YETI HOLDINGS Reports FY2022 Q4 Earnings Results for Quarter Ending December 31 2022.

March 6, 2023

Earnings report

YETI HOLDINGS ($BER:1YN) reported its FY2022 Q4 earnings results for the quarter ending December 31 2022 on February 23 2023. The company reported total revenue of USD -27.7 million for the quarter, which represented a decrease of 138.1% when compared to the same period the previous year. Furthermore, net income for the quarter was reported as USD 448.0 million, representing a 1.1% increase from the prior year.

This positive growth in net income is a reflection of YETI HOLDINGS’ ability to adjust to changing market conditions in order to remain profitable despite decreased revenue. The company is confident that its strategies will continue to improve results as it strives to reach its business objectives.

Market Price

The company opened at €38.6 and closed at €37.0, down by 1.0% from prior closing price of 37.3. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Yeti Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.6k | 89.69 | 5.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Yeti Holdings. More…

| Operations | Investing | Financing |

| 100.89 | -56.91 | -122.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Yeti Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 550.29 | 6.38 |

Key Ratios Snapshot

Some of the financial key ratios for Yeti Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.4% | 12.1% | 7.6% |

| FCF Margin | ROE | ROA |

| 2.8% | 14.0% | 7.0% |

Analysis

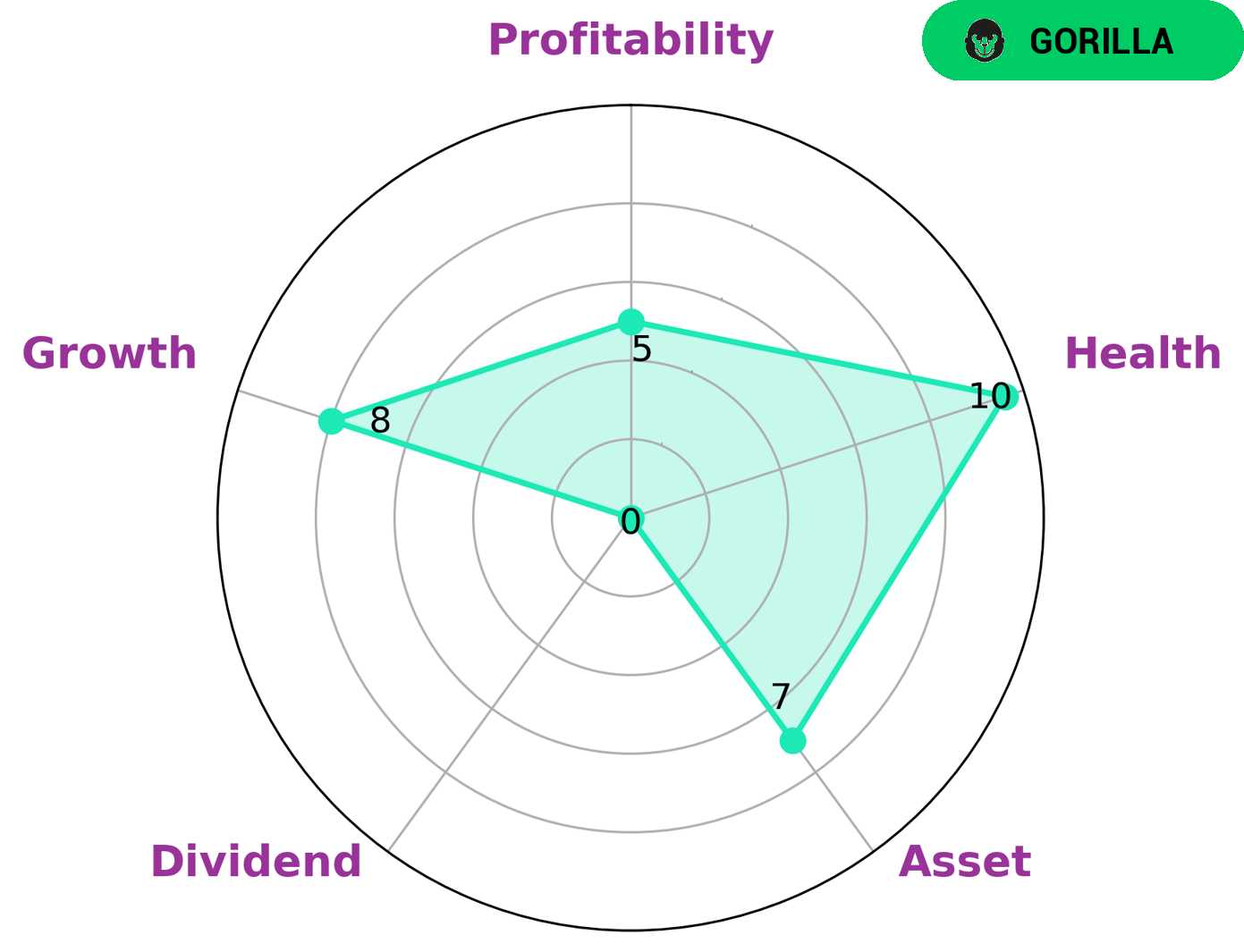

G o o d W h a l e h a s c o n d u c t e d a n a n a l y s i s o f Y E T I H O L D I N G S ‘ s f u n d a m e n t a l s , a n d t h e S t a r C h a r t h a s c l a s s i f i e d Y E T I H O L D I N G S a s a ‘ g o r i l l a ‘ , m e a n i n g i t h a s a c h i e v e d s t a b l e a n d h i g h r e v e n u e o r e a r n i n g g r o w t h d u e t o i t s s t r o n g c o m p e t i t i v e a d v a n t a g e . M o r e o v e r , Y E T I H O L D I N G S i s s t r o n g i n a s s e t s , g r o w t h a n d m e d i u m i n p r o f i t a b i l i t y , w h i l e b e i n g w e a k i n d i v i d e n d . T h i s d e m o n s t r a t e s t h a t t h e c o m p a n y i s f o c u s e d o n g r o w i n g i t s a s s e t s r a t h e r t h a n m a x i m i z i n g i t s d i v i d e n d p a y o u t s. More…

Summary

Total revenue was reported at USD -27.7 million, a 138.1% decrease from the same period a year prior. Net income, however, increased 1.1% to USD 448.0 million. This suggests that YETI experienced a decrease in revenue, but managed to keep expenses low in order to generate a higher net income. Investing in YETI may be a good opportunity for those investors looking for a stock with potential for growth and cost control.

Recent Posts