UBS Group AG Boosts Investment in Stantec

March 6, 2023

Trending News ☀️

UBS Group AG recently made headlines when they announced their increased investment in Stantec Inc ($TSX:STN). The multinational financial services company increased its stake in the Canadian professional services firm, which provides architecture, engineering, and consulting services for clients in the government, private, and public sectors. UBS Group AG’s increased investment in Stantec reflects the multinational financial services company’s confidence in the future of the Canadian professional services firm. This confidence is likely due to Stantec’s consistent track record of success, as the firm has managed to provide its clients with excellent services for decades. By expanding their stake in the firm, UBS Group AG is supporting Stantec’s mission of creating better places for people by providing innovative solutions for their clients.

The increased investment from UBS Group AG also serves a benefit to Stantec’s shareholders, as they will now be able to take advantage of the financial institution’s global reach and resources. This move will also increase Stantec’s financial stability, allowing them to continue providing top-notch services to their clients. UBS Group AG’s investment boost in Stantec is just one example of the multinational financial services company’s commitment to helping build a better future. With the increased stake, UBS Group AG has proven their faith in Stantec and their ability to continue providing innovative services to their clients.

Price History

Friday brought good news for Stantec Inc, as UBS Group AG increased their investment in the company. News coverage of the move was generally neutral. As the news spread, STANTEC INC stock opened at CA$79.1 and closed at CA$79.8, up by 0.7% from its previous closing price of 79.2.

This increase in the stock’s value is likely to have been encouraged by the higher investment from UBS Group AG. The future looks bright for this industrial and infrastructure engineering company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stantec Inc. More…

| Total Revenues | Net Income | Net Margin |

| 5.68k | 247 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stantec Inc. More…

| Operations | Investing | Financing |

| 304.3 | -73.8 | -296.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stantec Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.65k | 3.37k | 20.63 |

Key Ratios Snapshot

Some of the financial key ratios for Stantec Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 5.4% | 7.0% |

