Warren Buffett’s Critique of Netflix: Streaming Is ‘An Unattractive Business’

April 19, 2023

Trending News 🌧️

Netflix ($NASDAQ:NFLX) is a leading streaming service that has revolutionized the way people consume entertainment. Buffett has been vocal about his concerns with investment in streaming services such as Netflix. He believes that streaming services are unable to sustain their current growth rates due to competition from other companies and the fact that they need to keep prices low in order to attract customers. He also believes that streaming services are not able to generate enough revenue to make the business model attractive. This is a direct contrast to other more traditional investments, such as in real estate, which he considers to be more stable and profitable. Despite this critique, Netflix still remains an attractive investment for many investors. The company has seen continued success and growth over the years and recently reported its highest quarterly revenue ever.

Additionally, it has continued to innovate in the streaming industry with its original content and creative user experience. Netflix’s stock price continues to remain relatively high and its market value has grown exponentially over the years. Overall, despite Buffett’s critique, Netflix continues to be a top streaming service and a viable investment opportunity. It has consistently been able to remain competitive and relevant in the industry and continues to be a major player in the entertainment industry.

Market Price

On Monday, Warren Buffet, the renowned investor, shared his thoughts on the streaming industry, particularly on NETFLIX. He believes that streaming is an “unattractive business” and that investors should not invest in it. In light of his assessment, NETFLIX stock opened at $338.0 and closed at $332.7, down by 1.7% from last closing price of 338.6.

This shows that the market did not respond well to the news, signaling that investors are skeptical of Buffet’s view. Nevertheless, NETFLIX remains the largest streaming service provider in the world and continues to expand its offerings. Netflix_Streaming_Is_An_Unattractive_Business”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netflix. More…

| Total Revenues | Net Income | Net Margin |

| 31.62k | 4.49k | 14.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netflix. More…

| Operations | Investing | Financing |

| 2.03k | -2.08k | -664.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netflix. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 48.59k | 27.82k | 46.65 |

Key Ratios Snapshot

Some of the financial key ratios for Netflix are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.2% | 29.3% | 18.9% |

