Stock of FREYR Battery SA Drops Sharply in Pre-Market Trading

December 31, 2022

Trending News 🌥️

FREYR ($NYSE:FREY) Battery SA is a global leader in the electric vehicle battery market, providing sustainable battery solutions for vehicles and other consumer products. The company has been making strides in the industry, introducing the latest technology and innovative designs to the market. Recently, the stock of FREYR Battery SA has dropped significantly in pre-market trading, by 4.16%. This sharp drop in stock prices is attributed to a number of factors. First and foremost, there is the ongoing trade war between the United States and China. This has caused a decrease in demand for batteries from the Chinese market, which in turn has resulted in a drop in sales for FREYR Battery SA. Additionally, investors are concerned about the company’s ability to remain competitive in the face of strong competition from other battery producers. Investors have been questioning the company’s financials as well as their ability to remain competitive. This lack of transparency has caused some investors to lose faith in the company’s future prospects. In response to the stock drop, FREYR Battery SA has announced that they are making changes to their business model. They are focusing on improving their product lineup and investing in research and development. They have also announced plans to increase transparency and provide more detailed financial reporting to investors.

However, it is clear that investors have become more cautious about investing in the company due to its recent stock price drop. It is important for investors to do their own research before investing in any company, as this can help them make wise decisions about where to invest their money.

Share Price

Wednesday morning saw a sharp drop in the stock of FREYR Battery SA, one of the leading producers of lithium-ion batteries in the world. Pre-market trading saw the stock opening at $9.5 and closing at $9.5, down by 0.1% from its last closing price of 9.5. This marked a significant decline for the company, which had been steadily increasing in value over the past few weeks. The sudden drop in the stock price has raised concerns among investors, who are now wondering whether the company is facing a financial crisis. The company has not released any statement in response to the news, which has only added to the confusion.

Some analysts speculate that the drop could be due to a decrease in demand for lithium-ion batteries, while others believe that it could be due to a drop in investor confidence. The company’s future prospects will depend on how it responds to this sudden decline in its stock price and whether it can take steps to restore investor confidence. Most importantly, investors will be looking for reassurance that the company is still well placed to continue its growth trajectory. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Freyr Battery. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -152.12 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Freyr Battery. More…

| Operations | Investing | Financing |

| -100.49 | -99.9 | -1.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Freyr Battery. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 562.74 | 151.8 | 3.52 |

Key Ratios Snapshot

Some of the financial key ratios for Freyr Battery are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -20.6% | -16.9% |

