VERA BRADLEY Announces Q2 FY2024 Earnings Results for July 31 2023

September 1, 2023

🌥️Earnings Overview

VERA BRADLEY ($NASDAQ:VRA) reported their earnings results for the second quarter of FY2024 on July 31 2023, with total revenue amounting to USD 128.2 million, a decline of 1.7% compared to the same quarter one year prior. Net income, however, saw a 131.1% increase year over year, reaching USD 9.2 million.

Price History

In response to the news, the company’s stock opened at $7.0 and closed the day at $7.0, up by 2.8% from its previous closing price of $6.9. The company also announced plans to invest heavily in the growth of their direct-to-consumer business, which will include expanding their product range and investing in their e-commerce platform. The move is expected to help further drive sales and boost the company’s overall performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vera Bradley. More…

| Total Revenues | Net Income | Net Margin |

| 493.67 | -18.42 | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vera Bradley. More…

| Operations | Investing | Financing |

| 29.67 | -15.57 | -3.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vera Bradley. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 391.5 | 134.98 | 8.3 |

Key Ratios Snapshot

Some of the financial key ratios for Vera Bradley are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -30.5% | -7.6% |

| FCF Margin | ROE | ROA |

| 4.9% | -9.3% | -6.0% |

Analysis

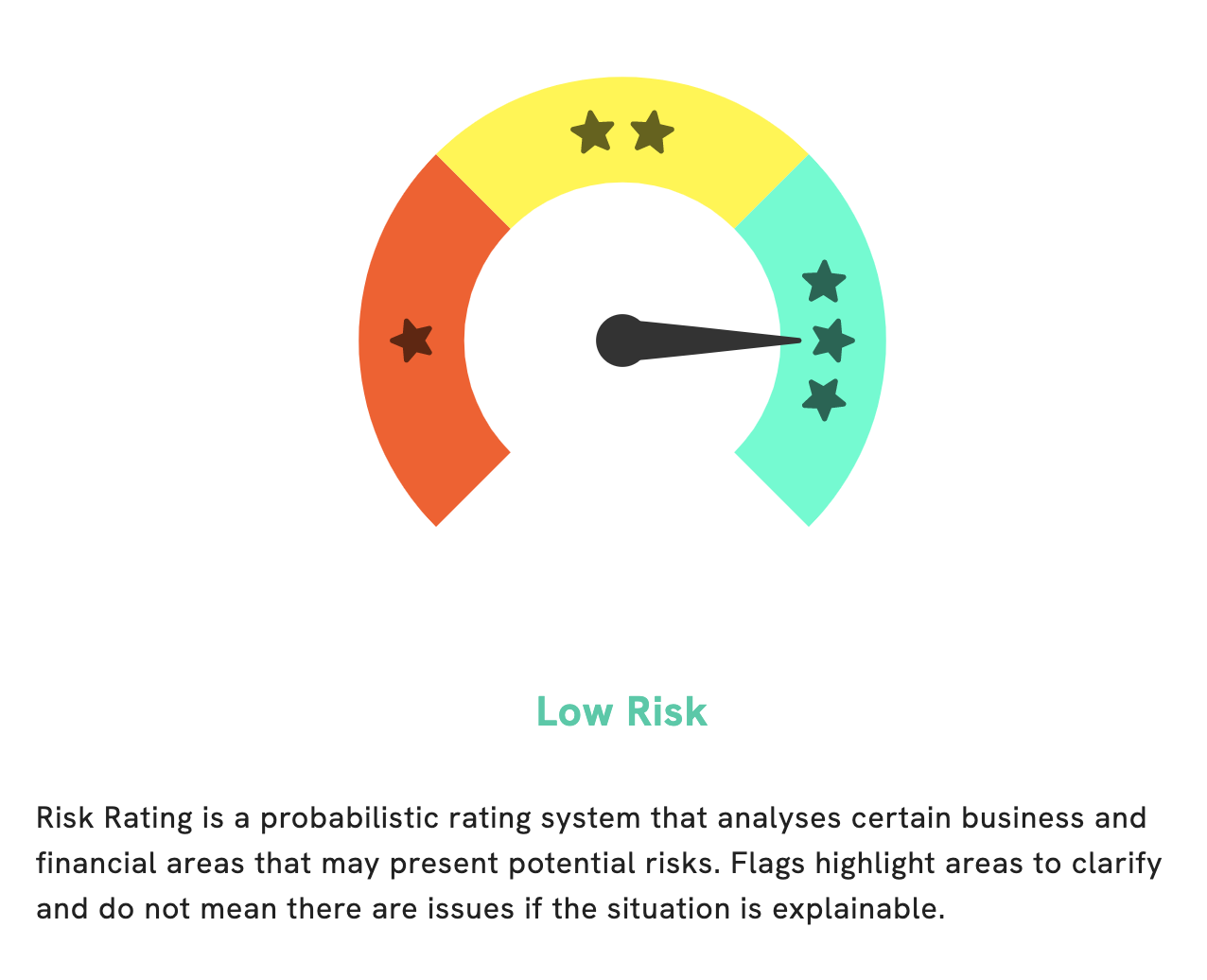

At GoodWhale, we are proud to provide an in-depth analysis of VERA BRADLEY’s financials. After thorough evaluation, we have determined that VERA BRADLEY is a low risk investment. This is based on our proprietary Risk Rating system which considers both financial and business aspects. However, GoodWhale has detected one risk warning in VERA BRADLEY’s balance sheet. We encourage you to register with us to learn more about this warning and to determine if it is something to be concerned about. Our team of experts is here to help answer any questions you may have. More…

Peers

The competition between Vera Bradley Inc and its competitors, Puma SE, Deckers Outdoor Corp, and C Banner International Holdings Ltd, is fierce. All four companies are vying for a share of the global market in the fashion and accessories industry, offering unique products and designs that appeal to different consumer segments. Despite the intense competition, Vera Bradley Inc has managed to stand out and become one of the leading players in the industry.