| FCF Margin | ROE | ROA |

| 4.0% | 11.0% | 4.4% |

Analysis

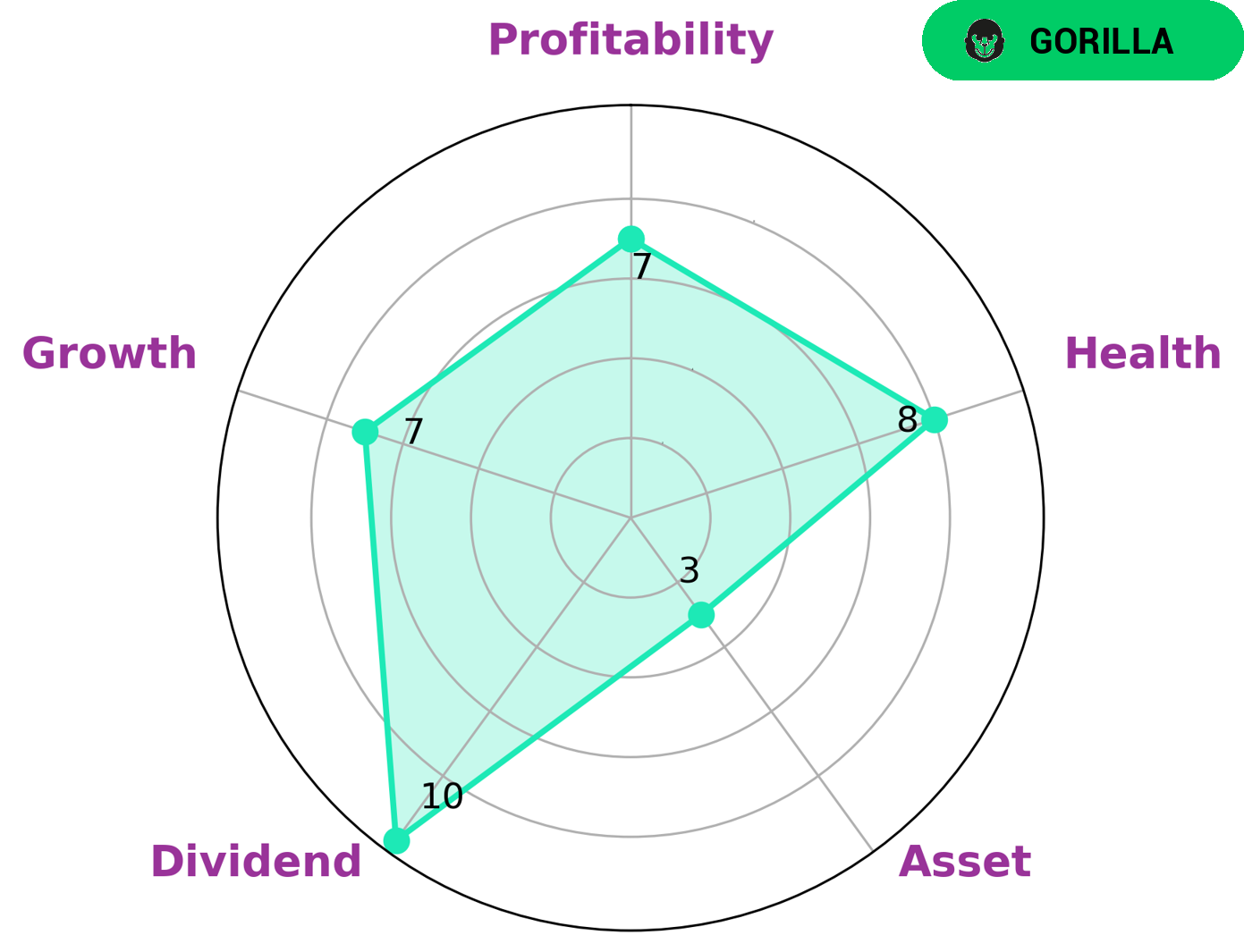

As a firm that specializes in analysis of companies’ financials, GoodWhale has recently conducted a financial analysis of STANTEC INC. According to the results from our Star Chart, STANTEC INC is strong in dividend, growth, and profitability and weak in asset. We classified STANTEC INC as a ‘gorilla’, a type of company that has achieved stable and high revenues or earnings growth due to its strong competitive advantage. Given such a strong performance, investors who are looking for steady return and high performance may be interested in investing in STANTEC INC. Moreover, with a health score of 8/10, there is evidence that the company is capable to pay off debt and fund its future operations with strong liquidity. It is thus a great option for investors who prefer companies with solid financial standing. More…

Peers

The company has a strong presence in North America and Europe and has completed many large-scale projects. Stantec’s competitors include Team Consulting Engineering and Management PCL, JSTI Group, and Dhruv Consultancy Services Ltd. All of these companies are large, well-established firms with a strong track record in the engineering and construction industry.

– Team Consulting Engineering and Management PCL ($SZSE:300284)

With a market cap of 7.2B as of 2022 and a return on equity of 5.66%, JSTI Group is a publicly traded company that provides various services including but not limited to engineering, construction, and project management. The company has a wide range of clients including government agencies and private companies. JSTI Group has been in business for over 50 years and has a strong reputation in the engineering and construction industry.

– JSTI Group ($BSE:541302)

Dhruv Consultancy Services Ltd is an engineering consultancy firm based in India. The company has a market capitalisation of 889.15 million as of 2022 and a return on equity of 10.73%. The company provides engineering and project management services to clients in the oil and gas, power, and infrastructure sectors. The company has offices in Mumbai, Delhi, Pune, and Bangalore.

Summary

UBS Group AG has recently boosted its investment in Stantec Inc., a global professional services firm providing management consulting, architecture, engineering, and other specialized services. Market watchers now anticipate that UBS’s increased stake in the company will have a positive impact on Stantec shares. Analysts have pointed out that the capital from UBS will help Stantec continue to grow and improve its competitive standing in the industry. At present, most news coverage of the company is neutral and analysts recommend taking a longer-term view on the stock as the uptrend in Stantec shares may continue in the coming months.

Investors should also consider short-term opportunities as potential buying opportunities due to the potential for accelerated growth. With continued investment from UBS Group AG, Stantec Inc. is likely to remain a good investment choice for the future.

Recent Posts