Hyster-Yale Materials Handling Shares Dip 2.23% to $45.56

April 14, 2023

Trending News ☀️

HYSTER-YALE ($NYSE:HY): Hyster-Yale Materials Handling Inc. is a leading manufacturer and global supplier of materials handling equipment and related aftermarket parts and services. The company designs, engineers, manufactures, sells and services a comprehensive line of lift trucks and aftermarket parts throughout the United States, Canada, Europe, South America, Africa, the Middle East, Asia and Australia. At the close of business last night, Hyster-Yale Materials Handling Inc.’s stock was priced at $45.56, a decrease of -2.23% from its prior closing price of $46.60. With the dip in the stock price, investors are questioning whether the current price is still too expensive for their shares. They offer a wide range of products from electric lift trucks to warehouse automation equipment, as well as aftermarket parts and services for their customers’ needs. They are committed to providing quality products and services that are reliable, robust, and cost-effective.

With their commitment to innovation and customer service, Hyster-Yale Materials Handling Inc. is poised to continue to be a leader in the materials handling industry. Despite the dip in their stock price, Hyster-Yale Materials Handling Inc. still remains a strong choice for investors who are seeking a long-term investment in the materials handling industry. Their commitment to innovation and customer service gives them an advantage in a competitive marketspace, making them a strong contender in the industry. The stock dip may provide an opportunity for investors to buy in at a lower price while still having the potential to benefit from long-term growth potential from this leader in the materials handling industry.

Market Price

On Monday, shares of Hyster-Yale Materials Handling Inc. (HY) dipped 2.23% to $45.56. This was despite a modest rise in the stock’s opening price of $45.4, which closed at $46.4, up by 1.7% from its last closing price of 45.6. Overall, the stock suffered a slight loss on the day, with investors perhaps taking a wait-and-see approach to the stock. It is unknown what factors may have contributed to the stock’s drop, but investors may want to keep an eye on the company as it seeks to grow its market share and diversify its products and services. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HY. More…

| Total Revenues | Net Income | Net Margin |

| 3.55k | -74.1 | -2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HY. More…

| Operations | Investing | Financing |

| 40.6 | -35.4 | -10.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.03k | 1.8k | 12.07 |

Key Ratios Snapshot

Some of the financial key ratios for HY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.5% | -13.1% | -1.0% |

