F R E Y R B a t t e r y O u t p e r f o r m s E x p e c t a t i o n s w i t h Q 4 G A A P E P S o f $ 0 . 2 0

March 1, 2023

Trending News 🌥️

FREYR ($NYSE:FREY) Battery recently announced their Q4 GAAP EPS of $0.20, which was a beat of expectations of only $0.39. This stellar performance showcases the advanced technologies that FREYR Battery has been investing in this past year to ensure their batteries out-perform the competition. This result was especially impressive considering the challenging macroeconomic environment and the effects of the pandemic on the industry. This fantastic performance from FREYR Battery comes from the company’s continued investment in advanced technologies and new product development.

Their cutting-edge products have helped them achieve strong market share in the automotive and electronic vehicle markets, and now they are actively pursuing new partnerships to expand their reach even further. The Q4 GAAP EPS results show that FREYR Battery is well on its way to establishing itself as a leader in its industry. With their commitment to developing innovative products and technologies, they are sure to remain ahead of the competition and continue to out-perform expectations.

Share Price

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Freyr Battery. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -98.79 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Freyr Battery. More…

| Operations | Investing | Financing |

| -90.01 | -175.03 | 250.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Freyr Battery. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 827.7 | 107.57 | 5.14 |

Key Ratios Snapshot

Some of the financial key ratios for Freyr Battery are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -13.4% | -9.1% |

