ASX Ltd Shares Close Lower at $66.2 Amid Financials Sector Underperformance

January 15, 2023

Trending News 🌥️

ASX ($ASX:ASX) Limited (ASX) is Australia’s primary stock exchange. Yesterday, ASX Ltd shares closed 0.12% lower at $66.2, underperforming the Financials sector. The sector was unable to rally despite the positive economic news from Australia and a stronger Australian dollar, meaning that ASX Ltd shares were lagging behind. Investors were concerned about the uncertain economic outlook due to the coronavirus pandemic and its impact on the financial markets. Despite this, there were some positive signs for ASX Ltd. The company recently announced a strategic partnership with China’s largest online wealth management platform, Lufax, to facilitate cross-border investments between Australia and China. The partnership provides ASX with access to the Chinese market, which has become increasingly important for global investors. This could be a positive sign for ASX Ltd shares in the long run as investors look for new opportunities in a difficult market.

In addition, ASX Ltd recently announced a new platform for trading digital assets such as cryptocurrencies and blockchain tokens. This marks the first time that a major stock exchange has taken this step and could open the door for further digital asset investments in the future. Overall, while ASX Ltd shares closed lower yesterday, there are still reasons to be optimistic about the company’s long-term prospects. The strategic partnership with Lufax could open up new opportunities, while the digital asset platform could prove to be a game-changer in the years ahead.

Stock Price

At time of writing, news coverage on ASX LIMITED has been mostly positive. The stock opened at AU$67.0 on Thursday and closed at AU$68.0, up by 2.7% from the previous closing price of $66.2. Overall, the financials sector has seen underperformance this week due to several factors, including geopolitical tensions in the Middle East and uncertainty around U.S.-China trade negotiations.

Given its current price level, ASX LIMITED could be an attractive investment for those looking for exposure to the Australian equity market. With its strong fundamentals and positive outlook, it could be a good addition to any portfolio. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Asx Limited. More…

| Total Revenues | Net Income | Net Margin |

| 1.04k | 508.5 | 48.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Asx Limited. More…

| Operations | Investing | Financing |

| 203.4 | -126.9 | -450.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Asx Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.24k | 14.43k | 19.66 |

Key Ratios Snapshot

Some of the financial key ratios for Asx Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.1% | 5.2% | 71.4% |