| FCF Margin | ROE | ROA |

| 0.3% | -13.3% | -1.0% |

Analysis

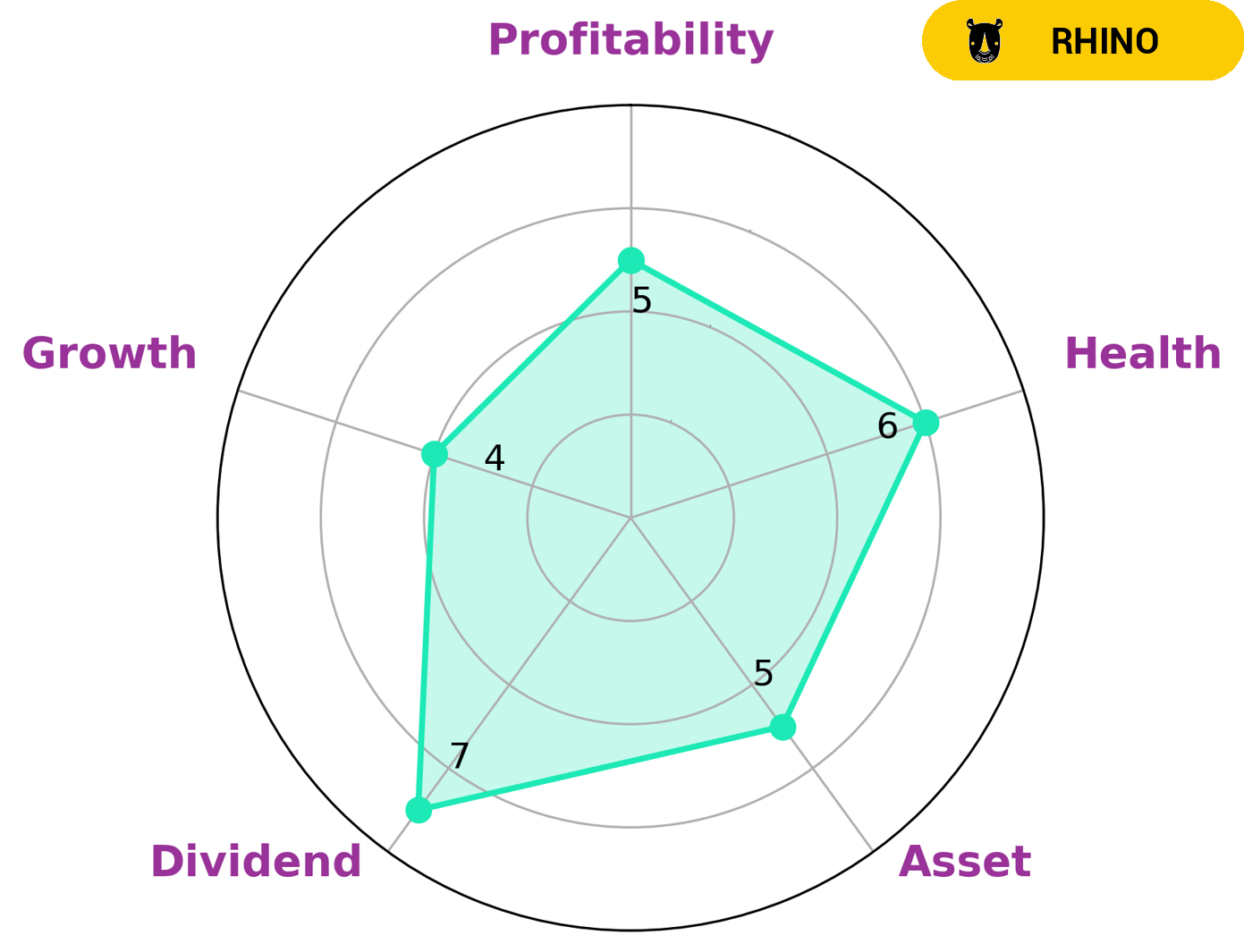

GoodWhale has conducted an analysis of HYSTER-YALE MATERIALS HANDLING’s financials and classified them as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. We believe that this type of company might be of interest to value investors, as well as those looking for stable dividend income. HYSTER-YALE MATERIALS HANDLING stands out in terms of dividend payments, with a strong score in this category. In terms of growth, assets, and profitability, they have a medium score but still demonstrate some appeal in these areas. Moreover, HYSTER-YALE MATERIALS HANDLING has an intermediate health score of 6/10 with regard to its cashflows and debt, which suggests that they may be able to sustain future operations in times of crisis. Therefore, this company may be attractive to a variety of investors, depending on their investment needs. More…

Peers

It is competing with other leading companies in the sector such as PACCAR Inc, Qingling Motors Co Ltd and Tadano Ltd. All of these companies are renowned for their innovative products and cutting-edge technologies that help businesses to improve their efficiency and productivity.

– PACCAR Inc ($NASDAQ:PCAR)

PACCAR Inc is a Fortune 500 company that designs, manufactures, and distributes light, medium, and heavy-duty trucks under the Kenworth, Peterbilt, and DAF nameplates. With a market capitalization of 34.7 billion dollars as of 2023, the company has demonstrated significant growth in recent years. Moreover, its Return on Equity (ROE) of 19.26% is one of the highest in its sector, indicating that the company is highly profitable and efficiently utilizing its equity to generate returns.

– Qingling Motors Co Ltd ($SEHK:01122)

Qingling Motors Co Ltd is a leading Chinese manufacturer of passenger cars and commercial vehicles. The company has a market capitalization of 2.63 billion dollars as of 2023, which puts it among the top largest companies in the automotive industry. Qingling Motors Co Ltd also has a strong Return on Equity of 1.96%, which indicates that the company is able to generate good returns on its investment and is a good indicator of its financial health.

– Tadano Ltd ($TSE:6395)

Tadano Ltd is a global leader in the manufacturing and sales of cranes and other heavy machinery. It has a market capitalization of 115.49 billion as of 2023, indicating that it is a highly profitable and well-recognized company. Furthermore, its Return on Equity (ROE) of 3.31% reflects its strong financial performance and ability to generate returns on its investments. Tadano’s products are well-known for their quality, durability, and reliability, making them the preferred choice of customers in the industry. The company has established itself as a leader in the crane and heavy machinery market, and its strong financial performance is a testament to its success.

Summary

Hyster-Yale Materials Handling Inc. is a leading provider of material handling equipment and integrated solutions. As of close of business last night, the company’s stock was priced at $45.56, down -2.23% from its previous closing price of $46.60. Investing analysis reveals that the stock is volatile, with significant fluctuations in its price over the past few weeks.

Long-term investors may find the current price to be attractive for entry into the stock, but short-term investors should be wary of the potential for further price drops. Research into the company’s fundamentals and risk management strategies is essential for any investor looking to enter the stock at this price point.

Recent Posts