Adecoagro S.a Intrinsic Value Calculator – SG Americas Securities LLC Reduces Stake in Adecoagro S.A. Stock Holdings

May 9, 2023

Trending News ☀️

SG Americas Securities LLC has recently reduced its stock holdings in Adecoagro ($NYSE:AGRO) S.A. according to Defense World. Adecoagro S.A. is a leading agricultural company in South America that specializes in the production, processing, and marketing of agro-industrial products. Adecoagro S.A. has a diversified portfolio of assets across its three countries of operation. Its assets include farmland, sugar mills, dairy processing plants, and renewable energy power plants. It is one of the largest producers of sugar, ethanol, and milk in South America.

The company also has an extensive network of storage and distribution facilities for its products. Despite the recent reduction in stock holdings by SG Americas Securities LLC, the company remains well-positioned to benefit from rising demand for its products both domestically and abroad. With its strong presence in three countries and its diversified asset portfolio, Adecoagro S.A. continues to be an attractive investment opportunity.

Stock Price

ADECOAGRO S.A is an agricultural company that operates in South America, providing integrated agricultural solutions and services to producers, industries and consumers. The stock opened at $8.4 and closed at $8.6, which was a 0.8% increase from its previous closing price of 8.5. This slight increase indicates that investors are still bullish on the company’s prospects despite the reduction in holdings by SG Americas Securities LLC. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adecoagro S.a. More…

| Total Revenues | Net Income | Net Margin |

| 1.35k | 108.14 | 9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adecoagro S.a. More…

| Operations | Investing | Financing |

| 370.03 | -299.26 | -23.57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adecoagro S.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.11k | 1.95k | 10.29 |

Key Ratios Snapshot

Some of the financial key ratios for Adecoagro S.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.0% | 27.2% | 16.1% |

