Yeti Holdings Stock Intrinsic Value – YETI HOLDINGS Reports Record Earnings for FY2023 Q1 Ending March 31 2023.

May 28, 2023

Earnings Overview

On May 11 2023, YETI HOLDINGS ($NYSE:YETI) released their financial report for Q1 of FY2023, which concluded on March 31 2023. The total revenue amounted to USD 302.8 million, representing a 3.1% rise from the same quarter in the previous year. Unfortunately, net income plummeted 58.8% year over year, with USD 10.6 million recorded.

Share Price

On Thursday, YETI HOLDINGS reported record earnings for its fiscal year 2023 Q1, ending March 31 2023. The company’s stock opened at $45.1 and closed at $43.2, up by a modest 0.3% from the prior closing price of $43.1. This positive news was a major boost for YETI HOLDINGS investors, who have seen the company make steady progress over the past few quarters. YETI HOLDINGS’ impressive financial performance was driven by strong sales of its core products, which continued to be in high demand despite the ongoing pandemic.

These impressive figures indicate that YETI HOLDINGS is well-positioned to continue its growth trajectory in the coming quarters. With its innovative products and robust marketing strategy, YETI HOLDINGS is well-positioned to capitalize on the growth opportunities presented by the increasingly digital world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Yeti Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.6k | 74.6 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Yeti Holdings. More…

| Operations | Investing | Financing |

| 142.76 | -54.05 | -22.39 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Yeti Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.01k | 463.95 | 6.26 |

Key Ratios Snapshot

Some of the financial key ratios for Yeti Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.8% | 3.6% | 6.3% |

