Exchange Traded Concepts LLC Sells Shares of Arrow Electronics, on Defense World

July 4, 2023

☀️Trending News

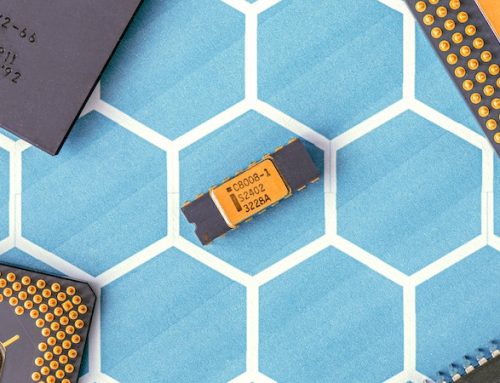

Exchange Traded Concepts LLC recently sold shares of Arrow Electronics ($NYSE:ARW), Inc. on Defense World. The company offers a broad portfolio of products and services, including semiconductors, interconnects, passives, power sources, electromechanical components, embedded solutions, connectivity solutions, and engineering services. Arrow Electronics also provides logistics services, inventory management, and aftermarket services. With its extensive network of suppliers and customers, Arrow Electronics is well positioned to serve the growing demand for components and solutions across a wide range of industries.

Market Price

ARROW ELECTRONICS opened the trading day at $143.3 and closed at $144.0, up by 0.5% from the prior closing price of 143.2. This increase in value demonstrates a steady increase in investor confidence and a desire to continue to buy the stock. The share prices have been relatively stable in recent weeks, pointing to continued investor interest in the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arrow Electronics. More…

| Total Revenues | Net Income | Net Margin |

| 36.79k | 1.34k | 3.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arrow Electronics. More…

| Operations | Investing | Financing |

| 390.98 | -67.86 | -328.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arrow Electronics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.28k | 14.68k | 96.06 |

Key Ratios Snapshot

Some of the financial key ratios for Arrow Electronics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.3% | 36.5% | 5.4% |

| FCF Margin | ROE | ROA |

| 0.8% | 22.4% | 6.1% |

Analysis

At GoodWhale, we have conducted an analysis of ARROW ELECTRONICS‘s fundamentals to provide our customers with a better understanding of the company. Based on our Risk Rating, ARROW ELECTRONICS is deemed to be a high risk investment in terms of both financial and business aspects. Our team has identified 3 risk warnings in the income sheet, cashflow statement, and non-financial elements of the company. We strongly recommend that our customers register with us to have access to the most up-to-date information about ARROW ELECTRONICS and to explore the red flags that we have identified. More…

Peers

Arrow Electronics Inc is one of the leading global distributors of electronic components and enterprise computing solutions. Its main competitors are Avnet Inc, Samsung Electro-Mechanics Co Ltd, and WPG Holding Co Ltd.

– Avnet Inc ($NASDAQ:AVT)

Avnet Inc is an American technology company headquartered in Phoenix, Arizona. The company is a distributor of electronic components, computer products and embedded technology. Avnet was founded in 1921 and has been publicly traded on the New York Stock Exchange since 1963.

As of 2021, Avnet has a market capitalization of $4.14 billion and a return on equity of 16.09%. The company is a distributor of electronic components, computer products and embedded technology. Avnet was founded in 1921 and has been publicly traded on the New York Stock Exchange since 1963.

– Samsung Electro-Mechanics Co Ltd ($KOSE:009150)

Samsung Electro-Mechanics Co Ltd is a South Korean electronics company that specializes in the manufacture of electronic components and devices. The company has a market capitalization of 10.31 trillion as of 2022 and a return on equity of 14.53%. Samsung Electro-Mechanics is a subsidiary of the Samsung Group and its products are used in a wide range of electronic devices, including mobile phones, televisions, computers and digital cameras.

– WPG Holding Co Ltd ($TWSE:3702)

WPG Holding Co Ltd is a leading electronics manufacturer and distributor in Greater China. The company has a market cap of $78.92 billion as of 2022 and a return on equity of 14.11%. WPG Holding Co Ltd is a vertically integrated company with a strong presence in the upstream and downstream segments of the electronics manufacturing value chain. The company has a diversified product portfolio that includes semiconductors, passive components, displays, and assembly and test services. WPG Holding Co Ltd is a major supplier to global electronics brands such as Apple, Huawei, and Xiaomi.

Summary

Exchange Traded Concepts LLC recently sold a significant amount of shares in Arrow Electronics, Inc. (ARROW). The investment firm’s sales could be indicative of a shift in sentiment regarding the performance of the stock. Analysts have noted that ARROW’s stock price has been volatile in recent months, with both positive and negative swings. While the company’s fundamentals remain strong, investors may be cautious about the stock’s prospects in the near-term.

With the sell-off of shares, it is important to consider the implications of this transaction on ARROW’s share price and the overall investing landscape. Investors may want to research further before making any decisions regarding their investments in ARROW.

Recent Posts