Cowen Initiates Outperform Rating on Formula One with $90 Price Target

June 6, 2023

🌥️Trending News

TD Cowen has initiated an Outperform rating on the Formula One ($NASDAQ:FWONA) Group, the world’s leading motorsport series, with a target price of $90. The Formula One Group is a commercial organization that works with the 10 teams, sponsors, and suppliers that participate in the Formula 1 World Championship. The races feature the fastest cars driven by the world’s best drivers and teams, all competing to become the world champions. The Formula 1 season runs from March until November, with teams competing for points and a Grand Prix winner at each race. Formula 1 is also an incredibly lucrative business and has been for many years.

Sponsors pay millions of dollars to be associated with Formula 1, providing a large portion of the revenue for teams and drivers. Formula 1 has also developed new innovations in technology, providing advanced safety features for drivers and creating new opportunities for teams to increase their competitive edge. As a result of its strong performance and economic standing, TD Cowen has assigned an Outperform rating to Formula One Group, setting a target price of $90. With its wide-reaching global audience, strong revenues, and exciting races, Formula One Group is well-positioned for continued success in the future.

Market Price

This news sent the stock soaring, as it opened at $64.6 and closed at $65.4, a gain of 1.6% from its last closing price of $64.4. This rating and price target from Cowen & Co. suggests that Formula One stock has a strong upside potential and may be a good addition to any investor’s portfolio. It is important to note that while the new rating and price target are encouraging, it is always important to do your own research before investing in any stock.

Formula One has been in the news recently, especially due to its proposed acquisition of Liberty Media, so it may be important to keep an eye on the developments in that deal before making any major investment decisions. In the meantime, investors may look at Formula One as an attractive and potentially profitable option. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Formula One. More…

| Total Revenues | Net Income | Net Margin |

| 2.59k | 484 | 16.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Formula One. More…

| Operations | Investing | Financing |

| 656 | 172 | -1.51k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Formula One. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.98k | 4.14k | 29.07 |

Key Ratios Snapshot

Some of the financial key ratios for Formula One are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.6% | 16.6% | 13.1% |

