Texas Permanent School Fund Invests $1.20 Million in Lindsay Corporation

May 19, 2023

Trending News 🌥️

The Texas Permanent School Fund has recently invested $1.20 million in Lindsay Corporation ($NYSE:LNN), a leading global manufacturer and marketer of irrigation equipment and infrastructure products for agriculture. With a history of steady growth and consistent returns to shareholders, Lindsay Corporation has established itself as a reliable investment option. Lindsay Corporation operates through two primary business segments – irrigation equipment and infrastructure products. The company’s irrigation equipment segment manufactures center-pivot and lateral-move irrigation systems, while its infrastructure products segment produces highway safety barriers, guardrail systems, and bridge decking.

In addition, the company also offers aftermarket parts and services related to its products. With a diversified portfolio of products and services, Lindsay Corporation is positioned to continue its growth for years to come. The company’s commitment to innovation and market leadership will ensure that the Texas Permanent School Fund’s investment will remain a sound one.

Share Price

On Monday, the Texas Permanent School Fund (TPSF) announced their investment of $1.20 million in Lindsay Corporation (LINDSAY CORPORATION), a provider of irrigation and infrastructure solutions for agricultural, industrial and commercial property owners. Following the news, LINDSAY CORPORATION opened at $120.1 and closed at $120.7, up 0.6% from its prior closing price of 120.0. This injection of capital is expected to help drive further innovation and expansion of LINDSAY CORPORATION’s product and service offerings. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lindsay Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 746.86 | 79.27 | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lindsay Corporation. More…

| Operations | Investing | Financing |

| 46.79 | 0.95 | -17.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lindsay Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 709.08 | 286.81 | 36.78 |

Key Ratios Snapshot

Some of the financial key ratios for Lindsay Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.7% | 57.4% | 15.1% |

