Russell Investments Group Ltd. Increases Stake in Manitowoc Company

May 25, 2023

Trending News 🌥️

The Manitowoc Company ($NYSE:MTW), Inc. is a leading global manufacturer of cranes and lifting solutions, foodservice equipment, and commercial refrigeration products. Recently, Russell Investments Group Ltd. has increased its ownership in the company. This increase serves as a strong sign of confidence in the company’s prospects and future growth. The Manitowoc Company is currently in the process of refining its business strategy and restructuring operations to reduce costs and better serve its customers.

This increased ownership of The Manitowoc Company, Inc. by Russell Investments Group Ltd. is evidence that they view the proposed changes as beneficial and will likely create value for shareholders in the long run. Moving forward, The Manitowoc Company is committed to delivering on their promises and creating value for their shareholders.

Share Price

On Monday, Russell Investments Group Ltd. announced that it has increased its stake in Manitowoc Company, the leading global manufacturer of cranes and other equipment for the construction industry. The stock opened at $15.7 and closed at $15.4, down by 1.3% from the last closing price of $15.6. The news of Russell’s increased stake in Manitowoc Company has generated optimism among investors and analysts as to the future prospects of the company. It remains to be seen whether this will help Manitowoc Company to make further gains in the stock market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Manitowoc Company. More…

| Total Revenues | Net Income | Net Margin |

| 2.08k | -110.2 | -0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Manitowoc Company. More…

| Operations | Investing | Financing |

| 86.7 | -57.9 | -24.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Manitowoc Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.69k | 1.14k | 15.72 |

Key Ratios Snapshot

Some of the financial key ratios for Manitowoc Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.1% | -3.9% | -3.7% |

