Walt Disney Intrinsic Value Calculator – Disney Turns Attention Away from Proxy Battle Towards Bigger Projects

April 10, 2023

Trending News 🌧️

The Walt Disney ($NYSE:DIS) Company has made a move to turn their attention away from a proxy battle and focus on bigger projects. As one of the most recognizable entertainment companies in the world, Disney is a global leader in media and entertainment. The company operates through five business segments: media networks, parks and resorts, studio entertainment, consumer products and interactive media. These segments support a wide range of activities including the production of films and television programs, theme park operations, radio and broadcast networks, licensing, consumer products and interactive gaming. With such a broad range of businesses, Disney has been able to make great strides in the global entertainment industry.

By taking the focus away from the proxy battle and instead focusing on more meaningful matters, Disney can continue to make strides in its industry. The company is likely to benefit from this move as it will be able to better utilize its resources in order to develop new products and services. Disney is also likely to strengthen its relationship with its customers by putting more emphasis on customer service. With all these pieces in place, Disney is sure to remain a leader in the global entertainment industry.

Share Price

On Monday, Walt Disney Co. took a step back from its ongoing proxy battle and instead shifted its focus towards larger projects. WALT DISNEY stock opened at $100.2 and closed at $99.8, down by 0.4% from its prior closing price of 100.1. This slight decrease in stock price reflects the company’s decision to direct its attention away from the proxy battle and towards more ambitious projects.

Such projects include Disney’s expansion of its streaming services, such as the recent release of its new streaming service, Disney Plus. The company is also focusing on the development of more theme parks, investing in television networks and films, and capitalizing on the vast library of intellectual properties that it owns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walt Disney. More…

| Total Revenues | Net Income | Net Margin |

| 84.42k | 3.32k | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walt Disney. More…

| Operations | Investing | Financing |

| 5.24k | -5.31k | -5.49k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walt Disney. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 202.12k | 93.25k | 52.63 |

Key Ratios Snapshot

Some of the financial key ratios for Walt Disney are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.0% | -16.5% | 8.3% |

