Crocs Intrinsic Stock Value – Analyzing the Potential of Investing in Crocs Stock

April 7, 2023

Trending News 🌥️

Investing in Crocs ($NASDAQ:CROX) stock has been a popular choice for many investors over the past few years. The company, famous for its iconic foam clog shoes, has seen its stock price increase drastically over the past few years. As a result, many investors are wondering if investing in Crocs stock is still a profitable choice. To answer this question, it is important to first understand what makes Crocs stock stand out from other stocks. In addition to its well-known foam clog shoes, Crocs also manufactures and markets apparel, watches, and other lifestyle items. Crocs also has a strong balance sheet, solid cash flows, and a healthy return on capital. These factors have attracted many investors to the stock, driving its price up significantly over the past few years.

The company has also announced plans to expand its product lines, expand into new markets, and invest in research and development. This could further drive up the price of the stock and make it an even more attractive investment option. Overall, investing in Crocs stock could still be a profitable choice for investors who are willing to take on some risk. With its strong brand awareness and financial performance, there is potential for the stock to continue to grow over time. Investors should always do their research before investing and keep a close eye on the company’s financial performance to ensure that their investment is as profitable as possible.

Price History

Investing in Crocs stock may be a potential opportunity for investors. On Thursday, CROCS stock opened at $122.6 and closed at $121.9, representing a decrease of 1.4% from the prior closing price of 123.6. This could be an attractive entry point for potential investors given the recent dip in the stock. Of course, investors must do their own due diligence before making any investment decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Crocs. More…

| Total Revenues | Net Income | Net Margin |

| 3.55k | 540.16 | 15.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Crocs. More…

| Operations | Investing | Financing |

| 603.14 | -2.15k | 1.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Crocs. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.5k | 3.68k | 13.26 |

Key Ratios Snapshot

Some of the financial key ratios for Crocs are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 42.4% | 87.7% | 24.0% |