| FCF Margin | ROE | ROA |

| 1.1% | -8.8% | -2.8% |

Analysis

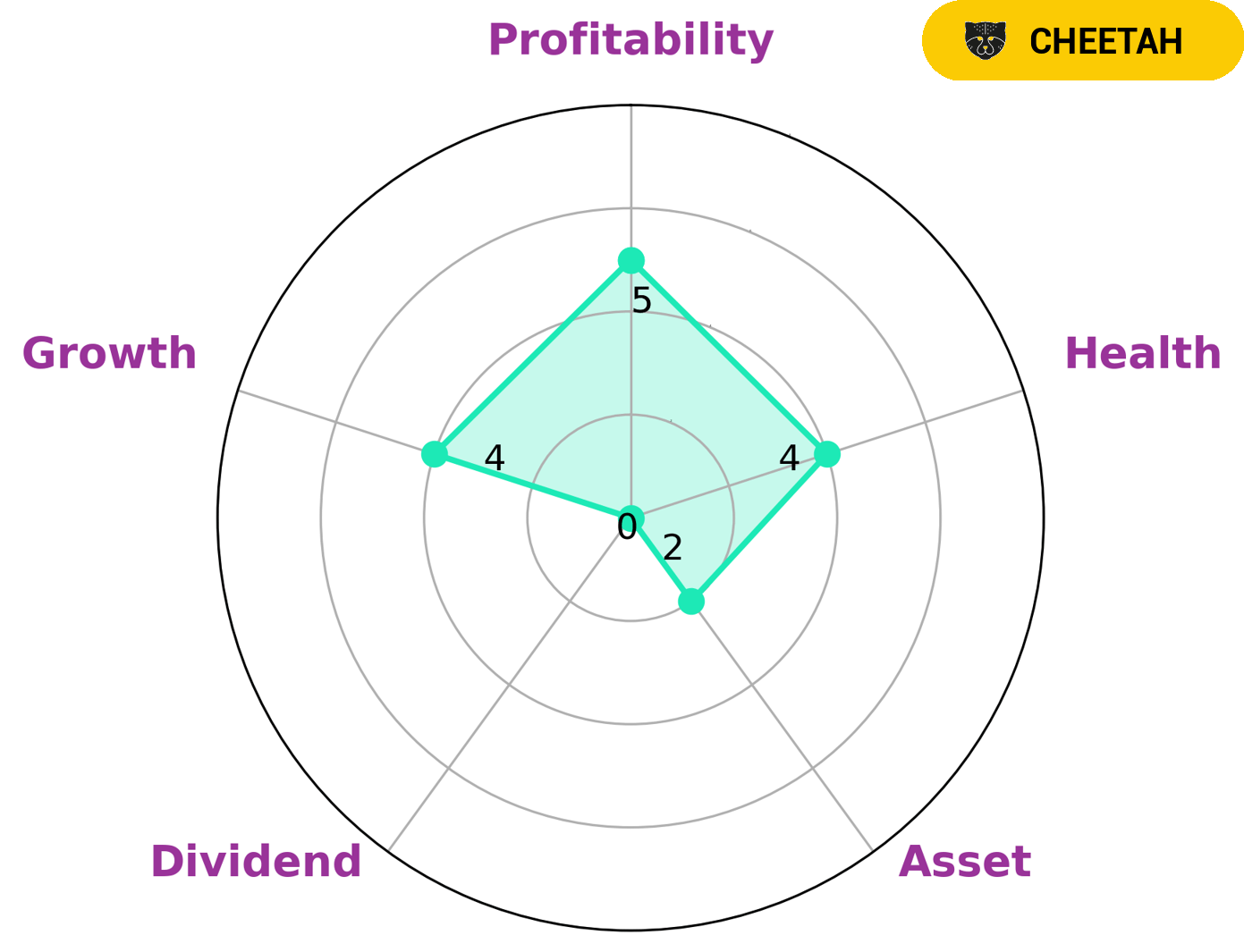

At GoodWhale, we conducted an analysis of MANITOWOC COMPANY‘s fundamentals. Based on Star Chart, MANITOWOC COMPANY is strong in growth, medium in profitability and weak in asset and dividend. We have classified MANITOWOC COMPANY as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Given this, we believe that investors looking for high risk/high reward investments may be interested in MANITOWOC COMPANY. Although its intermediate health score of 4/10 considering its cashflows and debt is likely to pay off debt and fund future operations, there is still a risk of underperformance. It is important to note that investors should do their own due diligence before investing in any company. More…

Peers

There is intense competition between Manitowoc Co Inc and its competitors Palfinger AG, Wacker Neuson SE, Volvo AB. All four companies are fighting for market share in the construction equipment industry. Manitowoc Co Inc has a strong presence in North America, while its competitors have a strong presence in Europe and Asia.

– Palfinger AG ($OTCPK:PLFRF)

Palfinger AG is a leading provider of innovative lifting, loading, and handling solutions. The company has a market capitalization of 704.98 million as of 2022 and a return on equity of 14.32%. Palfinger AG designs, manufactures, and markets a broad range of products, including cranes, aerial work platforms, and hydraulic loader arms. The company’s products are used in a variety of industries, including construction, agriculture, forestry, recycling, and material handling.

– Wacker Neuson SE ($OTCPK:WKRCF)

Wacker Neuson SE, with a market cap of 1.01B as of 2022, is a construction equipment company with a return on equity of 9.24%. The company has a strong focus on innovation and has a wide range of products that serve the construction, agriculture, and landscaping industries.

– Volvo AB ($OTCPK:VLVLY)

Volvo AB, together with its subsidiaries, manufactures and sells trucks, buses, construction equipment, and marine and industrial engines in Sweden, China, and internationally. The company operates through four segments: Trucks, Construction Equipment, Buses, and Financial Services. The Trucks segment offers medium to heavy-duty trucks. The Construction Equipment segment provides wheel loaders, articulated haulers, backhoe loaders, excavators, and compact equipment. The Buses segment offers city buses, intercity buses, coaches, and bus chassis. The Financial Services segment offers financing, leasing, and insurance products to its customers and dealers. Volvo was founded in 1915 and is headquartered in Gothenburg, Sweden.

Summary

Russell Investments Group Ltd. recently increased its ownership of The Manitowoc Company, Inc., a global provider of engineered lifting and foodservice equipment. The investment group’s analysis of the company led them to conclude that increased ownership was a wise decision, and they proceeded to raise their stake in the company. Analysts anticipate that the company stands to benefit from an increase in demand for specialty crane products due to a surge in infrastructure projects in the US, China, and the Middle East. The company is also predicted to benefit from ongoing investments in research and development, enabling them to introduce new products and services that will drive growth.

Additionally, the company’s restructuring program is expected to cut costs and improve efficiency, contributing to its overall success.

Recent Posts