– Puma SE ($LTS:0NQE)

Puma SE is a leading sports apparel and lifestyle brand that designs and manufactures products for professional athletes and everyday consumers. The company has a market cap of 8.14B as of 2022, reflecting the strong financial performance of the company. Puma SE also has an impressive Return on Equity (ROE) of 17.11%, demonstrating the company’s ability to generate profit from its investments. This indicates that the company is making effective use of its resources, and has strong prospects for future growth. With its strong financial performance, Puma SE is well-positioned to continue its success in the global market.

– Deckers Outdoor Corp ($NYSE:DECK)

Deckers Outdoor Corp is a global leader in designing and marketing lifestyle footwear, apparel, and accessories. Founded in 1973, Deckers Outdoor is headquartered in Goleta, California and has achieved a market cap of 10.35 billion as of 2022. Additionally, the company has a Return on Equity of 23.76% which reflects the company’s financial health and ability to generate profits from its shareholders’ investments. Deckers Outdoor Corp has become a leading designer and marketer of lifestyle footwear, apparel, and accessories for both men and women. The company has established a strong presence in the U.S. and International markets and is poised for continued growth.

– C Banner International Holdings Ltd ($SEHK:01028)

Banner International Holdings Ltd is a Hong Kong-based investment holding company that operates in the property and hotel industry. The company’s market cap of 386.32M as of 2022 reflects the impressive financial performance and growth potential it has demonstrated in recent years. Banner International Holdings Ltd has also demonstrated strong Return on Equity (ROE) of 0.93%, indicating that the company is using its assets and equity efficiently to generate profits and returns for its shareholders.

Summary

Investors in VERA BRADLEY saw mixed results during the company’s second quarter of FY2024. Revenue for the period was USD 128.2 million, a decrease of 1.7% compared to the same quarter of the previous year.

However, net income rose significantly, by 131.1%, to USD 9.2 million. Despite the decrease in revenue, investors may still find VERA BRADLEY to be a strong investment opportunity, as its net income growth has been impressive. It is important for investors to stay up to date on the company’s financial performance and any potential changes that may affect its long-term prospects.

Recent Posts