META MATERIALS Faces Uncertainty as Correction Looms Ahead

February 16, 2023

Trending News 🌧️

Meta Materials ($NASDAQ:MMAT) Inc. has been at the cutting edge of innovations in the materials sciences for many years, but now it may be facing a potential correction. In recent months, there has been a sharp increase in the company’s stock price as investors have responded to their new advances.

However, analysts are now warning that this increase may be short-lived and that a correction is likely to occur soon. The correction could be caused by any number of factors, such as a change in the market or an unexpected development within the company. It could also be due to competition from other companies in the industry that are keeping up with Meta Material Inc.’s innovations. Regardless of the cause, analysts are warning that the company’s share price may not stay where it is for much longer. This news comes at a time when the company was preparing to launch a series of new products that could potentially revolutionize the materials sciences industry. It also comes at a time when the company was planning to expand its business into new markets and open new offices around the world. It is uncertain what effect this potential correction may have on these plans. As Meta Materials Inc. faces this uncertainty, investors should remain mindful of the potential dangers of volatile markets. With the company’s stock price already at high levels, any correction in the near future could have a significant impact on its future prospects. Although it is impossible to predict how severe the correction may be, investors should be prepared for the possibility that Meta Materials Inc. may take a hit in the near future.

Market Price

META MATERIALS Inc. has been facing uncertainty as a correction looms in the horizon. Media coverage of the company has mostly been negative and investors have been reluctant to buy into their stock. On Wednesday, the stock opened at $0.7, and closed at the same price, with a 1.8% increase from the prior closing price.

Although the stock prices did not experience a significant decline, investors remain cautious about the future of the company. With the looming correction, META MATERIALS Inc. remain in the precarious position of uncertainty. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Meta Materials. More…

| Total Revenues | Net Income | Net Margin |

| 11.04 | -93.42 | -823.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Meta Materials. More…

| Operations | Investing | Financing |

| -67.7 | -89.22 | 47.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Meta Materials. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 482.65 | 93.83 | 1.08 |

Key Ratios Snapshot

Some of the financial key ratios for Meta Materials are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -849.0% |

