Netflix Sees 10% Gain Following Positive Response to First Ad Upfront

May 19, 2023

Trending News ☀️

Netflix ($NASDAQ:NFLX) recently experienced an impressive 10% gain in stock prices following a positive response to its first ever ad upfront. It primarily provides streaming television and film services, and recently added online video games to its repertoire. Netflix is consistently ranked as one of the leading companies in terms of revenue, and is one of the most valuable media companies in the world. The positive response to Netflix’s first ad upfront came as a surprise to many industry experts, who had expected the market to be more volatile given current economic conditions. The 10% stock price gain was a testament to the strength of the Netflix brand, and its ability to attract viewers and maintain loyalty. Netflix’s strong performance at the ad upfront further demonstrated the power of its digital streaming services, and how it is able to leverage its existing user base and content library.

Netflix’s success in the ad upfront was further bolstered by a series of strategic partnerships with a variety of media and advertising companies. These partnerships have enabled Netflix to expand its reach, allowing it to engage more users and generate more revenue. This increase in revenue has allowed Netflix to invest in more original content, which has been met with positive response from viewers. The 10% gain following Netflix’s first ad upfront is indicative of the company’s strong performance in the market and its potential for further growth. With its strategic partnerships, wide range of content, and ability to engage users, Netflix looks poised to continue its success for years to come.

