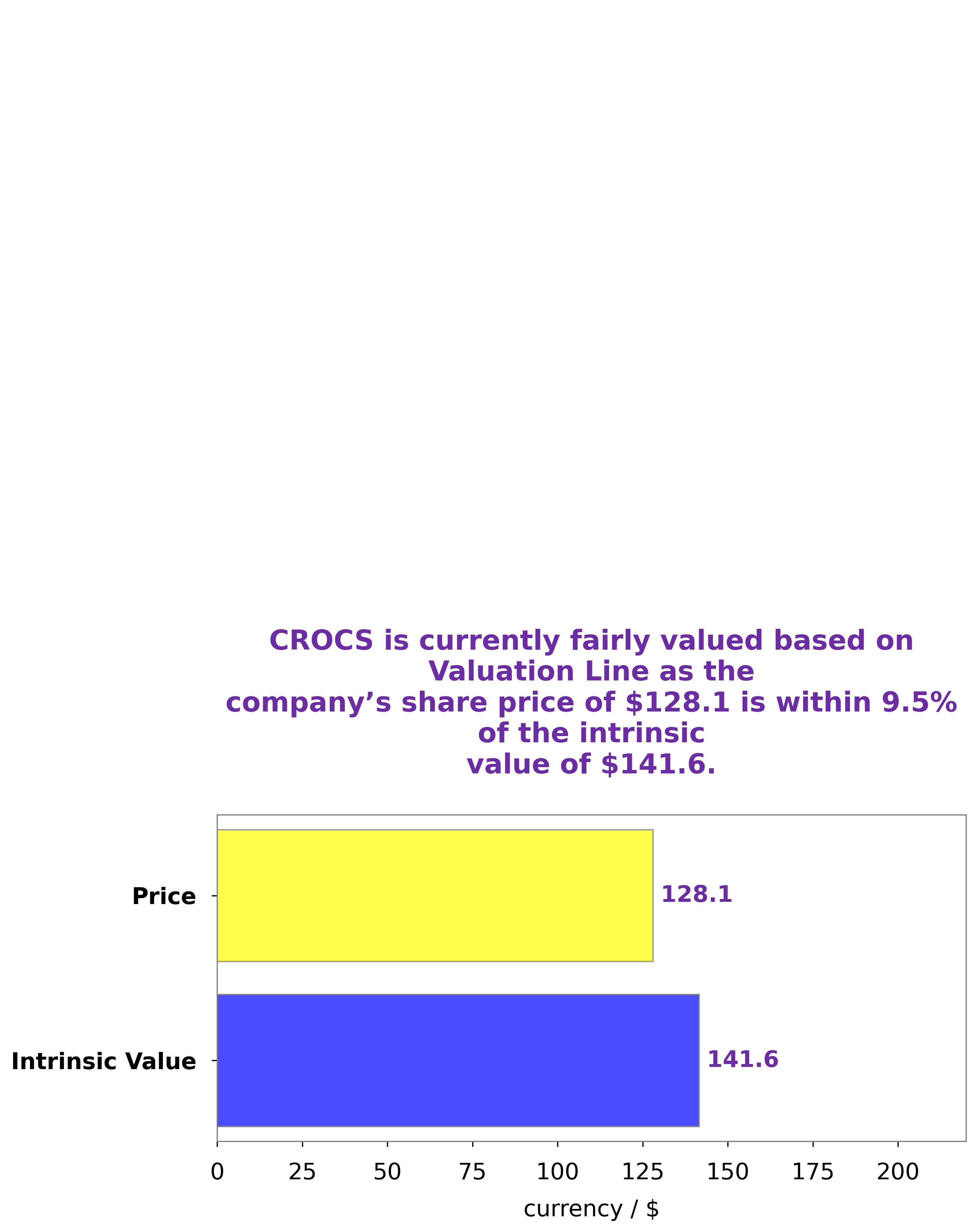

At GoodWhale, we have conducted an analysis of CROCS‘s financials and have determined that the fair value of its share is around $141.6. This was calculated using our proprietary Valuation Line. Currently, CROCS stock is being traded at $128.1, which is a fair price but slightly undervalued by 9.5%. We believe that this could present a great opportunity for investors to benefit from investing in CROCS. More…

Peers

Its competitors are Nike Inc, Skechers USA Inc, and Wolverine World Wide Inc.

– Nike Inc ($NYSE:NKE)

Nike is one of the largest sporting goods companies in the world. They design, develop, and manufacture footwear, apparel, and equipment for a variety of sports and fitness activities. Nike’s market cap as of 2022 is 138.47B. Their return on equity is 25.1%. Nike’s products are sold in over 190 countries worldwide.

– Skechers USA Inc ($NYSE:SKX)

Skechers USA Inc has a market cap of 5.44B as of 2022, a Return on Equity of 10.49%. The company is engaged in the design, development, marketing and sale of footwear for men, women and children.

– Wolverine World Wide Inc ($NYSE:WWW)

Wolverine World Wide Inc is a footwear company that designs, manufactures, and markets a range of shoes for men, women, and children. The company has a market cap of 1.3B as of 2022 and a Return on Equity of 18.81%. Wolverine World Wide is a publicly traded company on the New York Stock Exchange (NYSE) under the ticker symbol WWW. The company was founded in 1883 and is headquartered in Rockford, Michigan.

Summary

Investors should take a closer look at Crocs Inc., as it has high short interest but has sold out stock and is undervalued. Crocs is a footwear company that manufactures and sells shoes, sandals, and other footwear for men, women and children. The company has been experiencing strong sales momentum in recent quarters and is positioned for long-term growth. On the profitability side, Crocs could potentially benefit from its global presence and broad product portfolio, which can potentially lead to higher margins and improved returns.

Furthermore, its strong cash flows should help the company fund operations without relying on external financing. Overall, Crocs looks like an investment worth considering.

Recent Posts