Solid Power Intrinsic Value – Solid Power Reports In-Line GAAP EPS, Misses Revenue Estimate by $0.24M

May 10, 2023

Trending News 🌧️

Solid Power ($NASDAQ:SLDP), a publicly traded company, reported its GAAP earnings per share (EPS) of -$0.11, which was in line with analyst expectations. However, revenue came in at $3.79M, missing the estimated revenue by $0.24M. Solid Power is a leading producer of advanced rechargeable batteries for industrial, automotive and consumer applications. With numerous awards and accolades, Solid Power has established itself as a leader in energy innovation and is expanding its presence in the battery industry.

Market Price

The company’s stock opened at $2.2 and closed at $2.2, a 6.2% rise from the previous closing price of $2.1. The market reacted positively to the announcement, as investors cheered the in-line EPS report, while overlooking the missed revenue estimate. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Solid Power. More…

| Total Revenues | Net Income | Net Margin |

| 11.79 | -9.55 | -420.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Solid Power. More…

| Operations | Investing | Financing |

| -33.82 | -429.99 | 0.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Solid Power. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 594.45 | 39.07 | 3.16 |

Key Ratios Snapshot

Some of the financial key ratios for Solid Power are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 73.0% | – | -82.6% |

| FCF Margin | ROE | ROA |

| -785.6% | -1.1% | -1.0% |

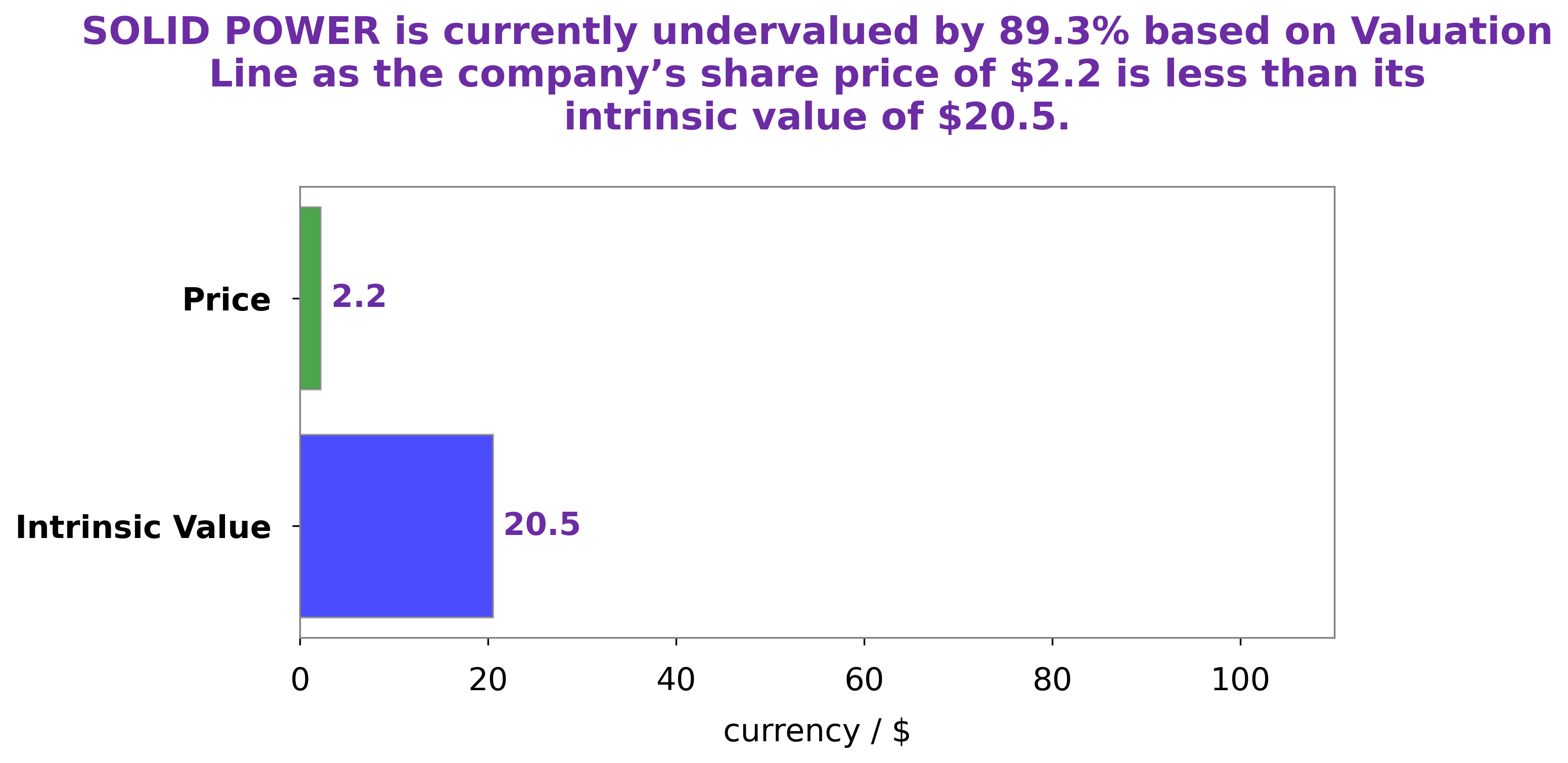

Analysis – Solid Power Intrinsic Value

At GoodWhale, we have conducted a comprehensive analysis of SOLID POWER‘s wellbeing. Our proprietary Valuation Line indicates that the intrinsic value of SOLID POWER share is around $20.5. However, currently, the stock is trading at only $2.2, which implies that the shares are undervalued by 89.3%. This provides an excellent opportunity for investors who are looking to invest in SOLID POWER. We strongly believe that SOLID POWER is an attractive investment option and recommend investors to consider investing in the company. More…

Peers

The company has a strong competitive position in the market and is facing competition from Dry Cell And Storage Battery JSC, Simplo Technology Co Ltd, Guangdong Greenway Technology Co Ltd.

– Dry Cell And Storage Battery JSC ($HOSE:PAC)

Simplo Technology Co Ltd is a publicly traded company with a market capitalization of 51.33 billion as of 2022. The company has a return on equity of 21.21%. Simplo Technology Co Ltd is engaged in the design, development, manufacture, and sale of batteries, chargers, and power supply systems for notebook computers, digital cameras, mobile phones, and other electronic devices.

– Simplo Technology Co Ltd ($TPEX:6121)

Guangdong Greenway Technology Co., Ltd. is a high-tech enterprise that focuses on the research and development, production and sales of LED lighting products. The company was founded in 2003 and is headquartered in Shenzhen, China. It has a market cap of 5.79B as of 2022 and a ROE of 9.22%. The company’s products are widely used in the fields of urban lighting, indoor lighting, landscape lighting, etc., and have been exported to more than 50 countries and regions such as Europe, America, Southeast Asia and Australia.

Summary

Solid Power reported a GAAP EPS of -$0.11, in-line with estimates. Despite the revenue miss, the stock price moved up on the same day, indicating that investors are confident in the company’s prospects going forward. Investors should consider carefully the risks associated with investing in Solid Power and make sure to carry out further research on the company’s financial position before committing capital.

Recent Posts