Solid Power Intrinsic Value Calculation – Analysts Overwhelmingly Positive on Solid Power (NASDAQ: SLDP) After Impressive 2023

March 31, 2023

Trending News ☀️

Analysts have been overwhelmingly positive about Solid Power ($NASDAQ:SLDP) Inc. (NASDAQ: SLDP) in the wake of their impressive performance in 2023. Solid Power is a leading developer and manufacturer of solid state batteries, which offer a wide range of benefits compared to conventional lithium-ion batteries. The company has seen tremendous growth and success in recent years, as it has captured a significant portion of the growing market for solid-state batteries. This impressive growth, along with their innovative approach to research and development, has driven analysts to take a closer look at the stock. Analysts need to be convinced that Solid Power will continue to perform well, as the rapid expansion in the industry has raised some concerns.

The company has invested in significant research and development to ensure that their products are reliable and efficient. This has allowed them to maintain a competitive advantage over their competitors and provide battery solutions for a variety of applications. Furthermore, the company has also made strategic investments in the automotive sector, which is expected to be one of the key drivers of growth for the industry over the coming years. All of these factors, along with the continued growth of the industry, have led analysts to be overwhelmingly positive about Solid Power’s future prospects.

Stock Price

On Thursday, its stock opened at $2.9 and closed at the same price, up by 1.0% from the prior closing price of 2.9. This positive news has driven up investor enthusiasm and analyst ratings of the company, as this reflects a profitable year for them. The impressive results have reaffirmed the positive outlook for Solid Power Inc. as it appears to be on the path to profits and growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Solid Power. More…

| Total Revenues | Net Income | Net Margin |

| 11.79 | -9.55 | -420.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Solid Power. More…

| Operations | Investing | Financing |

| -33.82 | -429.99 | 0.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Solid Power. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 594.45 | 39.07 | 3.16 |

Key Ratios Snapshot

Some of the financial key ratios for Solid Power are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 73.0% | – | -82.6% |

