Netflix Intrinsic Stock Value – Netflix Uses Innovative Tactics to Stay Ahead of the Competition in a Crowded Market

April 7, 2023

Trending News ☀️

Netflix ($NASDAQ:NFLX) is a streaming giant that has become an overwhelming 600-pound gorilla in the entertainment industry. Netflix has been successful in maintaining its competitive edge in a crowded market through innovative tactics. This includes investing heavily in content and creating unique experiences for its customers. Netflix has invested billions of dollars into producing original content and acquiring licenses for popular films and TV shows.

In addition, the company has worked hard to create an innovative user experience, with features such as personalized recommendations, watch lists, and a variety of viewing options. Moreover, Netflix has also implemented a subscription-based model that allows customers to access its content for a fixed monthly fee. This model has allowed Netflix to build a loyal customer base and generate consistent revenue streams.

Stock Price

On Thursday, NETFLIX stock opened at $339.3 and closed at the same price, down by 0.9% from previous closing price of 342.4. It has also been investing in technology such as artificial intelligence (AI), virtual reality (VR), and machine learning to stay at the forefront of the industry. Netflix is also diversifying its offerings by investing in films, documentaries, and even anime. These strategies have enabled Netflix to remain competitive despite the emergence of new streaming services such as Disney+, HBO Max, and Amazon Prime Video. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netflix. More…

| Total Revenues | Net Income | Net Margin |

| 31.62k | 4.49k | 14.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netflix. More…

| Operations | Investing | Financing |

| 2.03k | -2.08k | -664.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netflix. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 48.59k | 27.82k | 46.65 |

Key Ratios Snapshot

Some of the financial key ratios for Netflix are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.2% | 29.3% | 18.9% |

