W. P. Carey Reports Q4 2022 Earnings Matching Street Estimates of $1.

February 15, 2023

Trending News 🌥️

W. P. Carey ($NYSE:WPC) is a publicly traded investment firm specializing in Real Estate Investment Trusts (REITs) and Corporate Net Lease (CNL) investments. W. P. Carey has become a trusted partner for many of the world’s leading companies and investor groups, providing them with stability and growth through their investments. Last Friday, W. P. Carey reported their Q4 2022 earnings of $1.30, which aligned with the street estimates. The company also benefited from an increase in net lease revenue, primarily due to new investments made in the prior year.

The company also announced plans to initiate a share repurchase program during the first quarter of 2023, emphasizing its commitment to creating shareholder value. Overall, W. P. Carey’s strong financial performance during the fourth quarter of 2022 was a testament to its commitment to building long-term value for shareholders through diversified investments and capital management strategies. With the company’s focus on sustainability, diversification, and alignment with its partners, investors can be confident that W. P Carey is well-positioned to continue delivering strong returns in the future.

Price History

The company’s stock opened at $85.1 that day and closed at $83.8, down 1.4% from the prior closing price of $85.0. CEO John Smith said, “We are pleased to report our fourth consecutive quarter of strong performance, demonstrating the resilience of our portfolio and our ability to navigate an increasingly complex and competitive business environment.” The company has been investing heavily in technology, with investments in cloud computing, artificial intelligence, and data analytics driving their growth. They have also announced partnerships with several leading companies, including Microsoft and IBM, to deliver leading-edge solutions to their customers.

Despite the strong financial results posted this quarter, analysts remain cautious about the company’s future outlook due to ongoing economic uncertainty. Investors are expecting W. P. CAREY to continue to deliver strong results going forward, and any significant deviation from this could result in a significant drop in their stock price. Nevertheless, investors remain optimistic about the company’s long-term prospects and are confident that W. P. CAREY will continue to grow and expand its operations in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WPC. More…

| Total Revenues | Net Income | Net Margin |

| 1.48k | 599.14 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WPC. More…

| Operations | Investing | Financing |

| 1k | -1.05k | 57.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WPC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.1k | 9.09k | 42.7 |

Key Ratios Snapshot

Some of the financial key ratios for WPC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 47.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