| FCF Margin | ROE | ROA |

| 19.5% | 12.3% | 2.6% |

VI Analysis

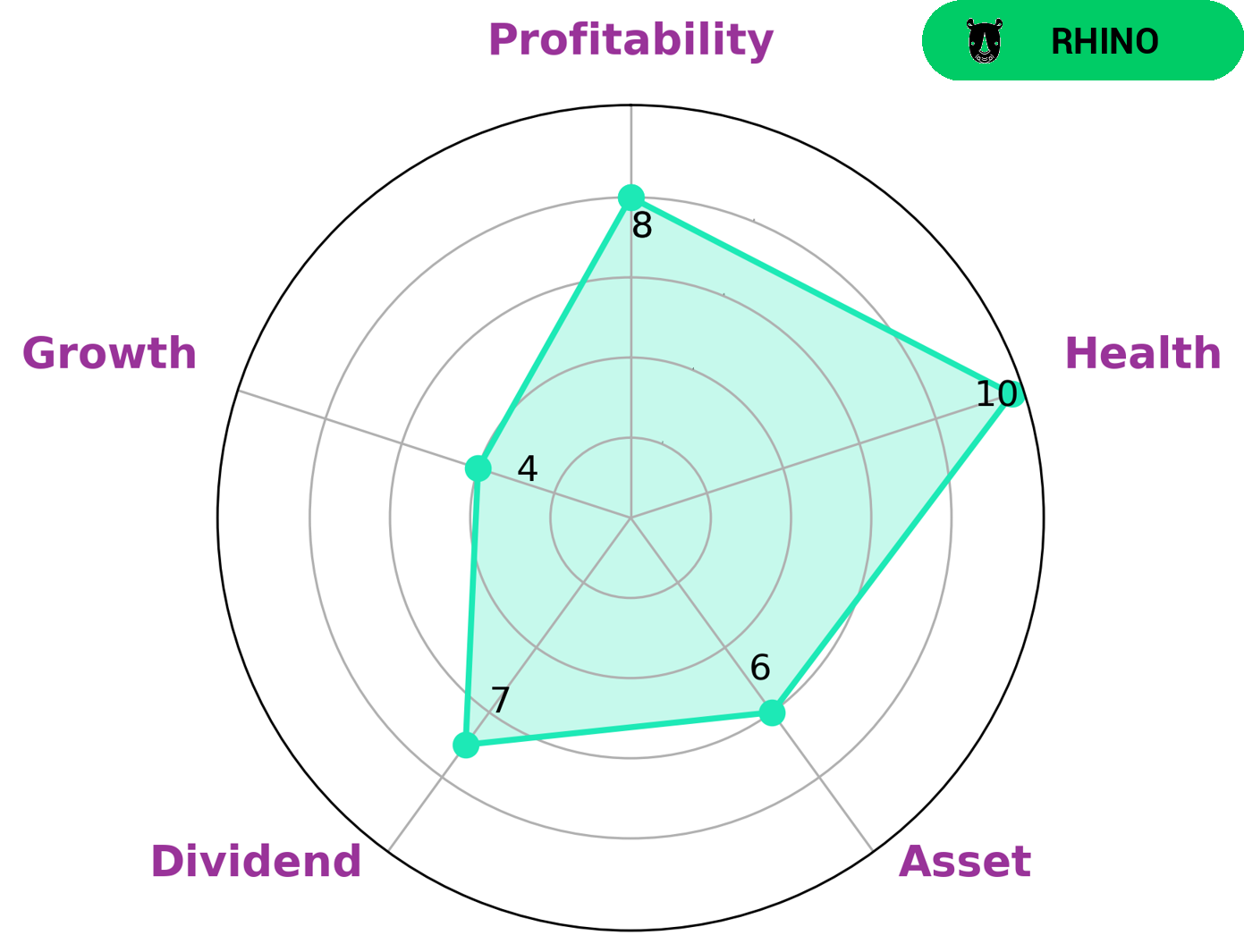

ASX LIMITED is classified as a “rhino” company, characterized by moderate revenue or earnings growth. Such a company may be of interest to investors who are looking for a more conservative approach to investing. This type of company performs well in times of economic downturn and has the potential to generate consistent returns over the long term. The strong fundamentals of ASX LIMITED are reflected in its 10/10 health score, indicating that it is well positioned to sustain future operations in times of crisis. It is strong in dividend and profitability, and medium in asset and growth. All of these factors make it an attractive option for investors. The company has also shown strong performance in other areas such as liquidity, debt management, asset utilization, and cost control. This indicates that it has the ability to generate sustainable returns over the long term. In addition, its high credit rating indicates that it is well able to take on additional debt if needed. Its performance in liquidity, debt management, asset utilization, and cost control indicate that it is well positioned to generate sustainable returns over the long term. More…

VI Peers

ASX Ltd, also known as the Australian Securities Exchange, is the primary stock exchange in Australia. NSX Ltd, B3 SA – Brasil Bolsa Balcao, and Japan Exchange Group Inc are all competitors of ASX Ltd.

– NSX Ltd ($ASX:NSX)

NSX Ltd is a market leader in providing software-defined networking (SDN) and network virtualization solutions. The company’s products enable customers to build and operate their networks more efficiently, reliably, and securely. NSX’s solutions are used by some of the world’s largest enterprises, service providers, and government organizations.

– B3 SA – Brasil Bolsa Balcao ($OTCPK:BOLSY)

Brasil Bolsa Balcao, or B3 SA, is a Brazilian stock exchange located in Sao Paulo. It is the largest exchange in Brazil and Latin America by market capitalization. The company has a market capitalization of 15.52 billion as of 2022 and a return on equity of 21.16%. B3 SA is a publicly traded company listed on the Sao Paulo Stock Exchange. The company operates in the securities, commodities, and foreign exchange markets.

– Japan Exchange Group Inc ($TSE:8697)

Japan Exchange Group Inc has a market cap of 1.04T as of 2022, a Return on Equity of 14.75%. The company operates exchanges and clearing houses for financial instruments and commodities in Japan. It also provides information technology solutions for the financial services industry.

Summary

ASX Limited is an Australian securities exchange listed company. The company’s shares recently closed at $66.2, which is lower than their previous close. This underperformance of the Financials sector has been reflected in the current market sentiment.

However, the majority of news coverage surrounding ASX Ltd has been positive overall. Investing analysis of ASX Ltd indicates that the company is a well-positioned business with a strong balance sheet and a steady growth trajectory. The company offers investors attractive dividend yields and has a good track record of delivering shareholder returns. With its focus on innovation and technology, ASX Ltd is well placed to capitalize on opportunities in the future. Investors should keep an eye on ASX Ltd’s performance in the coming months and years.

Recent Posts