| FCF Margin | ROE | ROA |

| 5.1% | 18.1% | 7.7% |

Analysis – Netflix Intrinsic Stock Value

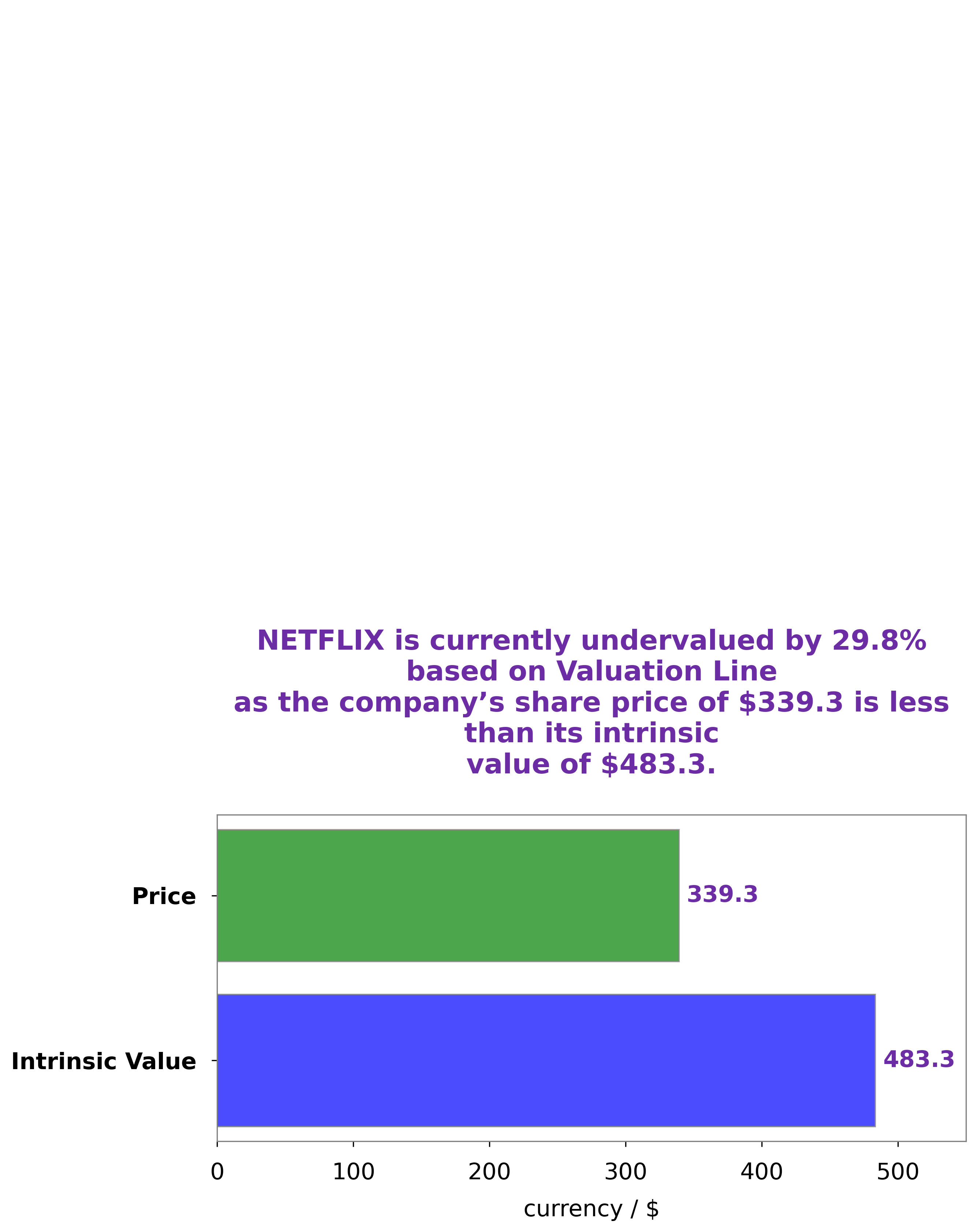

At GoodWhale, we conducted an in-depth analysis of NETFLIX’s wellbeing. After crunching the numbers, our proprietary Valuation Line was able to calculate the fair value of the NETFLIX share to be around $483.3. However, the current market value at the time of writing is $339.3, which means that the stock is currently undervalued by 29.8%. Investors should take advantage of this opportunity and buy NETFLIX stocks while they are still trading at a discounted price. Netflix_Uses_Innovative_Tactics_to_Stay_Ahead_of_the_Competition_in_a_Crowded_Market”>More…

Peers

It has a library of movies and TV shows to choose from. Disney, Paramount, and FuboTV are all streaming services that offer movies and TV shows. Netflix is the most popular of these services.

– The Walt Disney Co ($NYSE:DIS)

The Walt Disney Company has a market capitalization of 186.02 billion as of 2022 and a return on equity of 4.53%. The company operates in the media and entertainment industry and is known for its film and television productions, as well as its theme parks and resorts. Disney also owns and operates a number of cable and broadcast television networks, including ABC, ESPN, and the Disney Channel.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 12.6B as of 2022. The company’s ROE is 18.54%. Paramount Global is a leading provider of global logistics and transportation services. The company offers a full range of logistics and transportation services, including air and ocean freight forwarding, warehousing, trucking, and custom clearance. Paramount Global also offers a wide range of value-added services, such as product sourcing, order management, and supply chain management.

– FuboTV Inc ($NYSE:FUBO)

FuboTV Inc is a television streaming company that offers over 100 live channels. As of 2022, the company has a market capitalization of 681.89 million dollars and a return on equity of -43.27%. The company’s primary service is providing live streaming of television content, however, they also offer a cloud DVR service and a social TV platform. The company is headquartered in New York City.

Summary

Netflix has become a major player in the entertainment industry and has taken the streaming market by storm. Despite its success, industry analysts are warning that Netflix is becoming an increasingly riskier investment. The glut of content available through the platform has caused prices to drop, and other services offering content have emerged as viable competitors. To remain on top, Netflix will need to develop a new solution similar to how U.S. Steel transformed the steel industry in 1901.

Analysts suggest the company should focus on creating original content, strategic partnerships, and continuing to develop technologies that make their service more attractive. Investors should take caution when investing in Netflix as the competition is growing and the company will need to develop creative solutions to stay ahead.

Recent Posts