Vmware Stock Intrinsic Value – VMWARE Reports Second Quarter Earnings Results for FY2024

September 5, 2023

🌥️Earnings Overview

VMWARE ($NYSE:VMW) reported total revenue of USD 3408.0 million for the second quarter of FY2024, ending August 31 2023 – a 2.2% increase from the same period last year. Net income for the quarter also rose 37.5% year over year, amounting to USD 477.0 million. The results were announced on July 31 2023.

Price History

VMWARE reported their second quarter earnings results for the fiscal year 2024 on Thursday. The stock opened at $166.5 and closed at $168.8, up by 1.3% from the previous closing price of 166.7. This marks an impressive growth for the company, which is indicative of the solid performances of their products and services in the market.

VMWARE’s strong financial performance in the second quarter of FY2024 highlights the company’s commitment to creating value for its shareholders. With a strong focus on innovation and cost-saving measures, the company is poised to continue to experience growth and success in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vmware. More…

| Total Revenues | Net Income | Net Margin |

| 13.61k | 1.43k | 9.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vmware. More…

| Operations | Investing | Financing |

| 5.09k | -446 | -1.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vmware. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 32.2k | 29.65k | 5.92 |

Key Ratios Snapshot

Some of the financial key ratios for Vmware are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.3% | 4.7% | 15.9% |

| FCF Margin | ROE | ROA |

| 34.3% | 61.3% | 4.2% |

Analysis – Vmware Stock Intrinsic Value

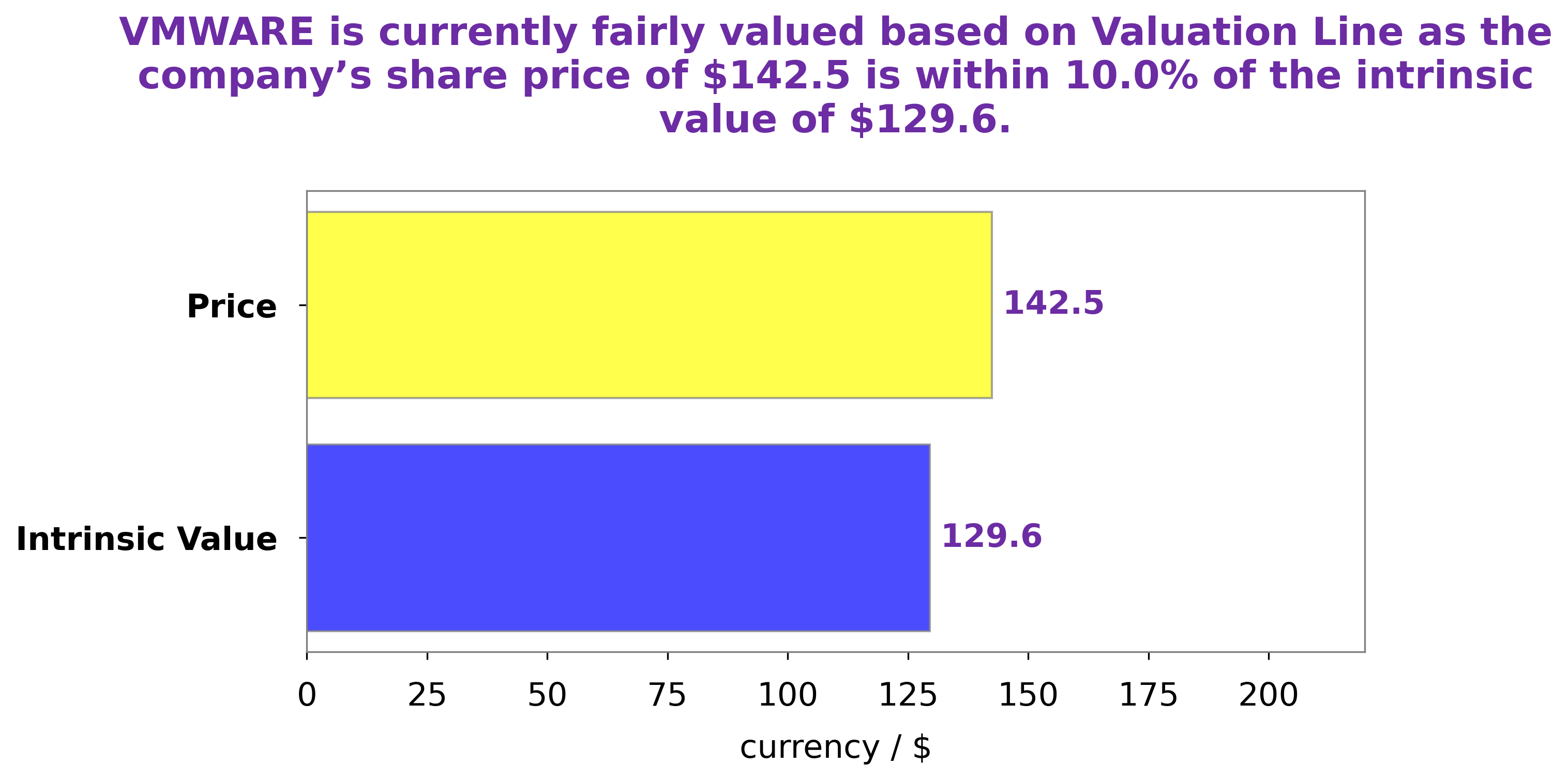

At GoodWhale, we analyze the financials of VMWARE with our proprietary metrics. Our Valuation Line gave us an intrinsic value of VMWARE share at around $127.7. Comparing to the current market price of $168.8, we can see the stock is currently overvalued by 32.2%. We believe investors should tread carefully with VMWARE and watch out for signs of a potential correction. More…

Peers

VMware Inc is a leading provider of virtualization and cloud infrastructure solutions. Its competitors include GSS Infotech Ltd, Venzee Technologies Inc, ProStar Holdings Inc.

– GSS Infotech Ltd ($BSE:532951)

GSS Infotech Ltd. is a global provider of software and IT services. The company offers a range of services, including application development, enterprise resource planning, and infrastructure management. It also provides software solutions for the banking, financial services, and insurance industries. GSS Infotech has a market cap of 4.49 billion as of 2021 and a return on equity of 12.46%. The company was founded in 1997 and is headquartered in Hyderabad, India.

– Venzee Technologies Inc ($TSXV:VENZ)

Assuming you are writing as of 2022:

Venzee Technologies Inc has a market cap of 2.47M as of 2022. The company’s return on equity is 1422.25%. Venzee Technologies is a software company that provides a platform to streamline the exchange of product data between retailers and brands.

– ProStar Holdings Inc ($TSXV:MAPS)

ProStar Holdings Inc is a provider of geospatial data and related services for the energy industry. The company’s market cap is $22.79 million and its ROE is -67.74%. ProStar’s geospatial data and services are used by oil and gas companies, government agencies, and other organizations involved in the exploration, production, and transportation of energy.

Summary

VMWARE‘s second quarter of FY2024 showed positive results, with total revenue increasing by 2.2% year-over-year to USD 3408.0 million, and net income increasing by 37.5% to USD 477.0 million. Investors are encouraged by these positive indicators, indicating that VMWARE continues to deliver strong financial performance despite challenging market conditions. VMWARE remains an attractive investment opportunity in the tech sector, with consistent revenue growth and increasing profitability.

Recent Posts