Analysis

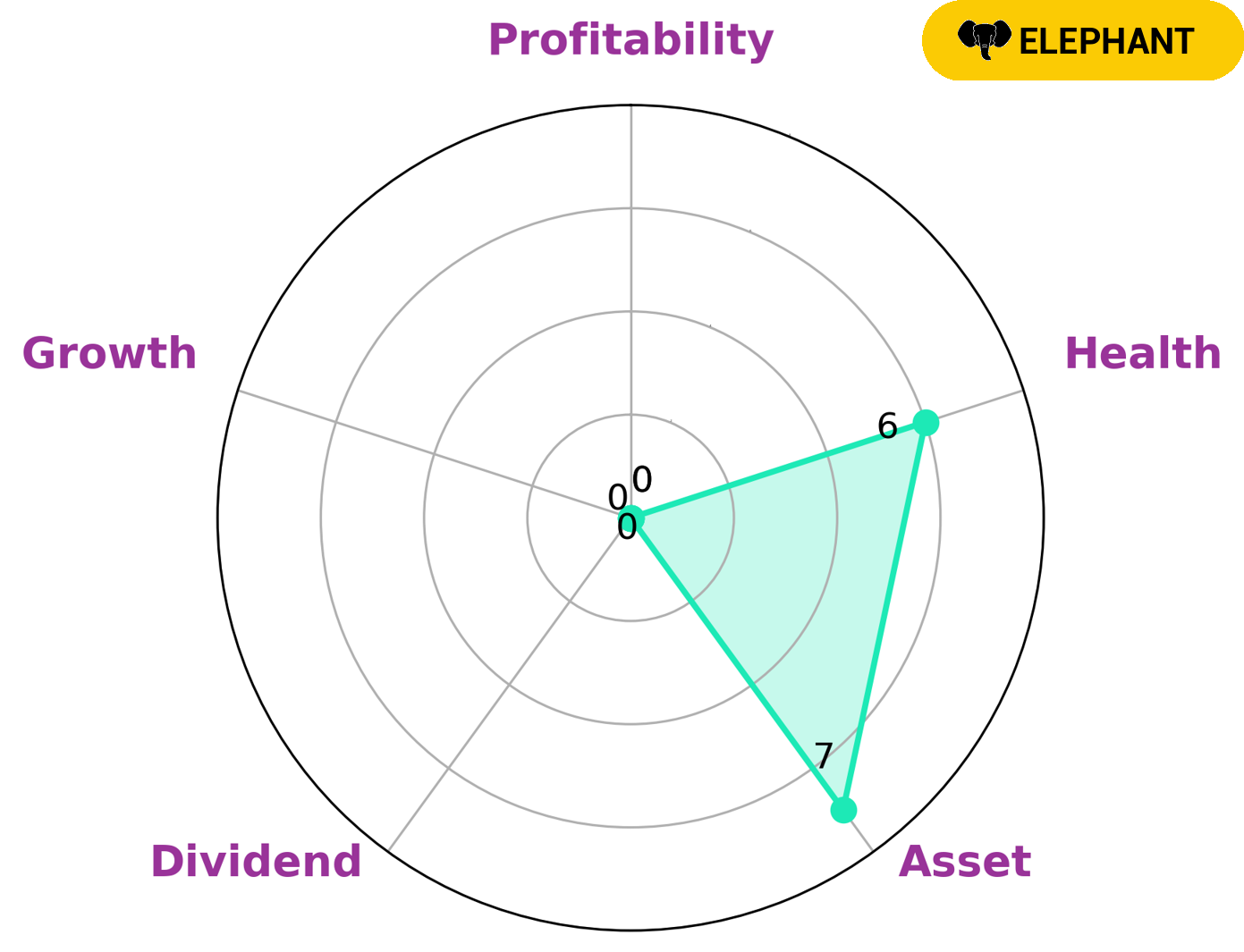

GoodWhale has analyzed FREYR BATTERY‘s financials and found that the company has an intermediate health score of 6/10 with regard to its cashflows and debt. This means that FREYR BATTERY is likely to be able to pay off debt and fund its future operations. Through our analysis, we have classified FREYR BATTERY as an ‘elephant’ type of company. This means that after subtracting its liabilities from its assets, there is still a significant amount of wealth left in the company. Therefore, this makes FREYR BATTERY an attractive investment opportunity for certain types of investors. Although FREYR BATTERY is strong in assets, it is weak in other areas such as dividend yield, growth, and profitability. Therefore, investors should take into consideration these other factors when evaluating the company’s overall investment potential. More…

Peers

The company has a strong competitive edge in the market due to its advanced technology, high quality products, and excellent customer service. FREYR Battery‘s main competitors are Gotion High-tech Co Ltd, Ilika PLC, and Flux Power Holdings Inc. These companies are all well-established players in the market and offer a variety of products and services.

– Gotion High-tech Co Ltd ($SZSE:002074)

Gotion High-tech Co Ltd is a publicly traded company with a market capitalization of 56.43 billion as of 2022. The company has a return on equity of 1.97%. Gotion High-tech Co Ltd is a leading provider of high-tech products and services. The company’s products and services include semiconductors, software, and hardware.

– Ilika PLC ($LSE:IKA)

Ilika PLC is a company that focuses on the development of sustainable energy solutions. The company has a market capitalization of 80.52 million as of 2022 and a return on equity of -15.25%. Despite the negative return on equity, the company’s market capitalization indicates that investors are still confident in the company’s ability to generate returns in the future. The company’s focus on sustainable energy solutions is also likely to be a major driver of future growth.

– Flux Power Holdings Inc ($NASDAQ:FLUX)

Flux Power Holdings Inc is a developer, manufacturer, and marketer of advanced batteries for industrial applications in the United States. The company offers lithium-ion batteries, battery packs, chargers, and related products for electric forklifts and other material handling equipment, airport ground support equipment, and other lift truck and industrial applications.

Summary

FREYR Battery is a leading developer and manufacturer of lithium-ion batteries for automotive and power storage applications. The company has recently been highlighted in the news for its impressive Q4 GAAP EPS of $0.20 and its stock price has been seen to have moved up in the same day. Analysts have suggested investing in the company due to its strong performance in the fourth quarter and its long-term prospects. The company is expected to continue to grow in the near future, and investors are encouraged to consider its growth potential as an attractive return on their investment.

Recent Posts