| FCF Margin | ROE | ROA |

| 14.0% | 73.7% | 11.9% |

Analysis – Crocs Intrinsic Stock Value

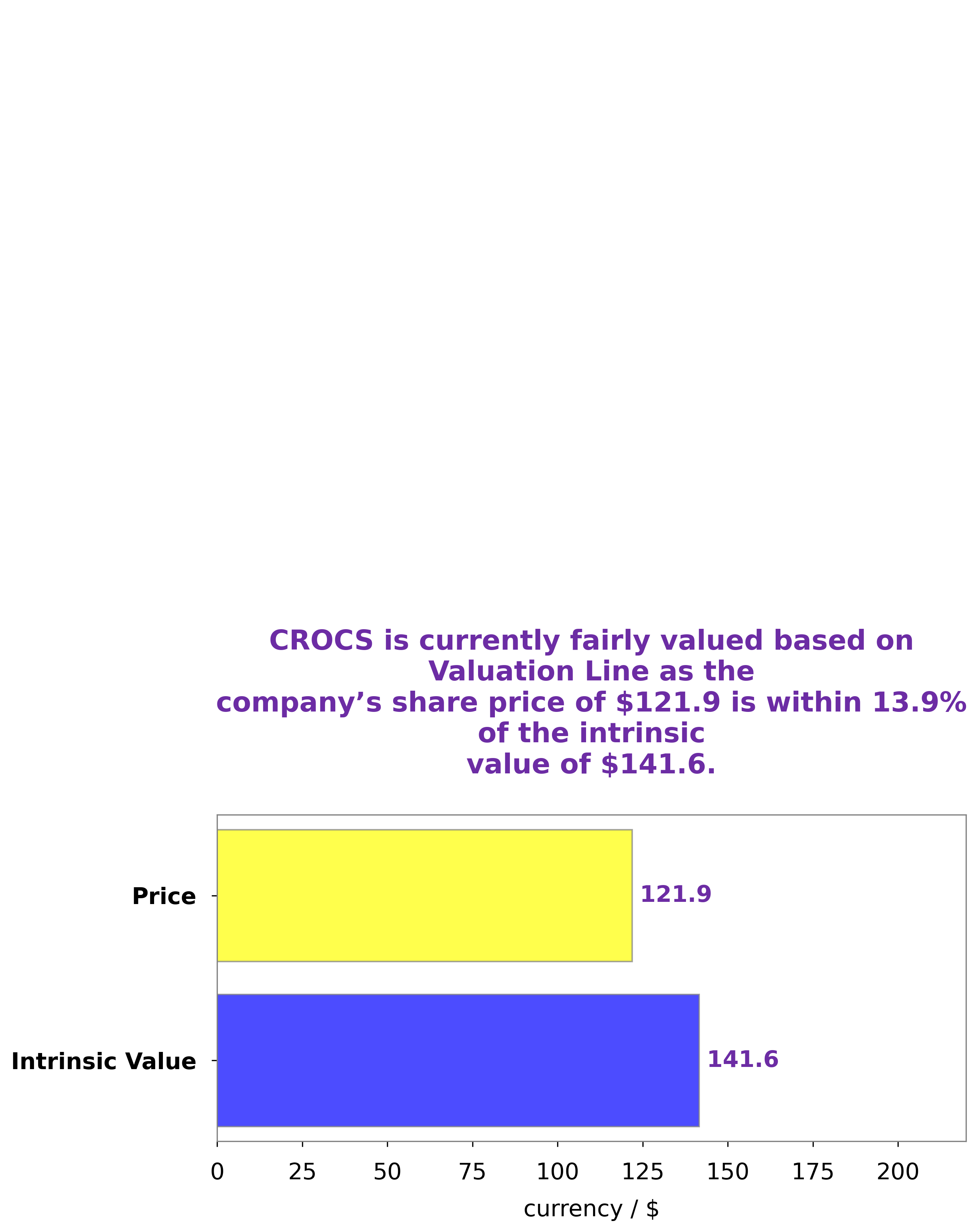

At GoodWhale, we performed an analysis of CROCS’s wellbeing. Through our proprietary Valuation Line, we determined that the fair value of CROCS shares is around $141.6. However, the current trading price of CROCS shares is $121.9 – a fair price that is undervalued by 13.9%. This presents an opportunity for investors to take advantage of the bargain and purchase CROCS shares while they are still trading at a discounted rate. Crocs_Stock”>More…

Peers

Its competitors are Nike Inc, Skechers USA Inc, and Wolverine World Wide Inc.

– Nike Inc ($NYSE:NKE)

Nike is one of the largest sporting goods companies in the world. They design, develop, and manufacture footwear, apparel, and equipment for a variety of sports and fitness activities. Nike’s market cap as of 2022 is 138.47B. Their return on equity is 25.1%. Nike’s products are sold in over 190 countries worldwide.

– Skechers USA Inc ($NYSE:SKX)

Skechers USA Inc has a market cap of 5.44B as of 2022, a Return on Equity of 10.49%. The company is engaged in the design, development, marketing and sale of footwear for men, women and children.

– Wolverine World Wide Inc ($NYSE:WWW)

Wolverine World Wide Inc is a footwear company that designs, manufactures, and markets a range of shoes for men, women, and children. The company has a market cap of 1.3B as of 2022 and a Return on Equity of 18.81%. Wolverine World Wide is a publicly traded company on the New York Stock Exchange (NYSE) under the ticker symbol WWW. The company was founded in 1883 and is headquartered in Rockford, Michigan.

Summary

Investing in Crocs can be a lucrative opportunity. Despite its recent run-up, the stock is still worth consideration for those looking for long-term returns. Analysts suggest that the company’s long-term prospects remain attractive, with a healthy balance sheet and strong cash position helping to bolster its financials.

Additionally, the company has seen strong growth in its digital presence, as well as a new line of products and collaborations with other brands, which may support future sales. Furthermore, the company’s competitive position in the footwear industry continues to be a major strength. Ultimately, investors should consider all factors when deciding whether or not to invest in Crocs.

Recent Posts