VI Analysis

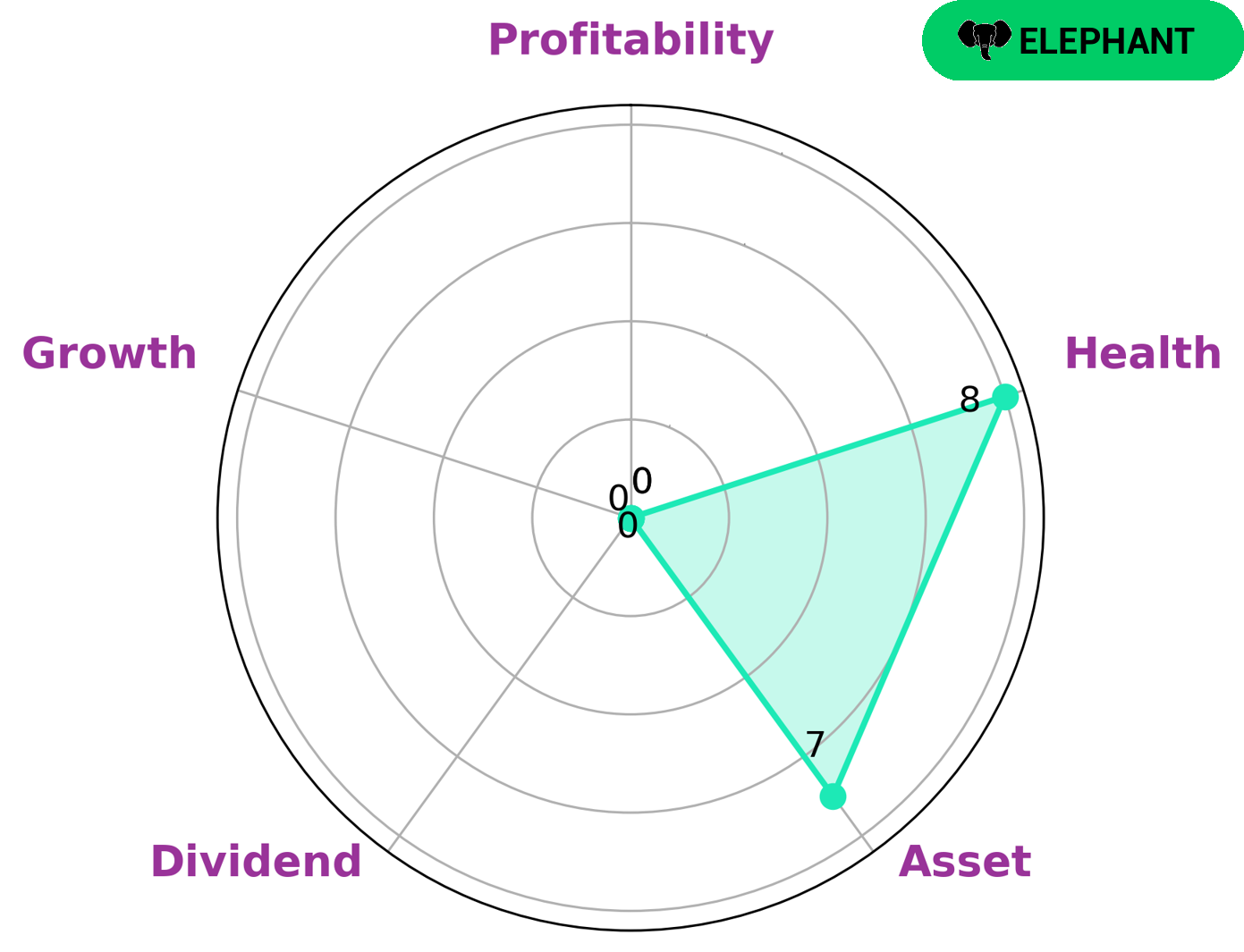

The VI app simplifies the analysis of a company’s fundamentals and provides a comprehensive picture of its long term potential. According to the VI Star Chart, FREYR BATTERY has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of paying off debt and funding future operations. It is also strong in asset, however weak in dividend, growth, and profitability. FREYR BATTERY is classified as an ‘elephant’, a type of company that has substantial assets after deducting off liabilities. Such companies may be attractive to investors who are looking for steady returns, as they are likely to have stable cashflows and moderate risk. At the same time, they may lack growth potential as they are already well-established players within their industry. Additionally, they may not be suitable for dividend investors as they may not have a history of paying dividends or may not have the resources to do so. Therefore, FREYR BATTERY may be suitable for investors who are looking for companies that can provide a steady stream of income, without the high risk associated with smaller and younger companies. Such investors may be more inclined to invest in large, established companies that have proven track records of profitability and stability. More…

VI Peers

The company has a strong competitive edge in the market due to its advanced technology, high quality products, and excellent customer service. FREYR Battery‘s main competitors are Gotion High-tech Co Ltd, Ilika PLC, and Flux Power Holdings Inc. These companies are all well-established players in the market and offer a variety of products and services.

– Gotion High-tech Co Ltd ($SZSE:002074)

Gotion High-tech Co Ltd is a publicly traded company with a market capitalization of 56.43 billion as of 2022. The company has a return on equity of 1.97%. Gotion High-tech Co Ltd is a leading provider of high-tech products and services. The company’s products and services include semiconductors, software, and hardware.

– Ilika PLC ($LSE:IKA)

Ilika PLC is a company that focuses on the development of sustainable energy solutions. The company has a market capitalization of 80.52 million as of 2022 and a return on equity of -15.25%. Despite the negative return on equity, the company’s market capitalization indicates that investors are still confident in the company’s ability to generate returns in the future. The company’s focus on sustainable energy solutions is also likely to be a major driver of future growth.

– Flux Power Holdings Inc ($NASDAQ:FLUX)

Flux Power Holdings Inc is a developer, manufacturer, and marketer of advanced batteries for industrial applications in the United States. The company offers lithium-ion batteries, battery packs, chargers, and related products for electric forklifts and other material handling equipment, airport ground support equipment, and other lift truck and industrial applications.

Summary

Investing in FREYR Battery SA can be an attractive option for those looking to diversify their portfolio. This company specializes in providing advanced battery technology solutions for a variety of applications, such as energy storage, electric vehicles, and more. Despite the stock dropping sharply in pre-market trading, it could still be a worthwhile investment for those seeking to benefit from the ongoing shift towards green energy sources. FREYR Battery SA is a leader in the field of battery technology and has a diverse portfolio of products and services that it offers to its clients. It has partnered with some of the world’s leading automotive companies to provide advanced battery solutions for electric vehicles. The company also has a long-term plan to expand its operations into new markets, such as residential energy storage systems, which could potentially provide further upside for its investors. In addition to its technological advancements, FREYR Battery SA is committed to sustainability and reducing its environmental impact.

It has invested heavily in research and development to develop more efficient technologies and to reduce the environmental impact of its operations. This could be beneficial for those looking for companies that prioritize sustainability and green energy sources. Despite the stock dropping sharply in pre-market trading, there may still be some potential for investors willing to take the risk. The company’s commitment to sustainability and green energy sources could prove beneficial, and the potential for further expansion into new markets could provide further upside. For those looking to invest in FREYR Battery SA, it is important to do your own research and assess the risks carefully before making any decisions.

Recent Posts