| FCF Margin | ROE | ROA |

| 12.1% | 3.1% | 1.9% |

Analysis

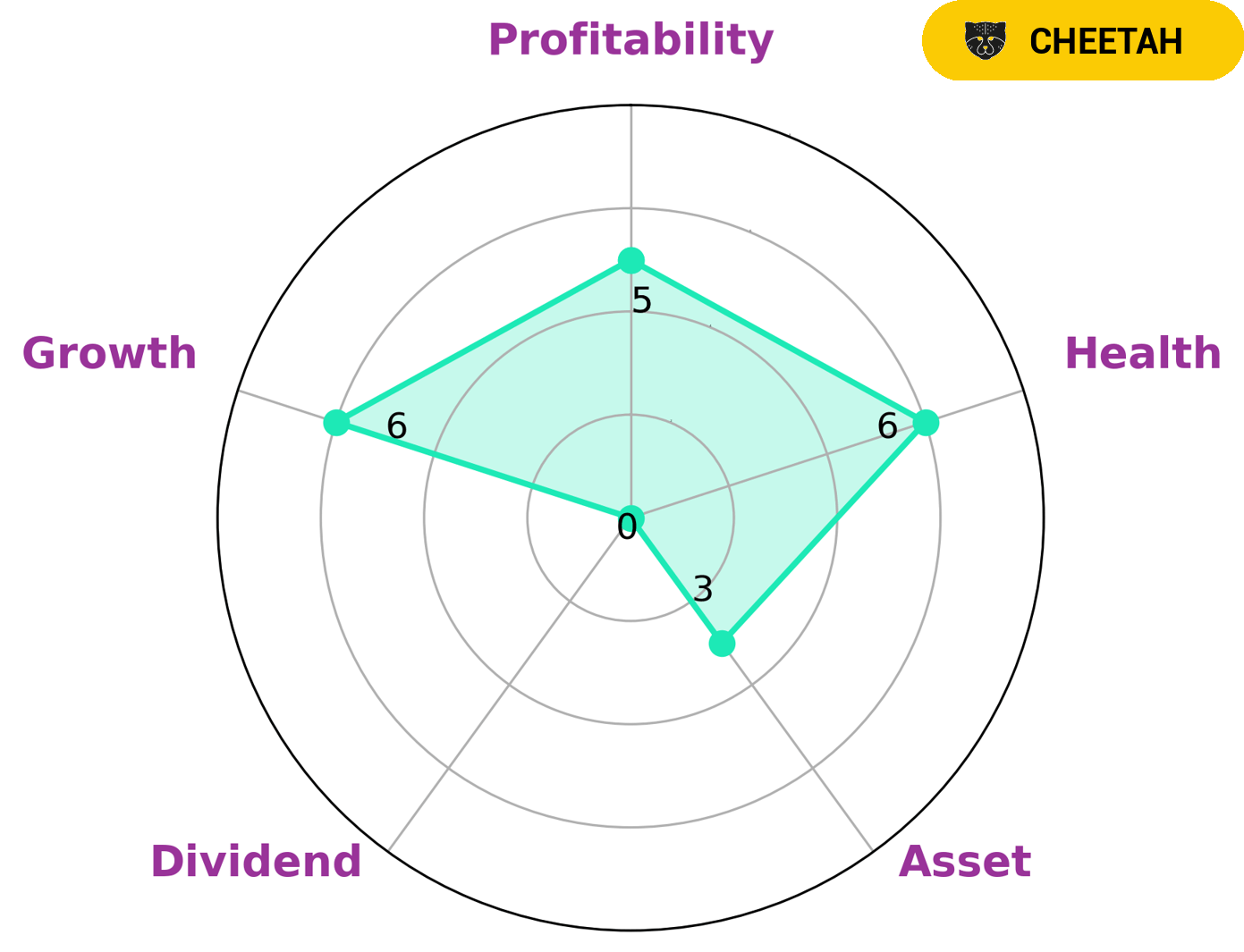

GoodWhale recently conducted an analysis of FORMULA ONE‘s wellbeing, and the results were quite interesting. Our Star Chart showed that FORMULA ONE had an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that it might be able to pay off debt and fund future operations. Additionally, FORMULA ONE was strong in growth, medium in profitability and weak in asset and dividend. Based on these findings, we classified FORMULA ONE as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors interested in companies such as FORMULA ONE should consider the potential risks involved. While it may be able to provide high returns, there is also a chance of encountering significant losses. As such, investors should conduct their own research before committing to an investment. Additionally, investors should pay close attention to the company’s financials over time to keep track of its performance and make sure that their investments are being managed in a responsible way. More…

Peers

All four companies provide unique and innovative services to their clients, and have established themselves as leaders in the Formula One industry.

– Alpha Group ($SZSE:002292)

Alpha Group is a diversified industrial services and manufacturing company. The company specializes in a variety of services ranging from energy management and engineering to construction and fleet management. Alpha Group’s current market capitalization is 7.28 billion dollars, an indication of its size and success in the industry. The company also has a negative return on equity of -5.59%, which implies that the company has not been able to generate sufficient returns relative to the amount of invested capital it has. Despite this, Alpha Group continues to make significant investments in its business and is positioned to grow its market share in the industry.

– Linmon Media Ltd ($SEHK:09857)

Linmon Media Ltd is a leading media and entertainment company offering a range of services such as television, radio, digital media, and motion picture production and distribution. The company has a current market cap of 6.92 billion as of 2022, and its return on equity (ROE) stands at 1.18%. This indicates that the company is performing well and generating a healthy return on its shareholders’ equity. Linmon Media continues to remain a leader in the media and entertainment industry and has been able to maintain its strong financial performance over the years.

– Values Cultural Investment Ltd ($SEHK:01740)

Cultural Investment Ltd is a company that is involved in the entertainment industry, creating content and services for customers. As of 2022, the company has a market capitalization of 146.29M and a return on equity of -6.98%. The market cap denotes the total value of the company’s outstanding shares and gives an indication of its size and its ability to generate revenue. The return on equity (ROE) measures the profitability of the company, which in this case is negative, meaning that the company is not profiting from its operations.

Summary

Formula One is a motorsport racing series, and TD Cowen has initiated coverage of the company with an Outperform rating and a $90 price target. Investing in Formula One stocks can be a lucrative option due to the strong brand recognition, global reach, and potential for further growth.

Recent Posts