Walt Disney Intrinsic Stock Value – Walt Disney Co. Experiences a Sudden Fall From Grace

June 12, 2023

☀️Trending News

The Walt Disney ($NYSE:DIS) Company has endured a sudden fall from grace in recent years. The company, once a major powerhouse in the entertainment industry, has seen its fortunes decline significantly, culminating in a sharp drop in its stock prices. This is especially surprising given Disney’s long and illustrious history. From animated films to theme parks, Disney has become synonymous with family-friendly entertainment, delighting generations of children and adults around the globe.

However, it seems that even the most beloved of companies can suffer from financial woes. In recent years, Disney has had to face the challenge of sustaining its success as consumer tastes and preferences have changed.

In addition, the rise of streaming services like Netflix has caused a shift in how people consume media, with many turning away from traditional cable and broadcast services. This has caused further strain on Disney’s business model, leading to its sudden fall from grace.

Stock Price

On Wednesday, Walt Disney Co. experienced a sudden fall from grace, as their stock opened at $92.8 and closed at $92.5, representing an increase of only 0.4% from the previous closing price of 92.2. The sudden dip in stock price has left many investors concerned about the future of Walt Disney’s success. It is unclear what caused such a sharp decrease in value, but many will be watching closely to see if the company can recover. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walt Disney. More…

| Total Revenues | Net Income | Net Margin |

| 86.98k | 4.12k | 5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walt Disney. More…

| Operations | Investing | Financing |

| 6.71k | -5.53k | -3.76k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walt Disney. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 204.86k | 94.49k | 54.95 |

Key Ratios Snapshot

Some of the financial key ratios for Walt Disney are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.6% | -7.9% | 9.4% |