| FCF Margin | ROE | ROA |

| 5.1% | 18.1% | 7.7% |

Analysis

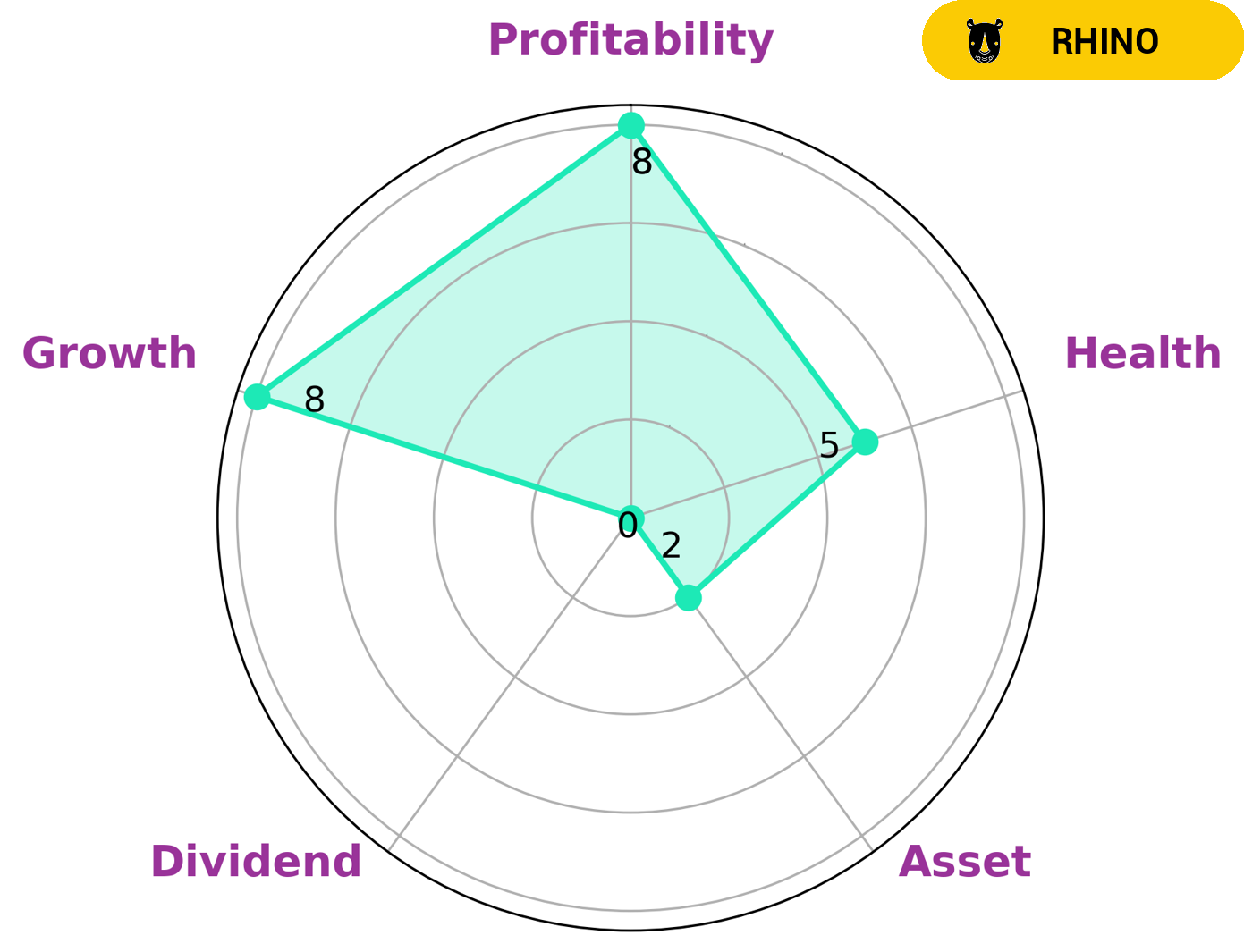

At GoodWhale, we conducted a fundamental analysis of NETFLIX and found that its Star Chart classified it as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. This type of company may be of interest to investors who are looking for a moderate, but consistent return on their investment. Our analysis also revealed that NETFLIX has an intermediate health score of 5/10 with regard to its cashflows and debt; indicating that the company is likely to sustain future operations in times of crisis. NETFLIX is particularly strong in the areas of growth and profitability, while showing weakness in asset and dividend. This makes NETFLIX an attractive investment option for those who want to achieve a moderate return while also limiting their risk exposure. Netflix_Streaming_Is_An_Unattractive_Business”>More…

Peers

It has a library of movies and TV shows to choose from. Disney, Paramount, and FuboTV are all streaming services that offer movies and TV shows. Netflix is the most popular of these services.

– The Walt Disney Co ($NYSE:DIS)

The Walt Disney Company has a market capitalization of 186.02 billion as of 2022 and a return on equity of 4.53%. The company operates in the media and entertainment industry and is known for its film and television productions, as well as its theme parks and resorts. Disney also owns and operates a number of cable and broadcast television networks, including ABC, ESPN, and the Disney Channel.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 12.6B as of 2022. The company’s ROE is 18.54%. Paramount Global is a leading provider of global logistics and transportation services. The company offers a full range of logistics and transportation services, including air and ocean freight forwarding, warehousing, trucking, and custom clearance. Paramount Global also offers a wide range of value-added services, such as product sourcing, order management, and supply chain management.

– FuboTV Inc ($NYSE:FUBO)

FuboTV Inc is a television streaming company that offers over 100 live channels. As of 2022, the company has a market capitalization of 681.89 million dollars and a return on equity of -43.27%. The company’s primary service is providing live streaming of television content, however, they also offer a cloud DVR service and a social TV platform. The company is headquartered in New York City.

Summary

Warren Buffett, the Oracle of Omaha, is not bullish on Netflix as a business. He believes that the streaming giant is not a good investment opportunity because it has a high cost structure and an unsustainable business model. Netflix has to constantly produce new content in order to keep their customers subscribed, leading to higher costs.

Additionally, Netflix has to compete with other streaming services in order to keep its market share. The amount of competition in the streaming market could lead to pricing wars that could further damage profits. Buffett also doubts the longevity of Netflix’s business model, as customers may eventually move away from streaming services as technology evolves. Though Netflix’s stock has been a solid performer over the last few years, Buffett is not convinced that the company’s success is sustainable.

Recent Posts