MasTec Shares Gap Down After Citigroup Downgrade

August 9, 2023

☀️Trending News

MASTEC ($NYSE:MTZ): MasaTec, Inc., an infrastructure services company primarily serving the communications, energy, and government sectors in the United States, Canada, and internationally, saw its share price drop at the start of trading on Friday following a price target reduction from Citigroup on the stock. The downgrade from Citigroup comes after MasaTec reported weak third-quarter results. Analysts at Citigroup said that they believed the near-term risk for MasaTec’s share price was too high given the company’s uncertain outlook. They did, however, maintain their “Buy” rating on the stock as they believe it has long-term potential.

Stock Price

On Monday, shares of MasTec Inc. (MASTEC) opened at $98.0 and ended the day trading at $96.1, representing a 3.4% decline from its previous closing price of $99.6. This drop came after Citigroup downgraded its rating of MasTec from “Buy” to “Neutral” citing a lack of catalysts for the stock to move higher. Despite this bearish sentiment, some analysts remain bullish on the stock and believe that given the company’s strong fundamentals and growth prospects, the shares may be undervalued at the current levels. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mastec. More…

| Total Revenues | Net Income | Net Margin |

| 10.98k | -12.88 | -0.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mastec. More…

| Operations | Investing | Financing |

| 252.85 | -742.62 | 471.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mastec. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.29k | 6.6k | 33.97 |

Key Ratios Snapshot

Some of the financial key ratios for Mastec are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.8% | -36.4% | 1.4% |

