Enersys Intrinsic Value – EnerSys Sees Bright Future Ahead with Unrivaled Energy Solutions

June 8, 2023

☀️Trending News

ENERSYS ($NYSE:ENS): EnerSys is a leading provider of stored energy solutions, and they have seen an optimistic outlook in the future of their business. With their unparalleled energy solutions, they are set to revolutionize the energy industry. From the development of advanced battery systems to the implementation of innovative storage solutions, EnerSys has everything needed to make a lasting impact. Their mission is to bring the world reliable, secure and sustainable energy solutions. They are committed to developing cutting-edge technologies and services that will help create a more efficient and sustainable future. Their goal is to create clean energy solutions that are cost-effective and safe for the environment. EnerSys stock has seen soaring results and is well positioned to take advantage of current trends in the energy industry.

The company’s focus on renewables, storage, and energy efficiency puts them in a great position to capitalize on a booming market. With their mix of products and services, EnerSys is well-positioned to benefit from a growing demand for stored energy solutions, both now and in the future. EnerSys presents a bright future ahead with its unrivaled energy solutions. As the demand for stored energy solutions increases, EnerSys is ready to revolutionize the industry with its innovative products and services. Their commitment to developing cutting-edge technologies and services will help create a more efficient and sustainable future.

Price History

Tuesday was an exciting day for ENERSYS shareholders as their stock opened at $101.5 and closed at $103.8, up by 1.9% from the previous closing price of 101.8. This is seen as a sign of the bright future that ENERSYS is set to have, thanks to their unrivaled energy solutions. ENERSYS offers a comprehensive range of products and services that deliver reliable, safe and efficient power to its customers. Their portfolio includes everything from industrial batteries and chargers to energy storage systems for utilities and backup power.

Moreover, they also provide monitoring, software and services to ensure that their products are managed efficiently and safely. As a result, ENERSYS is well-positioned to become a global leader in energy solutions that are reliable, innovative and cost-efficient. EnerSys_Sees_Bright_Future_Ahead_with_Unrivaled_Energy_Solutions”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Enersys. EnerSys_Sees_Bright_Future_Ahead_with_Unrivaled_Energy_Solutions”>More…

| Total Revenues | Net Income | Net Margin |

| 3.71k | 175.81 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Enersys. EnerSys_Sees_Bright_Future_Ahead_with_Unrivaled_Energy_Solutions”>More…

| Operations | Investing | Financing |

| 279.94 | -44.8 | -270.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Enersys. EnerSys_Sees_Bright_Future_Ahead_with_Unrivaled_Energy_Solutions”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.62k | 2.01k | 39.13 |

Key Ratios Snapshot

Some of the financial key ratios for Enersys are shown below. EnerSys_Sees_Bright_Future_Ahead_with_Unrivaled_Energy_Solutions”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.3% | 5.0% | 7.3% |

