Manitowoc Company Intrinsic Value – Manitowoc Company, Stock Struggles Despite Market Gains

April 15, 2023

Trending News 🌧️

The Manitowoc Company ($NYSE:MTW), Inc. is a global leader in the design, manufacture, and marketing of cranes, foodservice equipment, and marine and industrial products. The company’s stock took a dip on a day of market gains, closing at $15.10, down 0.46% from the previous session. This was despite positive market indices and strong performances from many other stocks across the board. The Manitowoc Company has seen its share of struggles in recent years. The company has faced an uphill battle as it tries to compete with larger, more established players in its industry and to keep up with the relentless pace of technological innovation.

In addition, the company has faced increasing pressure from its investors to maximize returns and minimize costs. Despite these challenges, the company has made strides to remain competitive and is focused on long-term growth. Despite the struggles, there are some encouraging signs for the Manitowoc Company. The company has seen an uptick in new orders, while its backlog continues to remain strong. In addition, the company recently announced a new strategic initiative that includes cost reductions and growth initiatives. This initiative marks a shift away from their previous strategy of cost-cutting and focus on organic growth. Though the stock of The Manitowoc Company, Inc. took a slight dip on a day of market gains, there are still reasons to be optimistic about the company’s future prospects. With its new strategic initiatives in place, the company looks to be well-positioned for growth in the coming years. Investors should keep an eye on this stock as it continues to chart its course in this ever-changing market.

Market Price

Manitowoc Company, Inc., a publicly traded industrial company, has been struggling in the stock market lately. On Friday, its stock opened at $15.2 and closed at $15.1, down 0.3% from the prior closing price of $15.1. Despite the general market gains, Manitowoc Company stock was unable to make any significant gains on Friday.

The company’s underperformance highlights further struggles the industrial sector is facing in light of the pandemic and its associated economic issues. As the market continues to fluctuate, Manitowoc Company’s investors will be watching closely to see if the company can make a comeback in the stock market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Manitowoc Company. More…

| Total Revenues | Net Income | Net Margin |

| 2.03k | -123.6 | -1.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Manitowoc Company. More…

| Operations | Investing | Financing |

| 76.9 | -58 | -29.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Manitowoc Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.62k | 1.08k | 17.93 |

Key Ratios Snapshot

Some of the financial key ratios for Manitowoc Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.5% | -12.1% | -4.4% |

