Amcon Distributing Intrinsic Value Calculator – AMCON DISTRIBUTING: High Risk, But Potentially High Reward with Robust Customer Base

April 15, 2023

Trending News ☀️

It is known as a high risk, but potentially high reward stock. The company’s customer base is extremely robust and diverse, ranging from fast food franchises to major entertainment studios. This has enabled the company to achieve consistent results even during economic downturns. The company’s customer lists could potentially result in considerable upside potential. With a well-established network of customers, AMCON ($NYSEAM:DIT) Distributing has been able to consistently generate profits by leveraging its existing customer base.

Additionally, the company has recently developed new offerings, such as beverage and snack machines, which have been well received by customers. AMCON Distributing’s long-term outlook is promising. The company’s strong customer base has enabled them to remain competitive even as the industry continues to evolve. Further, they have diversified their offerings to ensure that they remain relevant in an ever-changing marketplace. With its current customer base, AMCON Distributing is well-positioned for future growth and success.

Price History

On Friday, AMCON DISTRIBUTING opened at $179.2 and closed at $176.5, a decrease of 3.8% from its last closing price of 183.4. Although the stock had a slight dip, its customer base is still a strong indicator of potential success in the future. The company’s expansive customer base, coupled with a strong track record of success and the potential for further growth, make AMCON DISTRIBUTING a stock worth considering. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amcon Distributing. More…

| Total Revenues | Net Income | Net Margin |

| 2.15k | 16.3 | 0.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amcon Distributing. More…

| Operations | Investing | Financing |

| -24.98 | -15.65 | 40.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amcon Distributing. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 330.87 | 236.16 | 155 |

Key Ratios Snapshot

Some of the financial key ratios for Amcon Distributing are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.2% | 43.1% | 1.2% |

