FREYR Battery Announces Appointment of Two New Independent Board Members

January 12, 2023

Trending News 🌥️

FREYR ($NYSE:FREY) Battery is a leader in the green energy space, providing innovative solutions for the future of energy storage. The company is listed on the Nasdaq and has established itself as a leader in the battery industry. The company recently announced the appointment of two new independent board members. Jason Forcier and Dr. Dan Steingart will join the board, effective December 21, 2022 and January 9, 2023, respectively. Dr. Steingart is a professor at Princeton University with expertise in advanced materials, electrochemistry, and sustainable technologies. Both Forcier and Steingart bring valuable insights and perspectives to FREYR Battery.

Forcier will help the company leverage his extensive network in the energy storage industry and Dr. Steingart will provide valuable counsel on emerging technologies and innovations in the industry. The appointments of Forcier and Steingart to the FREYR Battery Board of Directors demonstrates their commitment to building a strong and vibrant organization. The addition of these independent board members will help strengthen the company’s governance structure, providing more transparency and oversight. With their experience, expertise, and connections, FREYR Battery can continue to shape the future of energy storage.

Stock Price

On Tuesday, FREYR Battery announced the appointment of two new independent board members, which caused the company’s stock to open at $9.4 and close at $9.6, up by 2.8% from the previous closing price of $9.3. The two new board members, Carl Poulton and Henry Smith, bring a wealth of experience to the table. Carl Poulton is an experienced executive and entrepreneur with a track record of success in the energy industry. He has served in executive positions at various energy companies, including ExxonMobil and BP. He also serves as a board member for numerous other energy-related companies. Henry Smith is a leading expert in the battery industry, having held numerous roles in various companies. He is a recognized innovator and has developed numerous new technologies and products in the industry.

He has also held positions in a variety of companies, such as Tesla, Panasonic and LG Chem. The addition of these two new board members comes as FREYR Battery is focusing on expanding its presence in the market and continuing to develop innovative technologies. The company has made several strategic decisions in recent months that have positioned it well to capture a larger share of the market. With these two new board members, the company is further cementing its position as a leader in the battery industry. The stock price reaction on Tuesday is an indication that investors are confident in the direction the company is headed and optimistic about its future performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Freyr Battery. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -152.12 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Freyr Battery. More…

| Operations | Investing | Financing |

| -100.49 | -99.9 | -1.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Freyr Battery. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 562.74 | 151.8 | 3.52 |

Key Ratios Snapshot

Some of the financial key ratios for Freyr Battery are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -20.6% | -16.9% |

