Jacobs to Develop Innovative Tools for ITER Experiment in France

April 26, 2023

Trending News ☀️

Jacobs Solutions ($NYSE:J), a leading provider of technical, professional, and construction services, is pleased to announce their involvement in the ITER experiment in France. Jacobs will be responsible for designing and engineering tools for the ITER experimental machine. This project, which is a collaboration between the European Union, India, China, Japan, South Korea, Russia, and the United States, is being led by the ITER Organization, which is based in France. Jacobs’ expertise in designing and engineering tools will be instrumental in the successful completion of this project. Their extensive experience in providing quality services, innovative technology, and superior customer service has enabled them to meet their customers’ needs and exceed their expectations.

Their commitment to staying ahead of industry trends and developing cutting-edge technologies to meet their clients’ needs has made them a leader in their field. Jacobs Solutions is committed to delivering reliable and innovative solutions that will help to push the boundaries of what is possible at ITER. They are excited to be part of a project that will revolutionize the way humans harness energy on earth and explore the possibilities of space. They look forward to continuing to work with the ITER team for years to come.

Price History

This is a major milestone for the company as they continue to develop ground-breaking technological solutions. The news sent their stock price down by 0.7%, with the opening price of $113.9 and closing price of $113.7, compared to the previous day’s closing price of $114.5. This announcement marks an important step forward in developing an efficient, cost-effective and safe form of generated energy from nuclear fusion. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jacobs Solutions. More…

| Total Revenues | Net Income | Net Margin |

| 15.34k | 645.65 | 4.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jacobs Solutions. More…

| Operations | Investing | Financing |

| 455.36 | -337.59 | -70.28 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jacobs Solutions. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.92k | 8.06k | 48.82 |

Key Ratios Snapshot

Some of the financial key ratios for Jacobs Solutions are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 30.2% | 6.7% |