| FCF Margin | ROE | ROA |

| -1.9% | 17.0% | 4.8% |

Analysis – Amcon Distributing Intrinsic Value Calculator

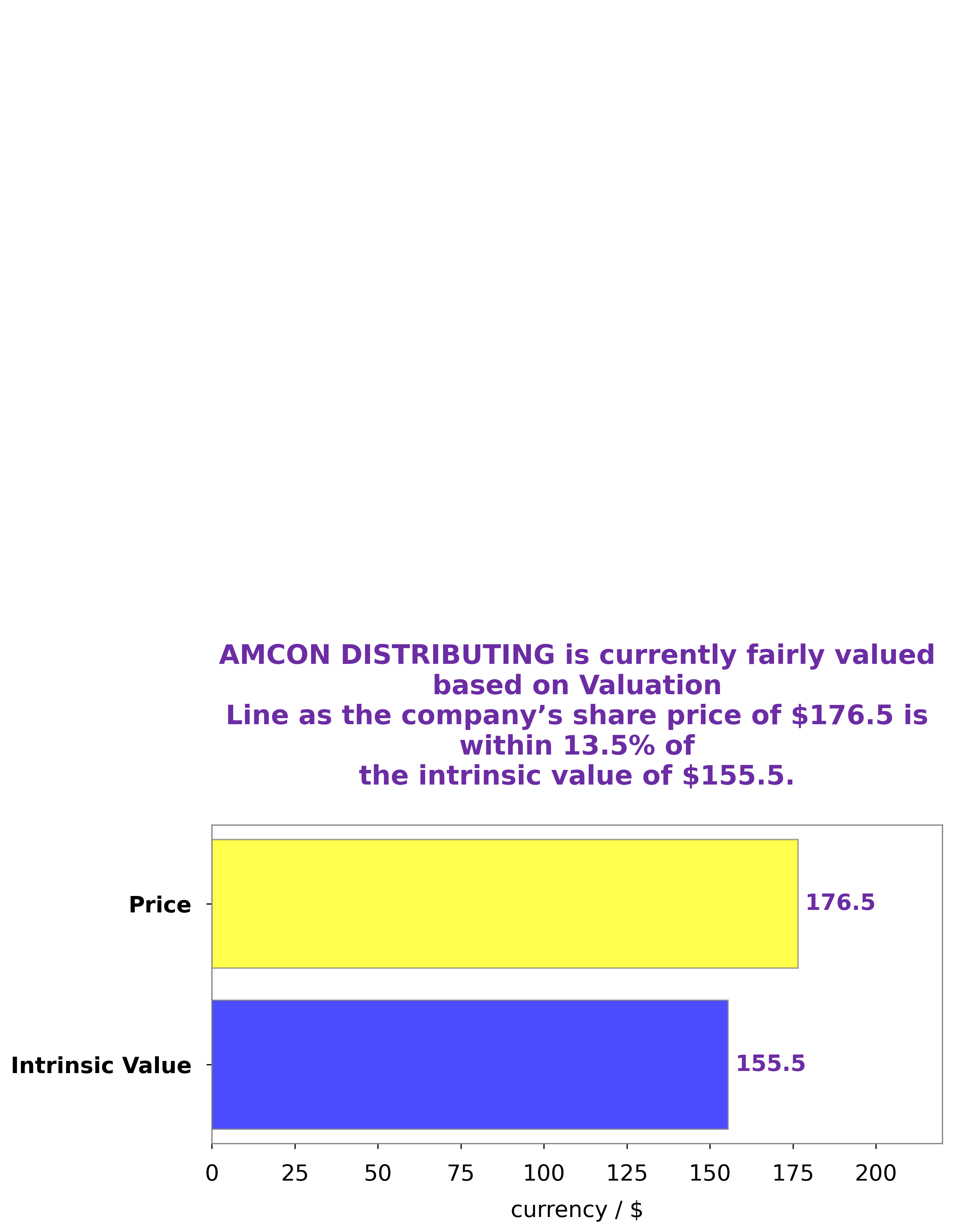

At GoodWhale, our goal is to provide the best financial analysis to our customers. With that in mind, we have thoroughly analyzed the financials of AMCON DISTRIBUTING by using our proprietary tools. After careful consideration, we estimate the fair value of AMCON DISTRIBUTING’s share to be around $155.5. This value is calculated by our Valuation Line and it takes into account the company’s current financials as well as industry trends and market conditions. This means that investors should tread with caution when investing in or buying shares of AMCON DISTRIBUTING. More…

Peers

The competition between Amcon Distributing Co and its competitors Metcash Ltd, SpartanNash Co, and iFresh Inc is fierce. These companies are all striving to provide their customers with the best products, services, and prices in the industry. Each company is looking for ways to outpace the competition and gain a competitive edge in the market. By leveraging their strengths, these companies are constantly innovating and pushing each other to be better.

– Metcash Ltd ($ASX:MTS)

Metcash Ltd is a leading Australian distributor and marketer of groceries, fresh food, and hardware. It has a market capitalisation of 3.99 billion as of 2022, indicating that the company is well-established and performing well. Metcash’s return on equity (ROE) of 22.07% is a measure of the profitability of the company and shows that Metcash has been able to generate strong returns for shareholders. The company’s strong financials indicate that it is well-positioned to continue to operate successfully in the future.

– SpartanNash Co ($NASDAQ:SPTN)

SpartanNash Co is a large food distributor and grocery retailer in the United States. As of 2022, the company has a market cap of 1.11 billion US dollars and a Return on Equity of 7.43%. Market capitalization is a measure of the company’s size and reflects the total value of its outstanding shares. The Return on Equity (ROE) measures how efficiently a company generates profits from the capital it has raised from shareholders. SpartanNash Co’s market cap and ROE indicate a healthy company that is able to generate significant profits from its operations.

– iFresh Inc ($OTCPK:IFMK)

iFresh Inc is a leading Asian American grocery supermarket chain and online grocer specializing in fresh produce, seafood and other products. The company currently operates over 20 stores across the United States, with a focus on the East Coast. As of 2022, iFresh Inc has a market cap of 182.92k, which reflects the overall value of the company. Furthermore, iFresh Inc has a Return on Equity (ROE) of -0.95%. This indicates that the company has been unable to generate sufficient returns on its invested capital and could be an indicator of financial distress.

Summary

AMCON Distributing is a publicly traded company that distributes food, beverages, and merchandise to convenience stores. Recently, investors have been taking a closer look at the company due to its customer list, which could indicate significant upside potential.

However, investing in AMCON is still considered to be a risky proposition, as it has not seen much success in recent years. Nonetheless, some analysts believe that its customer list could lead to better performance and higher stock prices in the future. Ultimately, investors should thoroughly research the company before investing in order to make an informed decision.

Recent Posts