| FCF Margin | ROE | ROA |

| 1.6% | 5.3% | 2.5% |

Analysis – Walt Disney Intrinsic Stock Value

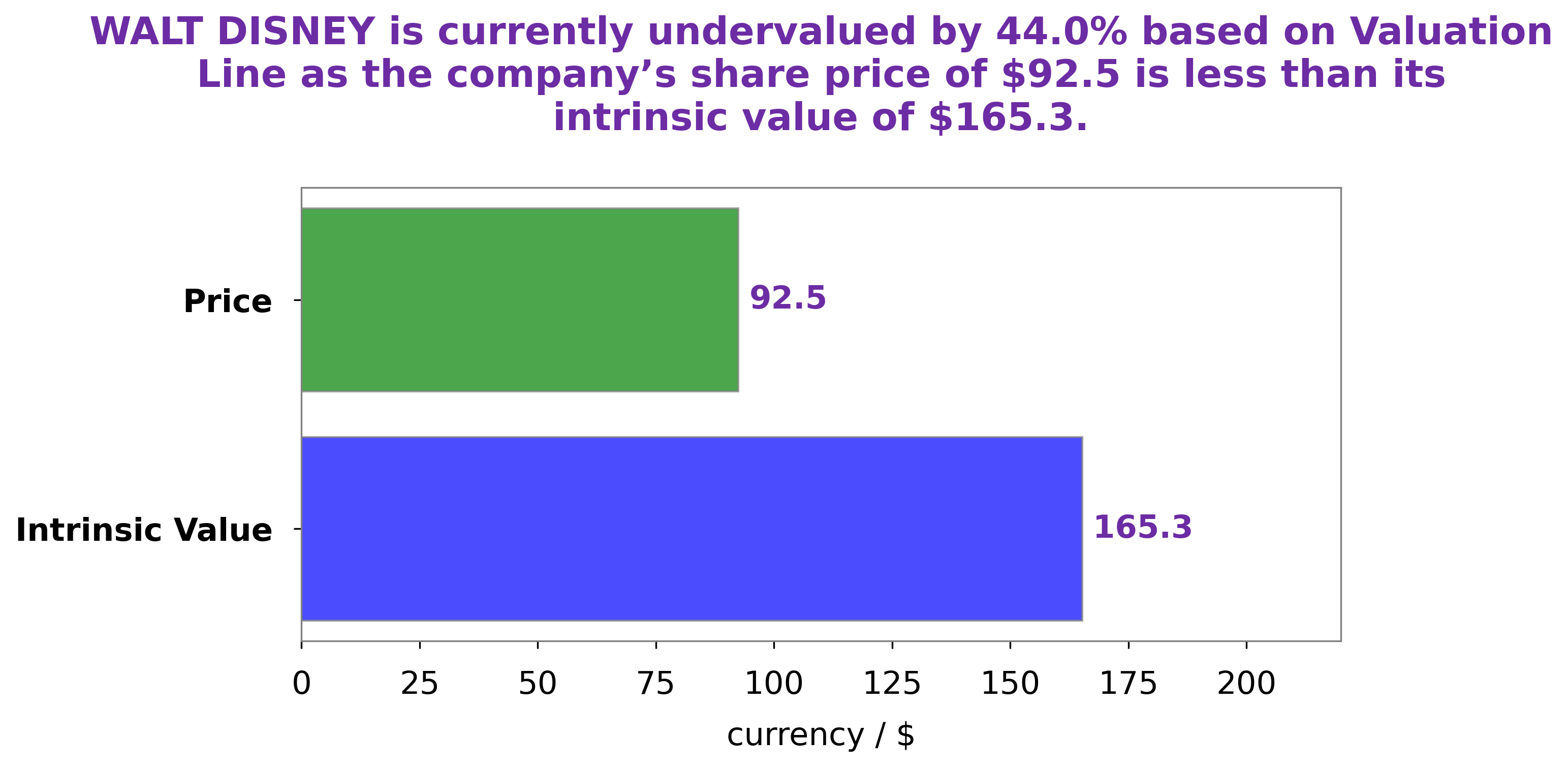

GoodWhale has conducted a thorough analysis of WALT DISNEY‘s fundamentals and concluded that the fair value of its shares is approximately $165.3. This value was determined using our proprietary Valuation Line. Currently, WALT DISNEY stock is traded at $92.5, which is 44.0% lower than its estimated value according to our analysis. This provides an excellent opportunity for investors to purchase the stock at a discounted price and potentially earn good returns in the future. More…

Peers

The Walt Disney Co is the largest entertainment company in the world. It operates in four business segments: media networks, parks and resorts, studio entertainment, and consumer products. The company has a wide array of competitors, including Netflix Inc, Paramount Global, Warner Bros.Discovery Inc, and many others.

– Netflix Inc ($NASDAQ:NFLX)

Netflix is a streaming service for movies and TV shows. It has a market cap of 109B as of 2022 and a Return on Equity of 22.38%. The company was founded in 1997 and is headquartered in Los Gatos, California.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 12.64B as of 2022, a Return on Equity of 18.54%. The company is a leading provider of global insurance and reinsurance solutions. It offers a broad range of products and services to meet the needs of its clients.

– Warner Bros.Discovery Inc ($NASDAQ:WBD)

Discovery, Inc. is a global media and entertainment company that operates a portfolio of cable television networks and produces original content for a variety of platforms. The company operates in over 220 countries and territories and reaches nearly 3 billion people around the world. Discovery’s primary businesses include Discovery Channel, Animal Planet, Science Channel, Investigation Discovery, TLC, OWN: Oprah Winfrey Network, Velocity, Travel Channel, Food Network, Cooking Channel, and HGTV. The company also operates Eurosport, Discovery Kids, Discovery Family, and Discovery Turbo. In addition to its cable networks, Discovery also owns and operates digital media properties, including Discovery Digital Networks, Seeker Network, and TestTube.

Summary

The Walt Disney Company is a household name, but its stock has experienced some volatility in recent years. Despite its strong brand, it has faced various risks, such as declining viewership for its cable network, an increasingly competitive streaming landscape, and global economic uncertainty. Investors should monitor Disney’s performance in these areas, as well as its ability to launch successful new products and services.

Additionally, they should watch for any potential changes in leadership or strategic direction. Taking all these factors into account, the company appears to be a solid long-term investment.

Recent Posts