| FCF Margin | ROE | ROA |

| 2.1% | 10.5% | 4.3% |

Analysis

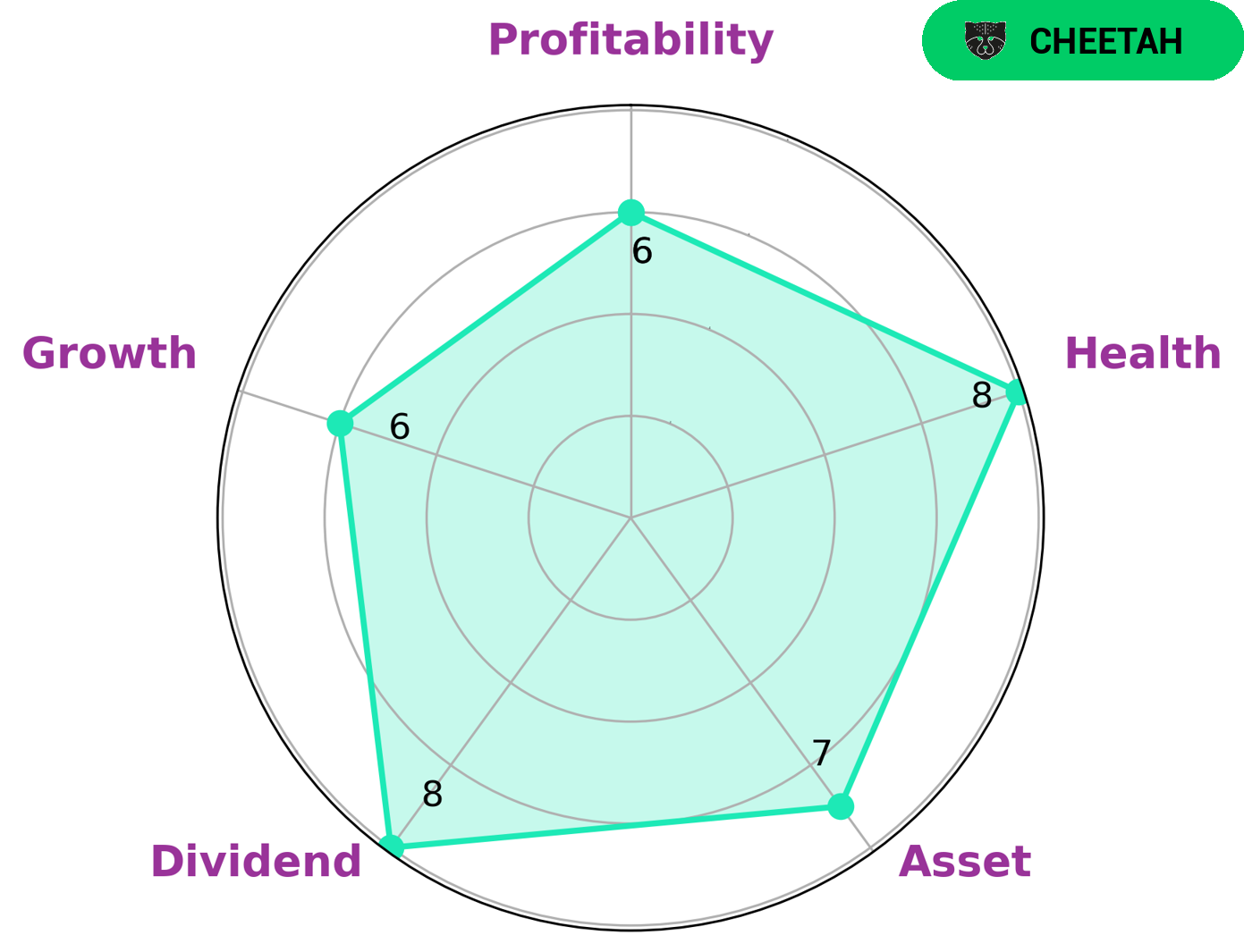

GoodWhale has taken a look at the wellbeing of JACOBS SOLUTIONS and have found that the company is strong in asset and dividend, and medium in growth and profitability. We have classified JACOBS SOLUTIONS as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors looking for capital growth as well as those who are willing to take on a bit more risk to potentially gain higher returns. JACOBS SOLUTIONS has a high health score of 8/10 considering its cashflows and debt and is capable to safely ride out any crisis without the risk of bankruptcy. More…

Peers

In the engineering services industry, Jacobs Engineering Group Inc. competes against a number of companies, including Baran Group Ltd, Henan Communications Planning and Design Institute Co Ltd, and Mold-Tek Technologies Ltd. While each company has its own strengths and weaknesses, Jacobs Engineering Group Inc. has been able to maintain a competitive advantage through its focus on innovation and customer service.

– Baran Group Ltd ($OTCPK:BRANF)

Baran Group Ltd is a diversified holding company with interests in a range of businesses, including real estate, construction, hospitality, and healthcare. The company has a market capitalization of 58.73 million as of 2022 and a return on equity of 4.03%. The company’s real estate portfolio includes residential and commercial properties in the United States, Europe, and Asia. The company’s construction business focuses on the construction of high-end residential and commercial properties. The company’s hospitality business operates a portfolio of luxury hotels and resorts. The company’s healthcare business provides healthcare services to a network of hospitals and clinics.

– Henan Communications Planning and Design Institute Co Ltd ($SZSE:300732)

The company provides engineering consulting and design services in the telecommunications industry in China. As of 2022, it had a market capitalization of $3.02 billion and a return on equity of 9.33%.

– Mold-Tek Technologies Ltd ($BSE:526263)

Mold-Tek Technologies is an Indian company that specializes in injection molding and mold making. It is headquartered in Hyderabad, Telangana. The company has a market cap of 2.61B as of 2022 and a return on equity of 15.67%. Mold-Tek was founded in 1976 and has since grown to become one of the leading providers of injection molding and mold making services in India. The company has a strong presence in the automotive, consumer goods, and electronics industries.

Summary

Jacobs Solutions is a provider of engineering, design and project management services to the energy and industrial sectors. Jacobs solutions offers a comprehensive range of services for investments, including financial analysis, valuations, due diligence, risk assessment, financial modeling, and asset management. The company’s expertise in investment analysis allows them to provide insights into potential opportunities and risks when investing in different markets.

They are able to analyse potential investments from both a qualitative and quantitative approach and develop strategies to better manage portfolio risks. Jacobs Solutions’ investment analysis capabilities help investors identify potential opportunities and make informed decisions.

Recent Posts