| FCF Margin | ROE | ROA |

| 5.2% | 10.8% | 4.7% |

Analysis – Enersys Intrinsic Value

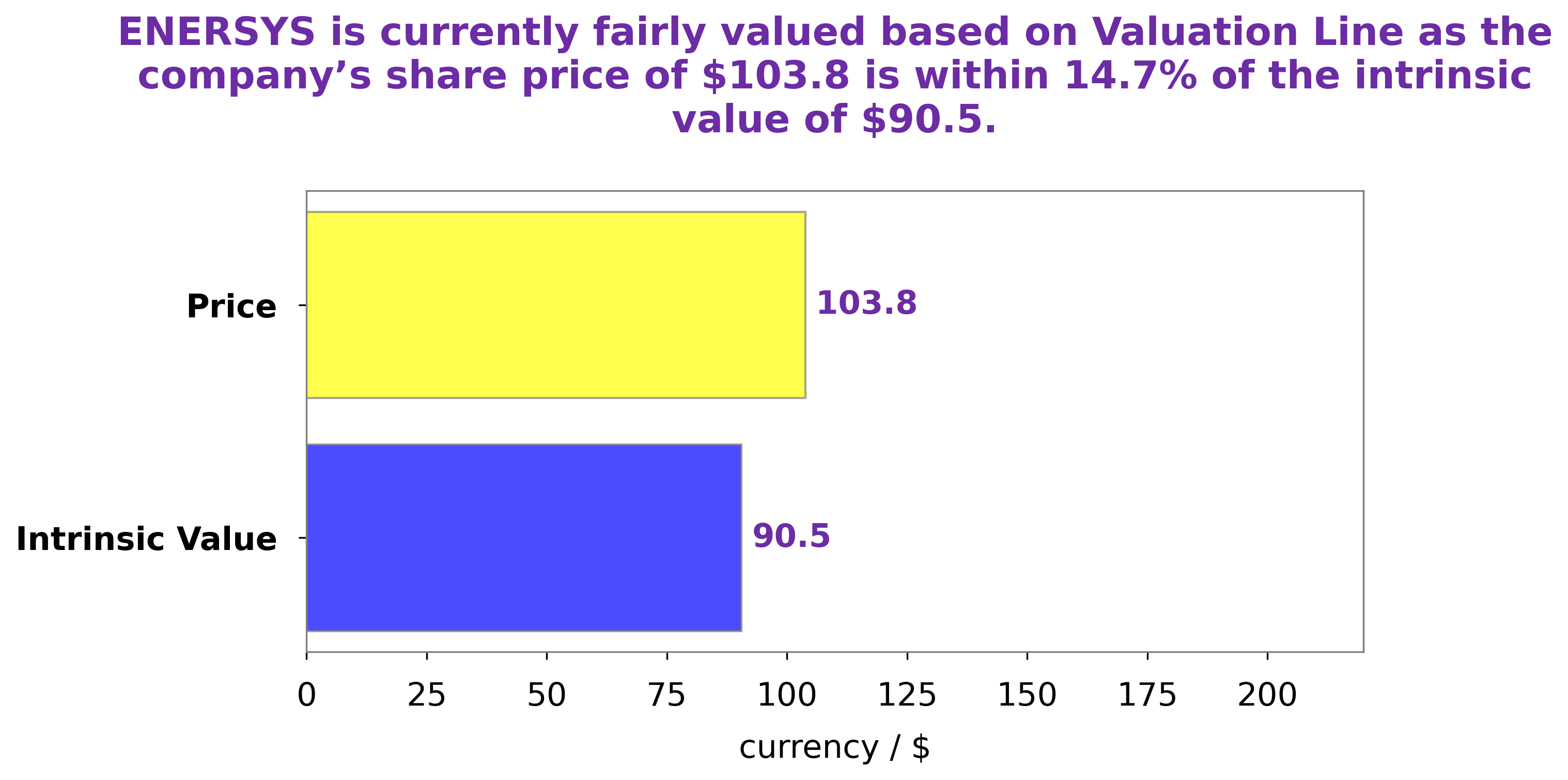

At GoodWhale, we have conducted an extensive analysis of ENERSYS’s wellbeing. Our proprietary Valuation Line analysis has revealed that the intrinsic value of ENERSYS share is around $90.5. Currently the stock is traded at $103.8, meaning it is overvalued by 14.7%. Although the stock may be viewed as a good investment, it is important to consider the intrinsic value to ensure that the decision is sound and based on the true value of the stock. EnerSys_Sees_Bright_Future_Ahead_with_Unrivaled_Energy_Solutions”>More…

Peers

The company competes with ESS Tech Inc, Shandong Sacred Sun Power Sources Co Ltd, Eos Energy Enterprises Inc, among others. EnerSys has a diversified product portfolio and a strong market position. The company’s products are used in a variety of applications including material handling, oil and gas, power generation, transportation, and other industrial applications.

– ESS Tech Inc ($NYSE:GWH)

Founder and CEO of the company is Jean-luc Roy. The company provides software for the management and analysis of data. The company went public in May of 2017. The company’s market cap as of December of 2020 was $525.68 million. The company’s ROE as of December of 2020 was -188.29%.

– Shandong Sacred Sun Power Sources Co Ltd ($SZSE:002580)

Shandong Sacred Sun Power Sources Co Ltd is a leading manufacturer of solar panels and related products. The company has a market cap of 4.97B as of 2022 and a return on equity of 4.18%. The company’s products are used in a variety of applications, including solar power plants, residential and commercial rooftops, and portable solar power systems.

– Eos Energy Enterprises Inc ($NASDAQ:EOSE)

Eos Energy Enterprises Inc is a publicly traded company with a market capitalization of 86.7 million as of 2022. The company has a return on equity of 163.71%. Eos Energy Enterprises Inc is engaged in the business of developing and commercializing energy storage solutions based on zinc-air batteries.

Summary

ENERSYS provides highly efficient energy storage solutions and is a bullish stock for investors looking to capitalize on the growing global demand for reliable energy access. The company has a strong portfolio of products and services which have been designed to meet the needs of large-scale industrial and commercial customers. ENERSYS also has a strong presence in the renewables industry, offering services that include energy storage systems, home energy storage solutions, and related aftermarket services.

With a commitment to developing innovative technologies, such as advanced lithium-ion batteries, to create new products and services, ENERSYS is well positioned to capitalize on growing opportunities in the global energy market. Furthermore, by leveraging its global operations and extensive network of service partners, ENERSYS is able to benefit from economies of scale, allowing it to offer competitively priced products and services to its customers.

Recent Posts