| FCF Margin | ROE | ROA |

| 0.1% | 4.6% | 2.2% |

Analysis – Walt Disney Intrinsic Value Calculator

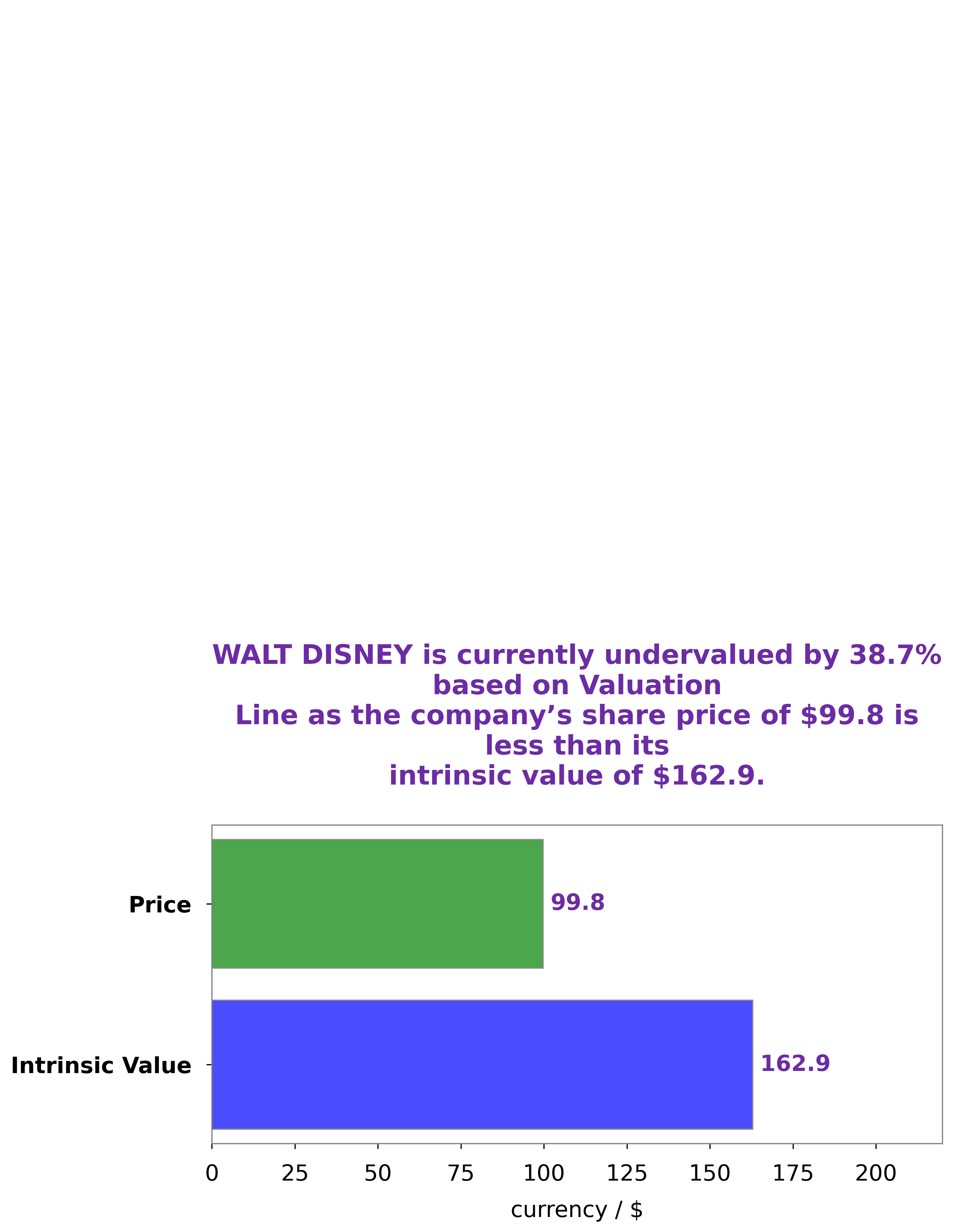

At GoodWhale, we have conducted an in-depth analysis of Walt Disney‘s fundamentals. Our proprietary Valuation Line has determined a fair value of around $162.9 per share. Currently, Walt Disney stock is trading at $99.8, which is significantly lower than its fair value, representing an undervaluation of 38.8%. This potentially represents a good opportunity for savvy investors to take advantage of the discrepancy between market price and fair value. More…

Peers

The Walt Disney Co is the largest entertainment company in the world. It operates in four business segments: media networks, parks and resorts, studio entertainment, and consumer products. The company has a wide array of competitors, including Netflix Inc, Paramount Global, Warner Bros.Discovery Inc, and many others.

– Netflix Inc ($NASDAQ:NFLX)

Netflix is a streaming service for movies and TV shows. It has a market cap of 109B as of 2022 and a Return on Equity of 22.38%. The company was founded in 1997 and is headquartered in Los Gatos, California.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 12.64B as of 2022, a Return on Equity of 18.54%. The company is a leading provider of global insurance and reinsurance solutions. It offers a broad range of products and services to meet the needs of its clients.

– Warner Bros.Discovery Inc ($NASDAQ:WBD)

Discovery, Inc. is a global media and entertainment company that operates a portfolio of cable television networks and produces original content for a variety of platforms. The company operates in over 220 countries and territories and reaches nearly 3 billion people around the world. Discovery’s primary businesses include Discovery Channel, Animal Planet, Science Channel, Investigation Discovery, TLC, OWN: Oprah Winfrey Network, Velocity, Travel Channel, Food Network, Cooking Channel, and HGTV. The company also operates Eurosport, Discovery Kids, Discovery Family, and Discovery Turbo. In addition to its cable networks, Discovery also owns and operates digital media properties, including Discovery Digital Networks, Seeker Network, and TestTube.

Summary

Walt Disney (DIS) is a global media and entertainment company with a wide-ranging portfolio of options. In terms of investment analysis, DIS offers many attractive opportunities. The company has a strong balance sheet and a history of steady dividend growth. It also has an impressive lineup of brands and businesses, which make it well-positioned to capitalize on future trends.

Additionally, DIS has a long track record of profitable operations and an effective capital allocation strategy. With a diverse portfolio of assets, strong management, and long-term potential, DIS is an attractive option for investors looking for a sound long-term investment.

Recent Posts