| FCF Margin | ROE | ROA |

| 5.5% | 11.9% | 6.3% |

Analysis – Yeti Holdings Stock Intrinsic Value

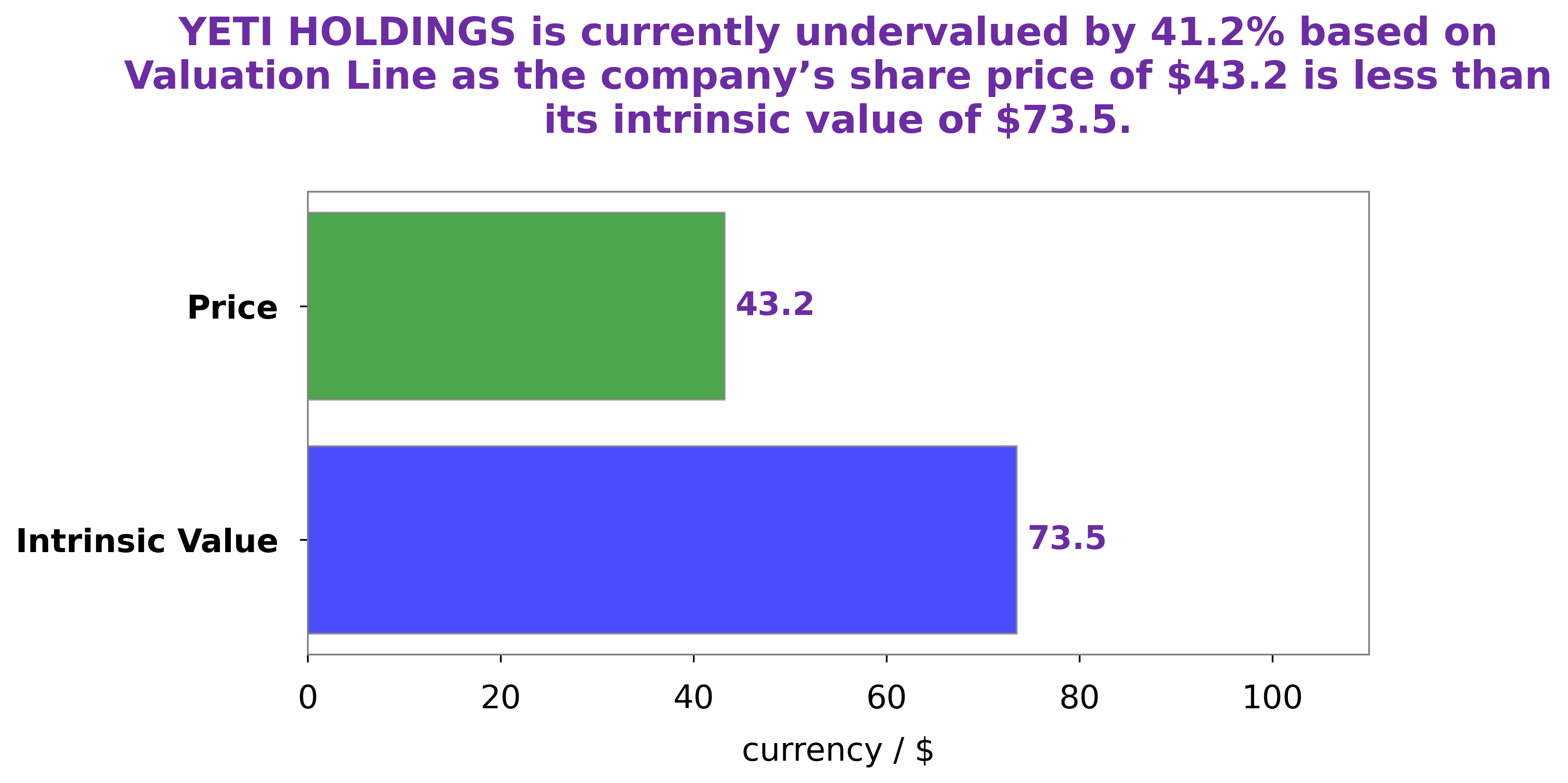

At GoodWhale, we recently conducted an analysis of YETI HOLDINGS‘s wellbeing. After careful consideration of the company’s financials, our proprietary Valuation Line determined that the fair value of YETI HOLDINGS share is around $73.5. However, the current price of YETI HOLDINGS stock is only $43.2, which is significantly below the fair value calculated by our Valuation Line. This implies that YETI HOLDINGS is currently undervalued by 41.2%. More…

Peers

In recent years, the competition between YETI Holdings Inc and its competitors has intensified, as each company strives to gain market share in the highly competitive cooler and drinkware industry. While YETI has long been the market leader, its competitors are quickly catching up, offering products that are comparable in quality and price. As the competition heats up, it will be interesting to see which company comes out on top.

– Tandem Group PLC ($LSE:TND)

Tandem Group PLC is a holding company that engages in the design, manufacture, and distribution of bicycles and bicycle related products. The company operates through the following segments: Bicycles, Components, and Others. The Bicycles segment designs, manufactures, and sells complete bicycles, electric bicycles, and folding bicycles. The Components segment manufactures and sells bicycle components and wheels. The Others segment includes the group’s online retailing business. Tandem Group was founded by Frank Bowden in 1885 and is headquartered in Coventry, the United Kingdom.

– Bonny Worldwide Ltd ($TWSE:8467)

Bonny Worldwide Ltd is a publicly traded company with a market capitalization of 2.57 billion as of 2022. The company has a return on equity of 16.57%. Bonny Worldwide Ltd is engaged in the business of providing offshore oil and gas services. The company has a fleet of offshore support vessels that it uses to provide services to the oil and gas industry.

– Bollinger Industries Inc ($OTCPK:BOLL)

Bollinger Industries Inc is a publicly traded company with a market capitalization of 262.12k. The company manufactures and sells a variety of products, including electric vehicles, towing products, and other related accessories. Bollinger Industries was founded in 1984 and is headquartered in New York, New York.

Summary

YETI HOLDINGS‘ FY2023 Q1 results show an overall increase in revenue of 3.1%, however net income was a major setback, decreasing by 58.8%. Investors may be concerned by this decrease in profits, and should review the company’s strategies and performance to determine if they are confident in YETI HOLDINGS’ ability to turn a profit in future quarters. Analysts will also be watching for how the company can improve its market position and profitability going forward to determine the potential for YETI HOLDINGS’ stock to appreciate.

Recent Posts