Janney Montgomery Scott LLC Reduces TD SYNNEX Co. Stake By 2.0% In Q1

August 11, 2023

🌥️Trending News

TD SYNNEX ($NYSE:SNX) Co. is a publicly-traded technology company based in Durham, North Carolina. It specializes in providing a wide range of business services, including logistics, distribution, and IT solutions, to global organizations. It is also one of the top ten distributors of technology products in the world. This represents a decrease from their previous position and indicates that the firm is decreasing its exposure to the technology company.

It is important to note that this decrease does not necessarily reflect any negative sentiment towards TD SYNNEX Co. or its stock, but instead may simply be due to changes in investment strategy or other circumstances. As such, it is still possible for investors to view TD SYNNEX Co. as a promising investment opportunity.

Analysis

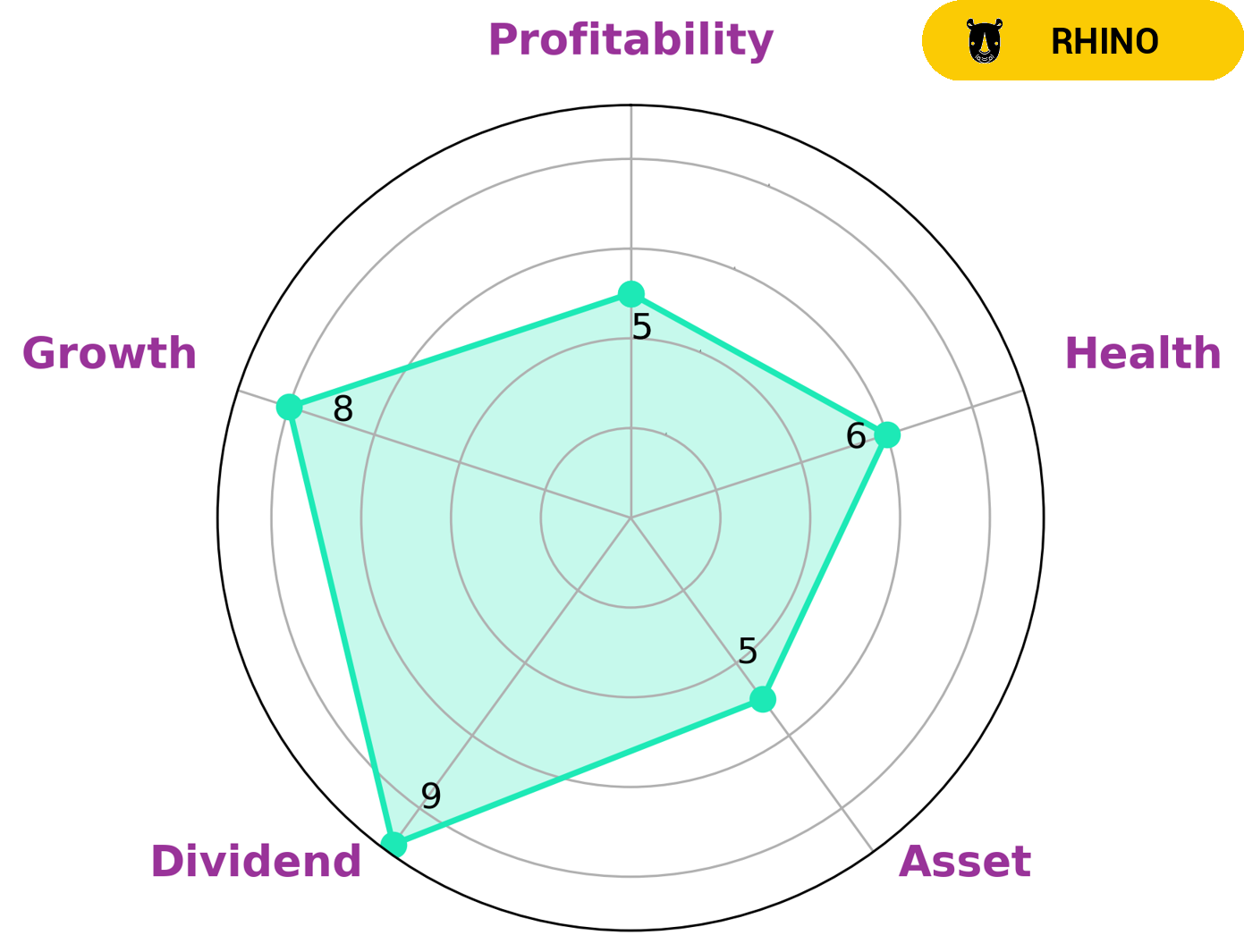

At GoodWhale, we conducted an analysis of TD SYNNEX‘s financials. Our star chart showed that TD SYNNEX had an intermediate health score of 6/10 which suggests that the company is in a good position and might be able to safely ride out any crisis without the risk of bankruptcy. The company’s classification as a ‘cheetah’ indicates that it achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for a company with strong dividend and growth prospects and medium asset and profitability should consider investing in TD SYNNEX. The company’s intermediate health score and cheetah classification indicate that it is a solid choice for investors who are comfortable with higher risk and potential rewards. With a focus on dividends, growth, and medium asset and profitability, TD SYNNEX is an attractive option for those who are searching for a reliable long-term investment. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Td Synnex. More…

| Total Revenues | Net Income | Net Margin |

| 60.79k | 667.54 | 1.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Td Synnex. More…

| Operations | Investing | Financing |

| 1.17k | -115.51 | -275.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Td Synnex. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.98k | 19.71k | 88.88 |

Key Ratios Snapshot

Some of the financial key ratios for Td Synnex are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 37.1% | 19.0% | 1.9% |

| FCF Margin | ROE | ROA |

| 1.7% | 8.6% | 2.5% |

Peers

It has a strong presence in the market with a wide range of products and services. The company has a good reputation and is known for its quality products and services.

However, it faces stiff competition from its competitors such as VNET Group Inc, DC Two Ltd, Searchlight Solutions Ltd.

– VNET Group Inc ($NASDAQ:VNET)

VNET Group Inc is a global provider of cloud-based communications and collaboration solutions. The company has a market cap of 760.84M as of 2022 and a return on equity of 2.37%. The company’s products and services include VoIP, video conferencing, cloud PBX, and unified communications. VNET Group Inc is headquartered in Toronto, Canada.

– DC Two Ltd ($ASX:DC2)

D2C Two Ltd is a publicly traded company with a market capitalization of 3.56 million as of 2022. The company has a negative return on equity of 73.27%. D2C Two Ltd is engaged in the business of providing online marketing and advertising services.

Summary

This indicates investors may have seen a loss of confidence in the company’s performance. Therefore, potential investors should consider a range of factors when researching a possible investment in TD SYNNEX before making any decisions. This includes analyzing the company’s current financial performance, its competitive landscape, and its long-term growth prospects.

Additionally, investors should be aware of any recent changes in the company’s management or leadership. While there may be opportunities to benefit from investing in TD SYNNEX, investors should weigh their options carefully.

Recent Posts