| FCF Margin | ROE | ROA |

| 10.4% | 12.0% | 4.4% |

Analysis – Adecoagro S.a Intrinsic Value Calculator

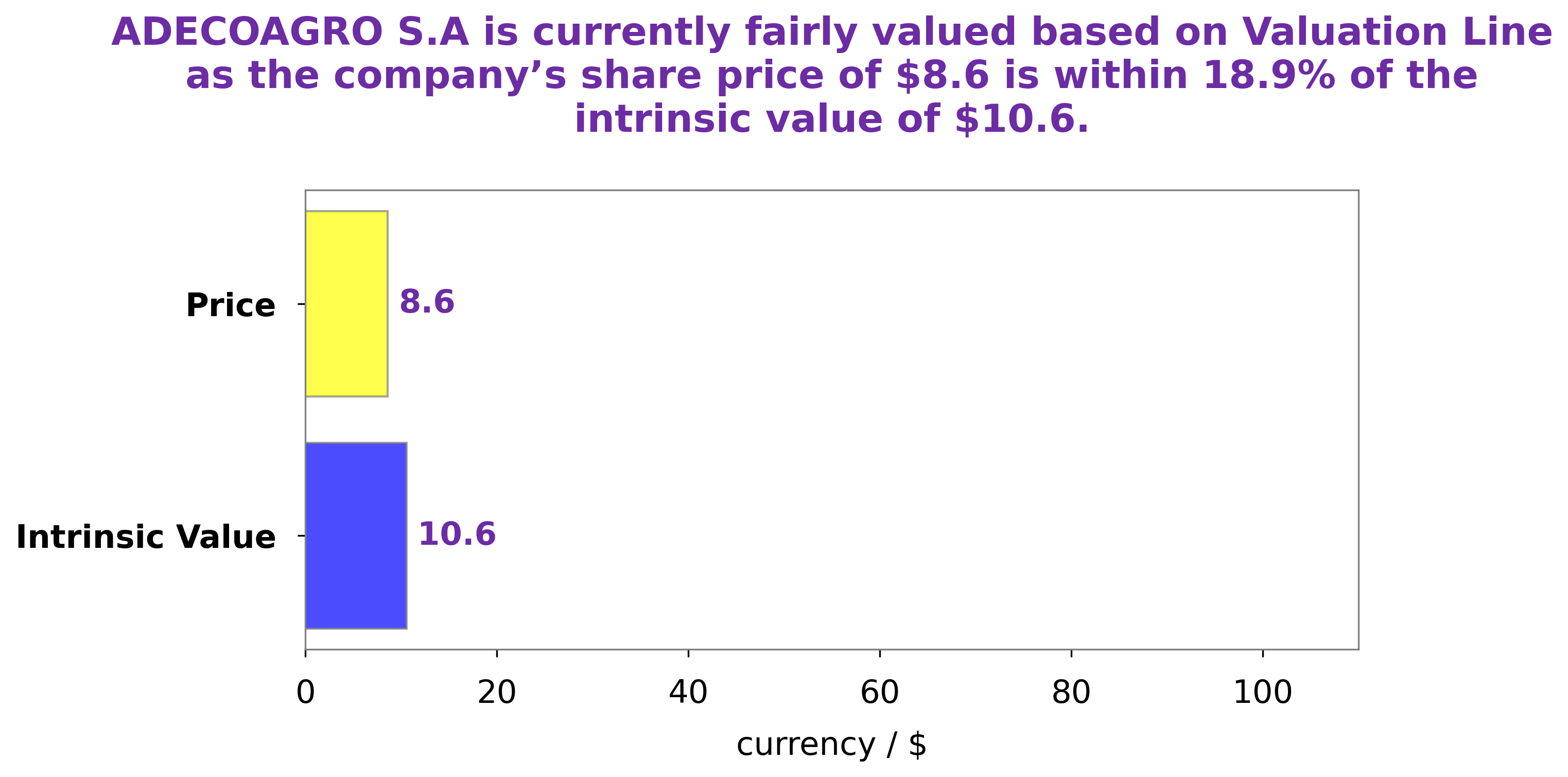

GoodWhale has conducted an in-depth analysis of ADECOAGRO S.A‘s fundamentals and used our proprietary Valuation Line to calculate the intrinsic value of the company. According to our calculations, the intrinsic value of an ADECOAGRO S.A share is around $10.6. Currently, ADECOAGRO S.A’s stock is traded at $8.6, representing a fair price that is undervalued by 19.0%. More…

Peers

The company faces competition from ASTARTA Holding NV, PT Aman Agrindo Tbk, and Magadh Sugar & Energy ltd, all of which are engaged in similar agricultural activities. With a presence in Brazil, Argentina, Uruguay, Paraguay and other countries, Adecoagro SA has managed to remain competitive in a highly dynamic sector.

– ASTARTA Holding NV ($LTS:0O0C)

ASTARTA Holding NV is an agricultural holding company based in Ukraine. It operates in the agribusiness sector, processing and selling agricultural products produced by its subsidiaries. As of 2022, the company has a market capitalization of 495.91M, making it one of the largest agricultural companies in Ukraine. Its Return on Equity (ROE) of 14.43% indicates that the company is generating returns that are higher than its cost of capital. This suggests that ASTARTA Holding NV is creating value for its shareholders.

– PT Aman Agrindo Tbk ($IDX:GULA)

Magadh Sugar & Energy Ltd is an Indian-based sugar, ethanol, and power generation company. It operates nine sugar mills in the state of Bihar, and has a total sugarcane crushing capacity of over 11,500 tons per day. The company also produces ethanol from molasses and has an installed capacity of 6.2 MW of power generation from bagasse. As of 2022, Magadh Sugar & Energy Ltd has a market capitalization of 4.44 billion and a return on equity of 10.61%. This data indicates that the company is performing well financially and has a strong presence in its industry. Its ability to produce sugar, ethanol, and power from its sugar mills makes it a unique player within its sector.

Summary

SG Americas Securities LLC recently decreased its holdings in Adecoagro S.A., an agricultural and industrial company based in South America. The company’s stock, which is traded on the New York Stock Exchange, has been volatile in recent months, with analysts citing a variety of factors that could affect the stock price. The reduction by SG Americas Securities LLC was likely due to uncertainty surrounding the company’s outlook and the resulting risk it poses to investments. Investors should analyze a variety of potential factors, including the company’s financials, competitive landscape, and potential regulatory changes, before making an informed decision about investing in Adecoagro S.A. Given the current environment and the uncertainty surrounding the stock price, investors should be cautious when considering investing in Adecoagro S.A.

Recent Posts