| FCF Margin | ROE | ROA |

| -779.4% | -14.6% | -12.1% |

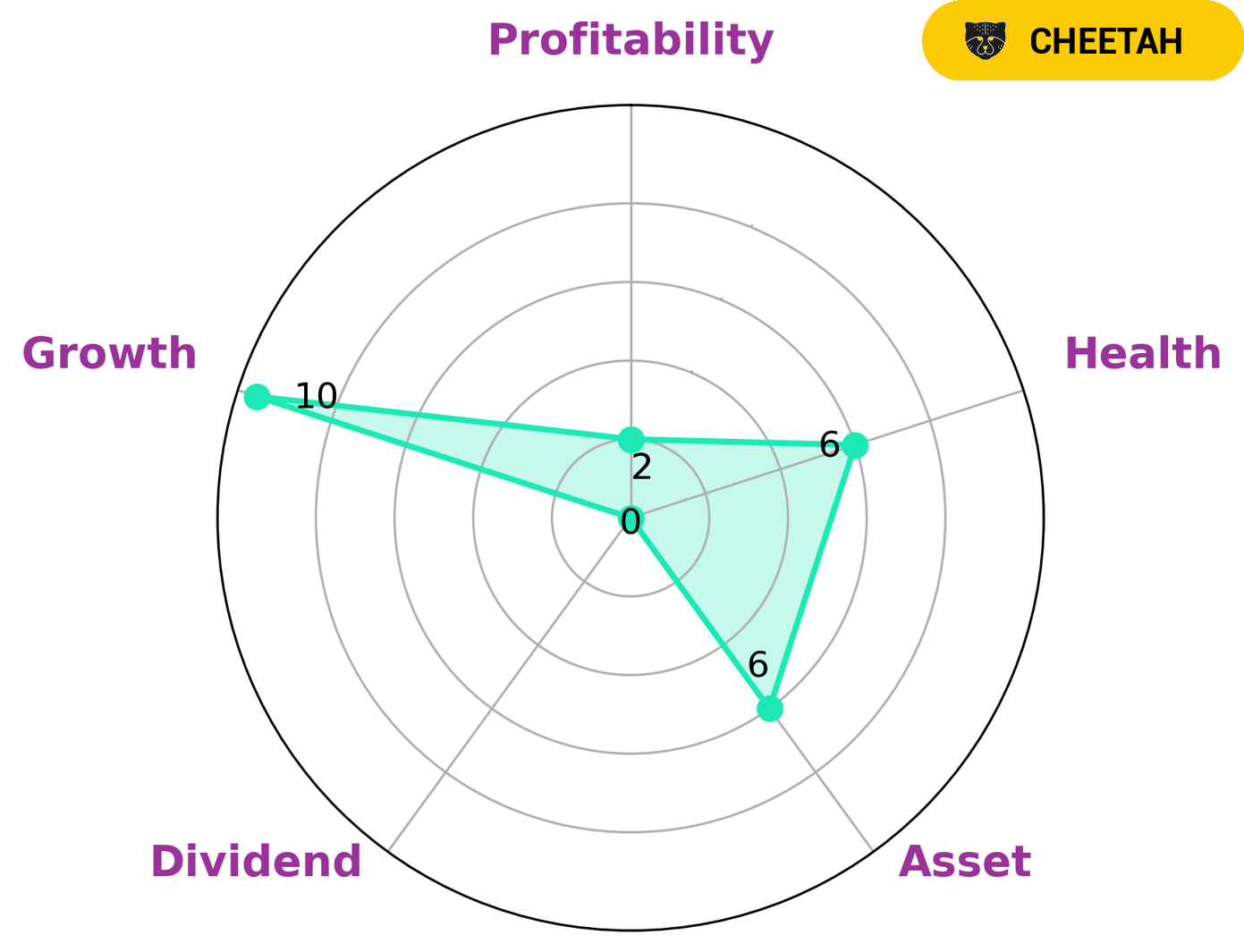

Analysis

At GoodWhale, we are known for our comprehensive analysis of companies’ financials. For META MATERIALS, our Star Chart showed that the company is strong in growth, medium in asset and weak in dividend and profitability. According to our research, it is classified as a ‘cheetah’ company, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company would likely be attractive to investors who are knowledgeable about the market and looking for higher growth potential. While META MATERIALS does not possess a strong dividend, its intermediate health score of 6/10 – indicating its ability to safely ride out any crisis without the risk of bankruptcy – might also be appealing to more risk tolerant investors. Ultimately, investors must decide for themselves if META MATERIALS is a viable investment for them. More…

Peers

Its competitors include Rogers Corp, Shenmao Technology Inc, Flex Ltd.

– Rogers Corp ($NYSE:ROG)

Rogers Corp is a materials science company that focuses on developing and manufacturing materials for use in advanced electronics applications. The company has a market cap of 1.97B as of 2022 and a Return on Equity of 5.3%. Rogers Corp’s materials are used in a variety of applications, including smartphones, tablets, laptops, and other electronic devices. The company’s products are also used in the automotive, aerospace, and defense industries.

– Shenmao Technology Inc ($TWSE:3305)

Shenmao Technology Inc is a global leader in the design, manufacture, and sale of advanced packaging solutions for the semiconductor and electronics industries. The company has a market capitalization of $5.23 billion and a return on equity of 15.74%. Shenmao’s products are used in a wide range of applications, including smartphones, computers, servers, and storage devices. The company’s products are manufactured at its facilities in China, Taiwan, and the United States.

– Flex Ltd ($NASDAQ:FLEX)

Flex Ltd is a leading manufacturer of electronic components and assemblies for original equipment manufacturers and contract manufacturers. The company has a market cap of 8.88B as of 2022 and a return on equity of 19.66%. Flex Ltd operates in more than 30 countries and offers a broad range of services, including design, engineering, manufacturing, and supply chain management. The company’s products are used in a variety of industries, including automotive, consumer electronics, healthcare, and industrial.

Summary

META MATERIALS Inc. is a company that has recently come under scrutiny in the investing market. Recent media coverage has largely been negative, suggesting that a market correction may be looming ahead. Analysts are warning potential investors to be wary of investing in the company, given the uncertainty of its future performance. Investors should be conscious of this risk, and should evaluate all of the potential risks before committing to an investment in META MATERIALS Inc.

Recent Posts