| FCF Margin | ROE | ROA |

| 0.7% | -9.5% | -3.4% |

Analysis – Manitowoc Company Intrinsic Value

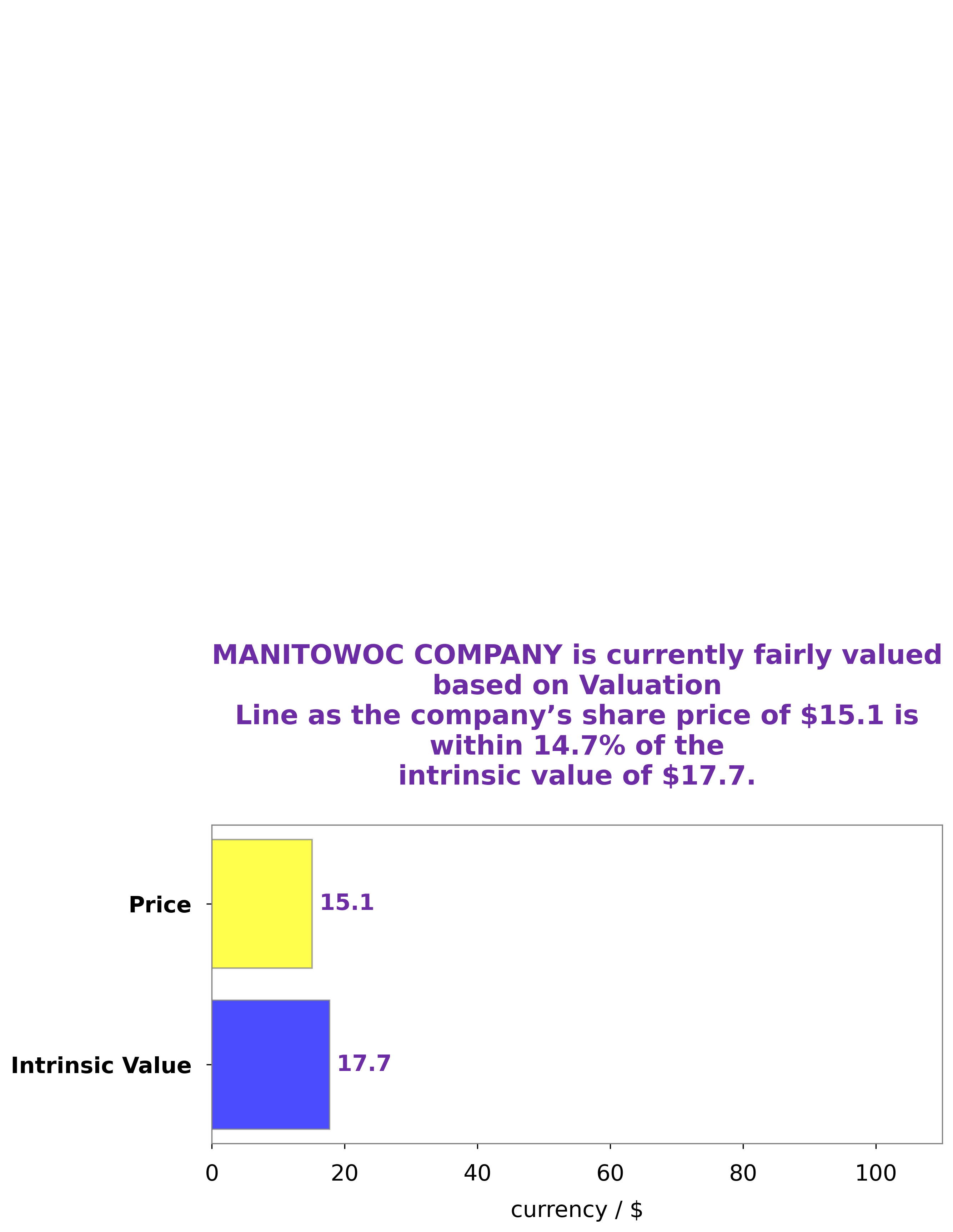

GoodWhale has completed an analysis of the fundamentals of MANITOWOC COMPANY. We have determined that the intrinsic value of MANITOWOC COMPANY’s share is around $17.7, which was calculated using our proprietary Valuation Line. Currently, MANITOWOC COMPANY’s stock is being traded at $15.1, which is a fair price but is undervalued by 14.7%. Our analysis suggests that it would be a good idea to invest in the company’s share at this price, as it has potential to increase in value over time. More…

Peers

There is intense competition between Manitowoc Co Inc and its competitors Palfinger AG, Wacker Neuson SE, Volvo AB. All four companies are fighting for market share in the construction equipment industry. Manitowoc Co Inc has a strong presence in North America, while its competitors have a strong presence in Europe and Asia.

– Palfinger AG ($OTCPK:PLFRF)

Palfinger AG is a leading provider of innovative lifting, loading, and handling solutions. The company has a market capitalization of 704.98 million as of 2022 and a return on equity of 14.32%. Palfinger AG designs, manufactures, and markets a broad range of products, including cranes, aerial work platforms, and hydraulic loader arms. The company’s products are used in a variety of industries, including construction, agriculture, forestry, recycling, and material handling.

– Wacker Neuson SE ($OTCPK:WKRCF)

Wacker Neuson SE, with a market cap of 1.01B as of 2022, is a construction equipment company with a return on equity of 9.24%. The company has a strong focus on innovation and has a wide range of products that serve the construction, agriculture, and landscaping industries.

– Volvo AB ($OTCPK:VLVLY)

Volvo AB, together with its subsidiaries, manufactures and sells trucks, buses, construction equipment, and marine and industrial engines in Sweden, China, and internationally. The company operates through four segments: Trucks, Construction Equipment, Buses, and Financial Services. The Trucks segment offers medium to heavy-duty trucks. The Construction Equipment segment provides wheel loaders, articulated haulers, backhoe loaders, excavators, and compact equipment. The Buses segment offers city buses, intercity buses, coaches, and bus chassis. The Financial Services segment offers financing, leasing, and insurance products to its customers and dealers. Volvo was founded in 1915 and is headquartered in Gothenburg, Sweden.

Summary

Investors in The Manitowoc Company, Inc. saw their shares sink 0.46% on Tuesday as the stock underperformed the broader market. This underperformance follows the release of their latest quarterly earnings report, which showed mixed results. Analysts have a mixed outlook for the company’s future, with some believing that its current share price is overvalued. Investors should continue to monitor the company’s performance closely and consider any potential catalysts for a rerating.

Recent Posts