| FCF Margin | ROE | ROA |

| 4.1% | 17.0% | 9.9% |

Analysis

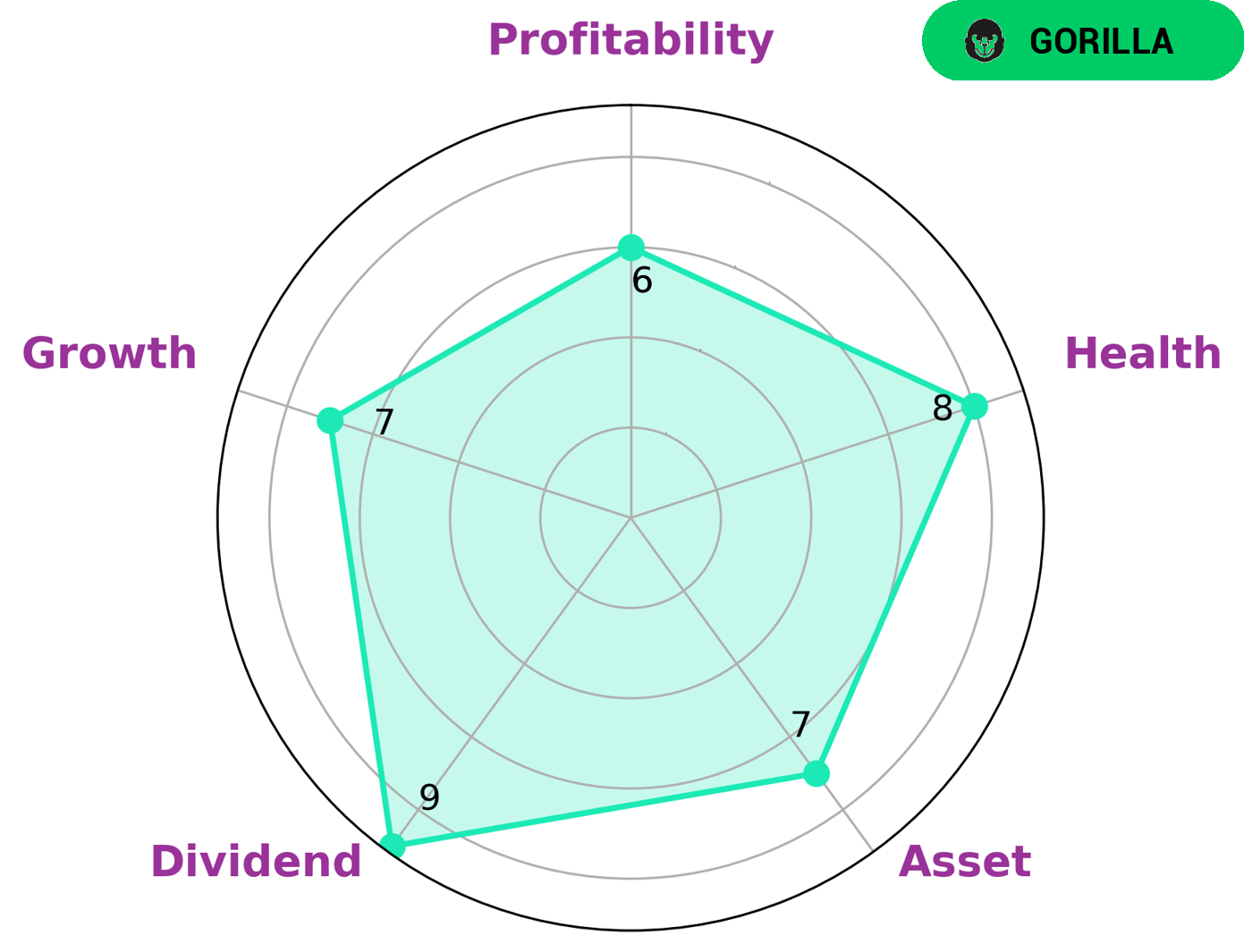

GoodWhale has conducted an analysis of LINDSAY CORPORATION‘s wellbeing and found that, based on the Star Chart, LINDSAY CORPORATION has a high health score of 8/10 with regards to its cashflows and debt, which means it is capable of safely riding out any crisis without the risk of bankruptcy. We have categorized the company as a ‘gorilla’, a type of company that has achieved a stable and high revenue or earning growth due to its strong competitive advantage. LINDSAY CORPORATION is strong in asset, dividend, and growth, and medium in profitability, making it the ideal target for long-term investors. These investors may include mutual funds, pension funds, endowment funds, and high-net-worth individuals seeking to benefit from the stability of the company’s performance over time. With its strong cash flows and high health score, LINDSAY CORPORATION is in an excellent position to provide returns to these types of investors. More…

Peers

The Company operates through three segments: Irrigation, Infrastructure, and Industrial. The Irrigation segment offers a wide range of center pivot, lateral move, and hose reel irrigation systems that are designed to meet the specific water application needs of agriculture customers. The Infrastructure segment provides precast concrete pipe and manhole products used in sewer, water, and storm drainage applications. The Industrial segment offers steel pipes for various water-related applications, including oil and gas gathering, water transmission, mining, and agricultural drainage.

– Retro Green Revolution Ltd ($BSE:519191)

Retro Green Revolution Ltd. has a market capitalization of $47.09 million as of 2022 and a return on equity of 5.72%. The company is engaged in the business of sustainable agriculture and forestry, with a focus on the reforestation of degraded lands. It has operations in the United States, Canada, and China.

– Two Rivers Water & Farming Co ($NASDAQ:NWPX)

Northwest Pipe Company is a manufacturer of welded steel pipe and tube products. The Company manufactures products primarily for the water transmission, oil and gas transmission, mining, and industrial end markets.

Summary

Lindsay Corporation is an American publicly traded company that specializes in the manufacturing and sale of irrigation and infrastructure products. The Texas Permanent School Fund, a trust fund for public schools in Texas, recently invested $1.20 million into Lindsay Corporation. This move is seen as an indication of the company’s positive outlook and potential for growth. Analysts suggest that Lindsay Corporation is well positioned to benefit from increased infrastructure investment and population growth in the United States.

The company has seen strong growth in its revenue and earnings in recent years, and it maintains a healthy dividend payout ratio. Overall, Lindsay Corporation appears to be a solid long-term investment opportunity.

Recent Posts