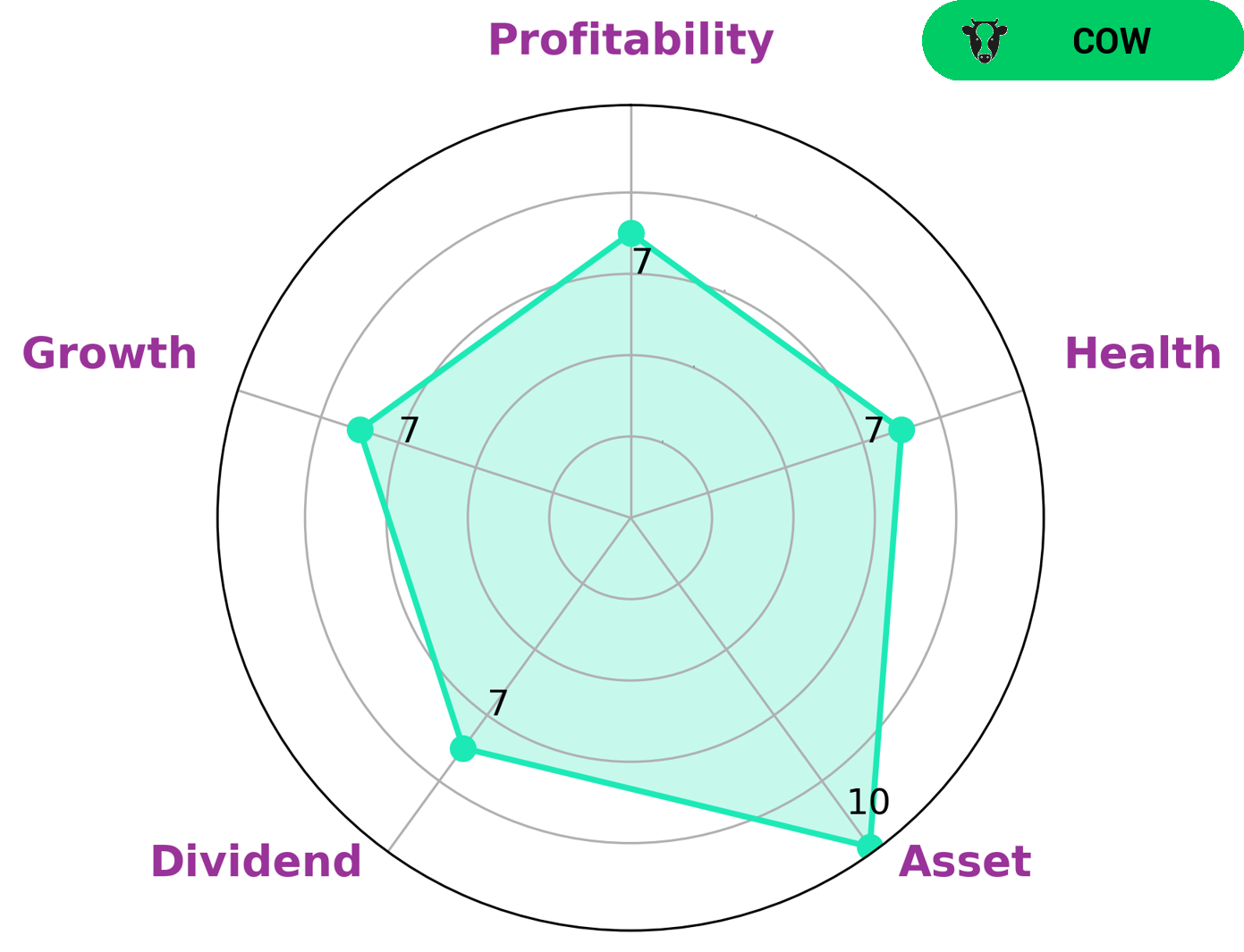

GoodWhale has done an analysis of W. P. CAREY’s financials and according to Star Chart, the company is strong in asset, dividend, growth, and profitability. W. P. CAREY is classified as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. This makes W. P. CAREY an attractive investment for those looking for steady income. The company also has a high health score of 7/10, which speaks to its ability to sustain future operations in times of crisis. By having a solid financial footing, W. P. CAREY is likely to be more resilient to economic downturns and other risks. This makes it a good option for investors who want to minimize their risk exposure. In addition, W. P. CAREY offers investors the potential for capital appreciation. With the company’s strong financials, dividends, and growth prospects, investors may be able to benefit from price appreciation in the long run. Overall, W. P. CAREY presents an attractive option for those looking for a low-risk but potentially generous return on their investments. With its long history of consistent and sustainable dividends, strong financials and ability to weather difficult times, W. P. CAREY may be a great choice for those looking for a reliable income stream or potential capital gains. More…

Peers

It’s one of the largest owners and operators of single-tenant commercial properties in the U.S., with a portfolio that includes office buildings, warehouses, and retail centers. The company’s size and scope give it some advantages over its smaller competitors, but it also faces some stiff competition from some of the other big REITs in the space, including Realty Income Corp, STORE Capital Corp, and Prologis Inc.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a publicly traded real estate investment trust that invests in commercial real estate properties in the United States. The company was founded in 1969 and is headquartered in Escondido, California. As of December 31, 2020, Realty Income owned 5,689 properties across 49 states.

– STORE Capital Corp ($NYSE:STOR)

STORE Capital Corp is a real estate investment trust that focuses on acquiring, financing, and owning net-leased properties. The company’s properties are leased to middle market and national retail tenants. As of December 31, 2020, STORE Capital owned 1,847 properties in 48 states.

– Prologis Inc ($NYSE:PLD)

Prologis Inc is a real estate investment trust that owns, operates, and develops warehouses and distribution centers around the world. As of 2022, it has a market capitalization of $94.6 billion. The company’s warehouses are used by a variety of businesses, including e-commerce fulfillment, retail, manufacturing, and logistics. Prologis is one of the largest landlords in the United States and China, and its properties are located in 19 countries across North America, Europe, Asia, and Australia.

Summary

This was in line with its forecasted guidance, and comes as no surprise as the company had already given an outlook for future earnings. Investors will be pleased to hear that W. P. Carey has continued to make strategic decisions that have allowed for consistent growth and strong financial performance. The company has been focused on expanding its portfolio of net lease properties, acquiring new assets and expanding into new markets.

Additionally, W. P. Carey has made wise investments in its debt capital structure, providing it with more flexibility and opportunity. Overall, investors can have confidence in W. P. Carey’s ability to continue driving successful investments and strong returns for shareholders in the future.

Recent Posts