| FCF Margin | ROE | ROA |

| 0.5% | 3.7% | 1.1% |

Analysis

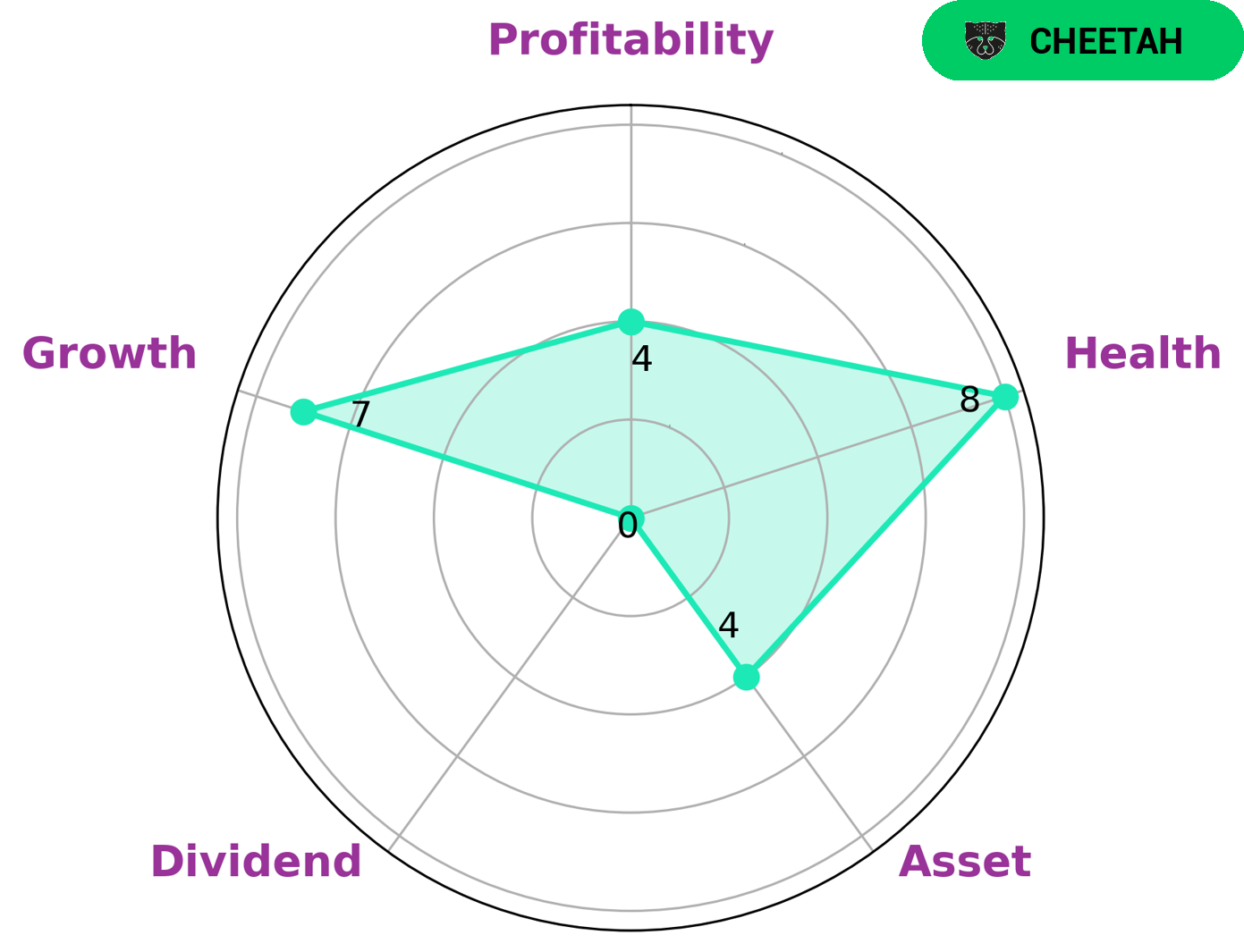

At GoodWhale, we conducted an analysis of MASTEC‘s financials and concluded that based on our Star Chart, MASTEC has a high health score of 8/10 considering its cashflows and debt. This means that MASTEC is capable to safely ride out any crisis without the risk of bankruptcy. After our analysis, MASTEC is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. The company is strong in growth, medium in profitability and weak in asset, dividend. Given the strong growth and high health score, investors who are looking for high return on investment may find MASTEC an attractive investment opportunity. However, due to its lower profitability and weaker asset and dividend metrics, investors with a more conservative approach might not find it to be a suitable opportunity. More…

Peers

In the engineering and construction services industry, MasTec Inc faces competition from Assystem SA, Quanta Services Inc, and Elecnor SA. These companies are all large, international competitors with significant market share. While MasTec Inc has a strong presence in the United States, these companies have a strong international presence and are able to compete on a global scale.

– Assystem SA ($LTS:0OA7)

Assystem SA is a French engineering and consulting company. It was founded in 1966 and has since grown to become one of the largest engineering firms in the world. The company has a market capitalization of 547.52 million as of 2022 and a return on equity of 8.74%. Assystem SA provides engineering and consulting services to a variety of industries, including aerospace, defense, energy, transportation, and construction. The company has a strong presence in Europe, North America, and Asia.

– Quanta Services Inc ($NYSE:PWR)

Quanta Services, Inc. provides specialty contracting services in the United States, Canada, Australia, South America, and select other international markets. The company operates through Electric Power Infrastructure Services and Pipeline Infrastructure Services segments. The Electric Power Infrastructure Services segment engages in the installation, upgrade, repair, and maintenance of electric power transmission and distribution infrastructure, including substations, underground and overhead conductor systems, and wireless and fiber optic communication systems. This segment also provides asset management services; and turnkey installation and maintenance services for solar power generation systems. The Pipeline Infrastructure Services segment engages in the construction, upgrade, repair, maintenance, and decommissioning of natural gas and oil pipelines, natural gas gathering systems, and other pipeline infrastructure; and provides asset management services. This segment also offers horizontal directional drilling services for the installation of pipelines and conduit systems. The company was founded in 1997 and is headquartered in Houston, Texas.

– Elecnor SA ($LTS:0K97)

Electricnor SA is a Spanish engineering and construction company. It focuses on the development, design, and construction of renewable energy projects, mainly wind farms. As of 2022, it has a market capitalization of 850.99 million dollars and a return on equity of 18.71%.

Summary

Mastec Inc. experienced a significant drop in stock price on Friday following a price target reduction from Citigroup. This drop was an indicator to investors that the company is not performing as well as expected. The analysis indicated that Mastec is likely to experience more volatility in the future and may not reach its full potential.

Investors should be aware of the risks associated with investing in Mastec and consider other alternatives in the market that may yield better returns. Furthermore, investors should keep an eye on the company’s performance and look for opportunities to capitalize on any sign of recovery or increase in performance.

Recent Posts