| FCF Margin | ROE | ROA |

| -785.6% | -1.1% | -1.0% |

Analysis – Solid Power Intrinsic Value Calculation

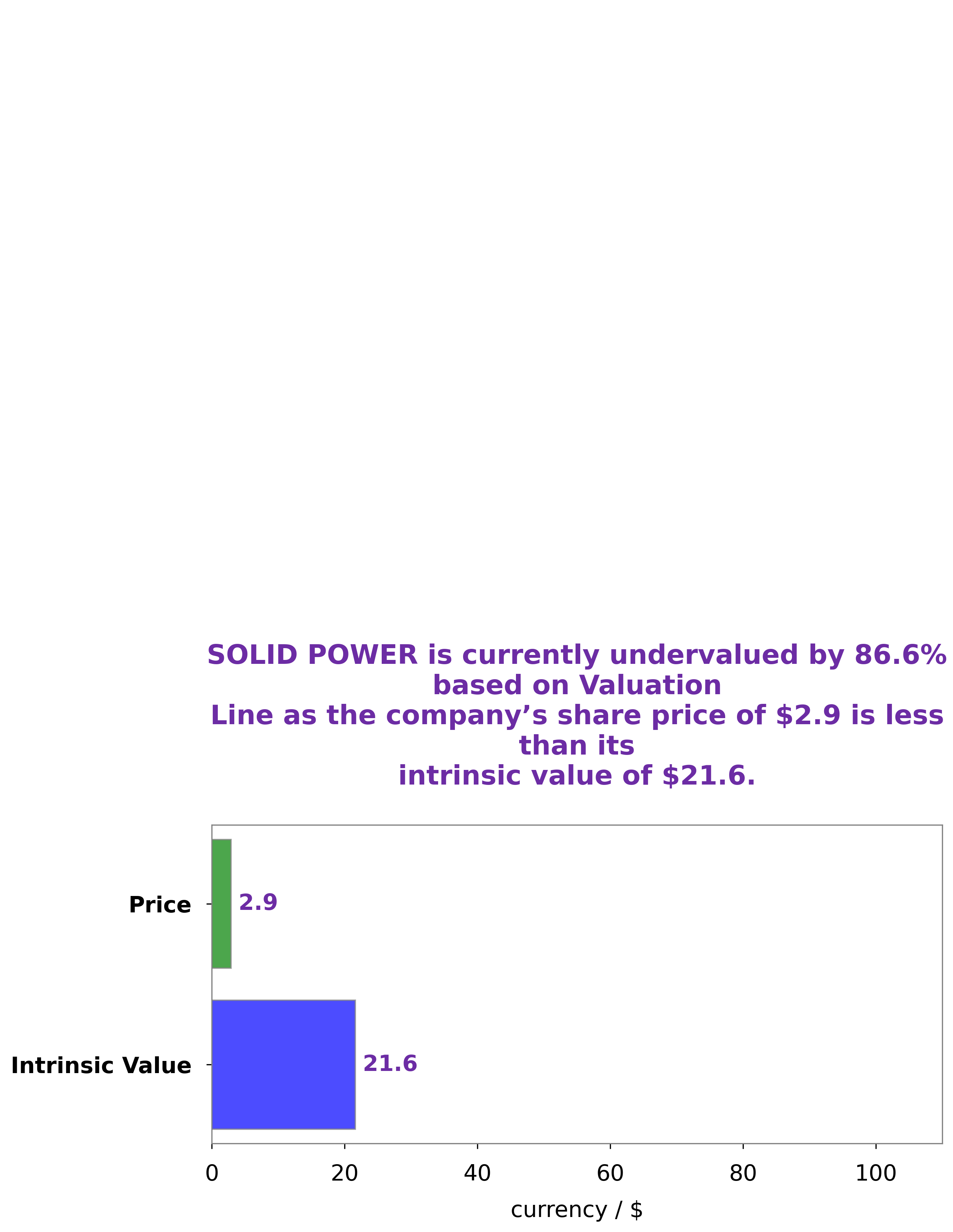

At GoodWhale, we recently conducted an analysis of SOLID POWER’s wellbeing. Through our proprietary Valuation Line, we determined that the intrinsic value of SOLID POWER shares was around $21.6. Currently, the stock is traded at $2.9, which represents an undervaluation of 86.6%. This offers a great opportunity for investors to get involved in the company at a very attractive price. More…

Peers

The company has a strong competitive position in the market and is facing competition from Dry Cell And Storage Battery JSC, Simplo Technology Co Ltd, Guangdong Greenway Technology Co Ltd.

– Dry Cell And Storage Battery JSC ($HOSE:PAC)

Simplo Technology Co Ltd is a publicly traded company with a market capitalization of 51.33 billion as of 2022. The company has a return on equity of 21.21%. Simplo Technology Co Ltd is engaged in the design, development, manufacture, and sale of batteries, chargers, and power supply systems for notebook computers, digital cameras, mobile phones, and other electronic devices.

– Simplo Technology Co Ltd ($TPEX:6121)

Guangdong Greenway Technology Co., Ltd. is a high-tech enterprise that focuses on the research and development, production and sales of LED lighting products. The company was founded in 2003 and is headquartered in Shenzhen, China. It has a market cap of 5.79B as of 2022 and a ROE of 9.22%. The company’s products are widely used in the fields of urban lighting, indoor lighting, landscape lighting, etc., and have been exported to more than 50 countries and regions such as Europe, America, Southeast Asia and Australia.

Summary

Analysts have been overwhelmingly positive on Solid Power Inc. (NASDAQ: SLDP) after the company reported impressive results for 2023. The company’s solid performance and outlook have been praised by analysts, who are recommending the stock to investors interested in taking a long-term position. Analysts have pointed to strong fundamentals and impressive growth potential in the company’s business segments as key reasons for their positive outlook on the stock.

They also note that Solid Power’s products have been well-received in the marketplace, and its expanding customer base is a testament to this fact. Analysts believe that given the company’s healthy financials and strong growth prospects, investors should consider taking a long-term position in Solid Power stock.

Recent Posts