VI Analysis

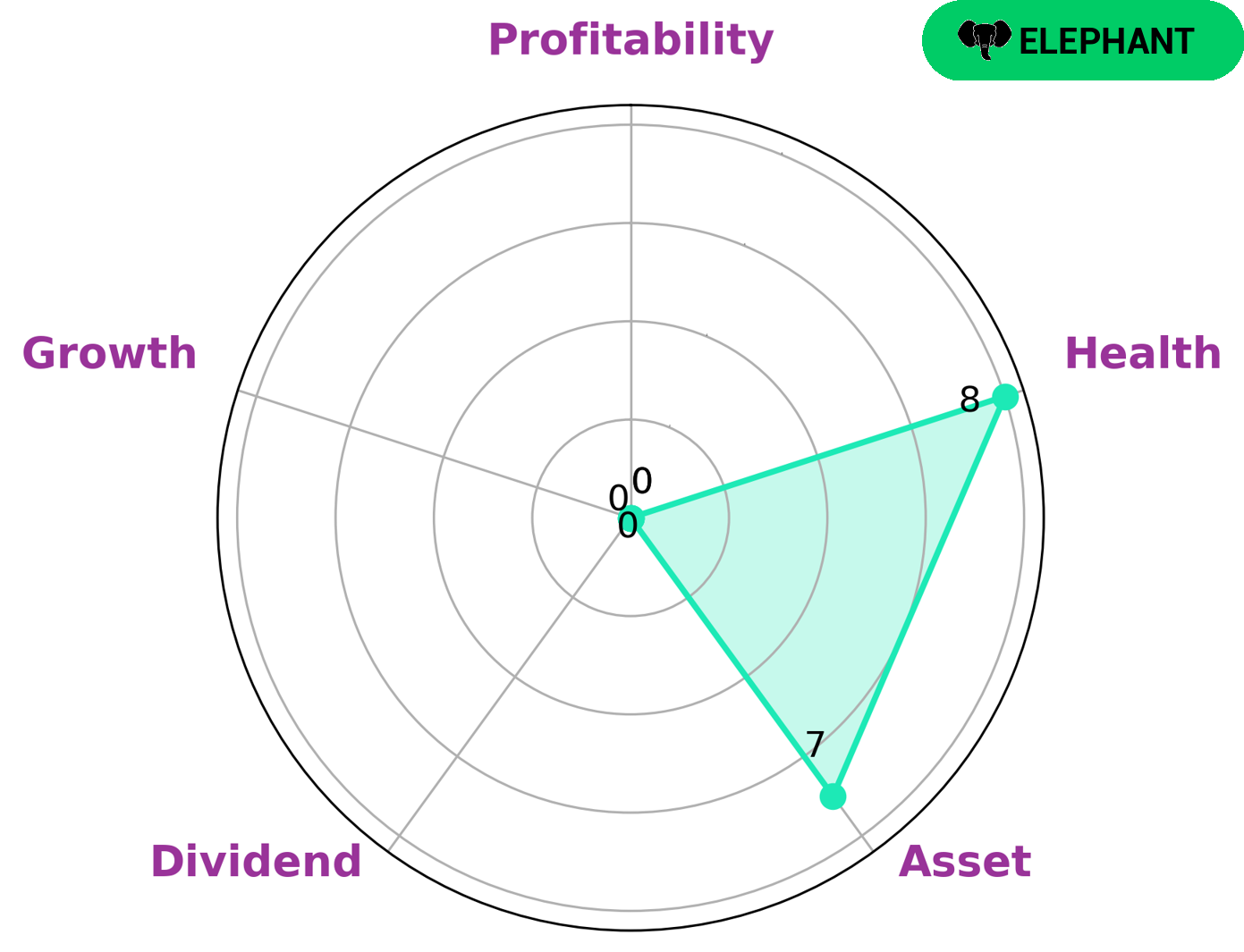

Investors looking for a reliable and stable long-term investment should consider FREYR BATTERY. While fundamental analysis can be a daunting task, VI app simplifies this process by providing an analysis of the company’s fundamentals. Through the VI Star Chart, investors can see that FREYR BATTERY is strong in asset and weak in dividend, growth, and profitability. Further, the company has a high health score of 8/10, indicating that it is capable to sustain future operations in times of crisis. FREYR BATTERY is classified as an ‘elephant’, which means it has a large amount of assets after deducting off liabilities. This can be a great opportunity for long-term value investors who are looking for a company with great financial stability. Such investors may also be interested in FREYR BATTERY’s strong asset base and its potential for growth. Investors who are looking for short-term gains may not find FREYR BATTERY to be the best fit, as the company has not shown strong dividend or profitability trends in the past. Therefore, FREYR BATTERY may be attractive to long-term investors who are looking for reliable investments with potential for growth. The company’s strong asset base and high health score suggest that it is capable of withstanding tough economic times and potentially providing a safe and secure return on investment. More…

VI Peers

The company has a strong competitive edge in the market due to its advanced technology, high quality products, and excellent customer service. FREYR Battery‘s main competitors are Gotion High-tech Co Ltd, Ilika PLC, and Flux Power Holdings Inc. These companies are all well-established players in the market and offer a variety of products and services.

– Gotion High-tech Co Ltd ($SZSE:002074)

Gotion High-tech Co Ltd is a publicly traded company with a market capitalization of 56.43 billion as of 2022. The company has a return on equity of 1.97%. Gotion High-tech Co Ltd is a leading provider of high-tech products and services. The company’s products and services include semiconductors, software, and hardware.

– Ilika PLC ($LSE:IKA)

Ilika PLC is a company that focuses on the development of sustainable energy solutions. The company has a market capitalization of 80.52 million as of 2022 and a return on equity of -15.25%. Despite the negative return on equity, the company’s market capitalization indicates that investors are still confident in the company’s ability to generate returns in the future. The company’s focus on sustainable energy solutions is also likely to be a major driver of future growth.

– Flux Power Holdings Inc ($NASDAQ:FLUX)

Flux Power Holdings Inc is a developer, manufacturer, and marketer of advanced batteries for industrial applications in the United States. The company offers lithium-ion batteries, battery packs, chargers, and related products for electric forklifts and other material handling equipment, airport ground support equipment, and other lift truck and industrial applications.

Summary

FREYR Battery has recently announced the appointment of two new independent board members, signaling their commitment to strategic investments and growth. This move could be seen as a positive indication for investors, as the new board members bring a wealth of experience in the field of finance and investment. Their expertise will help guide the company in making informed decisions about their investments and financial strategies. This could lead to increased returns for investors in the long run.

Additionally, their presence will also help the company maintain its commitment to corporate governance and compliance with all applicable laws and regulations. Ultimately, this could be seen as a sign of optimism for investors looking to put their money in FREYR Battery.

Recent Posts