Analysis

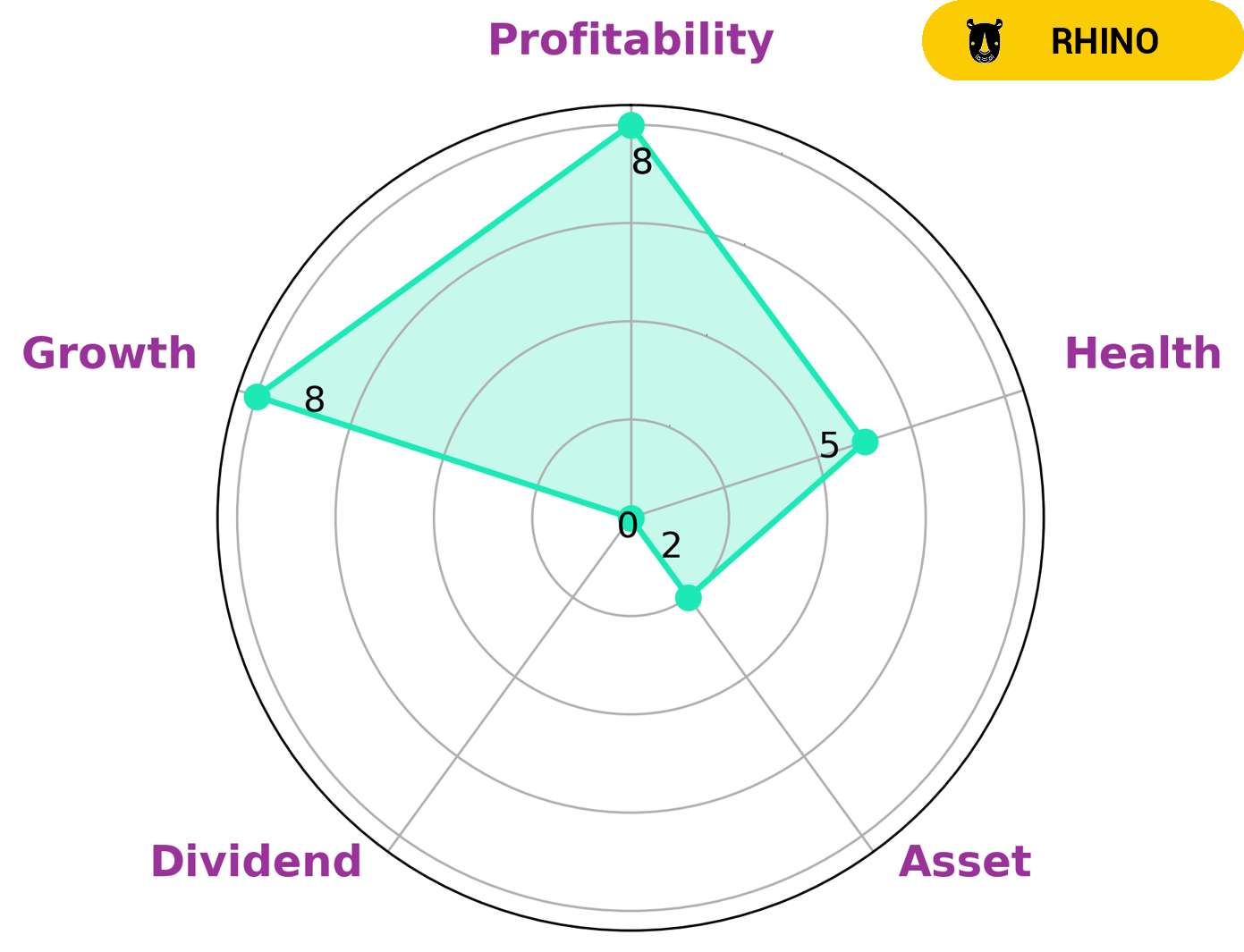

At GoodWhale, we analyzed NETFLIX‘s fundamentals and based on our Star Chart, we concluded that the company has an intermediate health score of 5/10 with regard to its cashflows and debt. We believe NETFLIX is likely to safely ride out any crisis without the risk of bankruptcy. Additionally, NETFLIX is classified as a ‘rhino’ type of company, meaning it has achieved moderate revenue or earnings growth. As a result, we believe value or growth investors may be interested in NETFLIX. Specifically, NETFLIX is strong in growth, profitability, but weak in asset and dividend. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netflix. More…

| Total Revenues | Net Income | Net Margin |

| 31.91k | 4.2k | 13.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netflix. More…

| Operations | Investing | Financing |

| 3.28k | -2.09k | -352 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netflix. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 49.49k | 27.66k | 46.65 |

Key Ratios Snapshot

Some of the financial key ratios for Netflix are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.2% | 20.1% | 17.3% |

| FCF Margin | ROE | ROA |

| 9.2% | 16.2% | 7.0% |

Peers

It has a library of movies and TV shows to choose from. Disney, Paramount, and FuboTV are all streaming services that offer movies and TV shows. Netflix is the most popular of these services.

– The Walt Disney Co ($NYSE:DIS)

The Walt Disney Company has a market capitalization of 186.02 billion as of 2022 and a return on equity of 4.53%. The company operates in the media and entertainment industry and is known for its film and television productions, as well as its theme parks and resorts. Disney also owns and operates a number of cable and broadcast television networks, including ABC, ESPN, and the Disney Channel.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 12.6B as of 2022. The company’s ROE is 18.54%. Paramount Global is a leading provider of global logistics and transportation services. The company offers a full range of logistics and transportation services, including air and ocean freight forwarding, warehousing, trucking, and custom clearance. Paramount Global also offers a wide range of value-added services, such as product sourcing, order management, and supply chain management.

– FuboTV Inc ($NYSE:FUBO)

FuboTV Inc is a television streaming company that offers over 100 live channels. As of 2022, the company has a market capitalization of 681.89 million dollars and a return on equity of -43.27%. The company’s primary service is providing live streaming of television content, however, they also offer a cloud DVR service and a social TV platform. The company is headquartered in New York City.

Summary

Netflix has seen a 10% gain in its stock price following the company’s first virtual ad upfront. Investors have been optimistic about the company, as Netflix is continuing to make strong gains in streaming services. Netflix has added more subscribers, increased its revenue, and grown its content library.

The company has also made steps towards diversifying its revenue streams by introducing new features such as interactive films and content production. Analysts believe that due to its successful strategies, Netflix will continue to outperform the competition in the long-term and remain one of the top stocks to invest in.

Recent Posts