TUSIMPLE HOLDINGS Reports FY2023 Q2 Earnings Results for Period Ending June 30 2023

September 29, 2023

🌥️Earnings Overview

On September 27 2023, TUSIMPLE HOLDINGS ($NASDAQ:TSP) announced their fiscal year 2023 second quarter earnings results for the period ending June 30 2023. Total revenue for the quarter was USD 0.1 million, a 96.5% dip compared to the same period in the previous year. Net income for the quarter fell to USD -78.0 million, a decrease from the -108.6 million recorded in the same quarter last year.

Stock Price

The stock opened at $1.5 and closed at $1.5, demonstrating a 4.8% increase from its closing price of $1.4 the previous day. As a result of the report and stock performance, TUSIMPLE HOLDINGS gained attention from investors and analysts alike. This was largely due to increased market penetration in the autonomous vehicle and artificial intelligence space.

Overall, the company’s performance was encouraging for investors, as TUSIMPLE HOLDINGS continues to be a leader in autonomous vehicle technology and artificial intelligence. The company is well-positioned to continue to grow and capitalize on the opportunities that the autonomous vehicle industry has to offer in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tusimple Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 4.82 | -410.8 | -8526.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tusimple Holdings. More…

| Operations | Investing | Financing |

| -311.03 | -528.28 | -1.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tusimple Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 909.62 | 89.48 | 3.59 |

Key Ratios Snapshot

Some of the financial key ratios for Tusimple Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 136.3% | – | -9218.2% |

| FCF Margin | ROE | ROA |

| -6656.4% | -32.4% | -30.5% |

Analysis

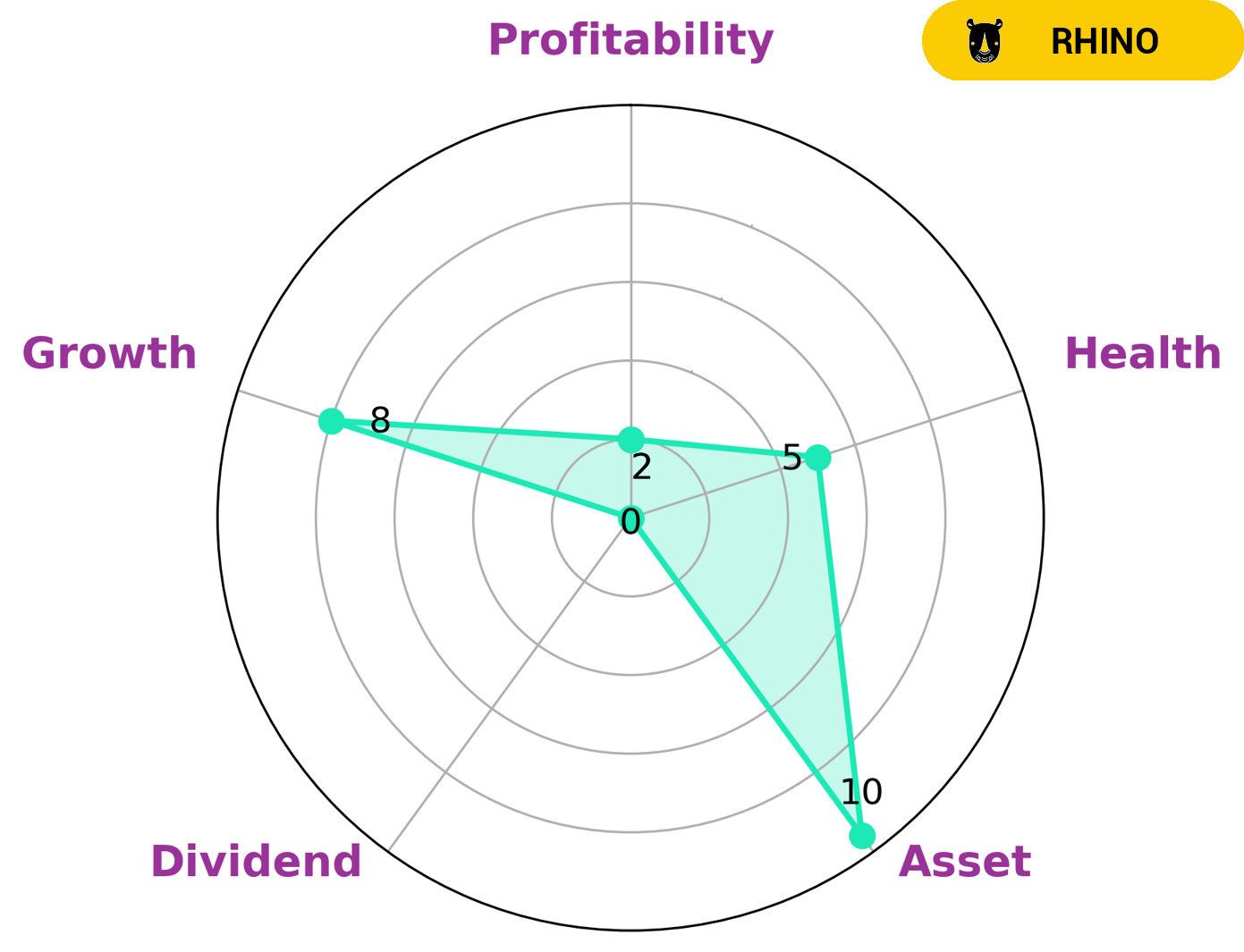

At GoodWhale, we performed an analysis of TUSIMPLE HOLDINGS‘s financials and classified them as ‘rhino’ based on our Star Chart. This implies that the company has achieved moderate revenue or earnings growth. As such, there may be a variety of investors interested in such a company. TUSIMPLE HOLDINGS has an intermediate health score of 5/10, indicating that it may be able to pay off debt and fund future operations. When looking at the other metrics, it is evident that the company is strong in assets and growth, but weak in dividend and profitability. This highlights the need for investors to be aware of the potential risks associated with investing in such a company. More…

Peers

The competition between TuSimple Holdings Inc and its competitors is fierce. Each company is vying for a share of the market and the prize money that comes with it. Nikola is a leading company in the electric vehicle market, while ANE (Cayman) Inc is a leading company in the autonomous navigation market.

– Embraer SA ($NYSE:ERJ)

Embraer SA is a Brazilian aerospace conglomerate that produces commercial, military, and executive aircraft and provides aviation services. As of 2022, it has a market capitalization of 1.93 billion dollars and a return on equity of 4.38%. The company’s products include the Legacy 600 and 650, Phenom 100 and 300, and the Lineage 1000. It also provides services such as aircraft maintenance, pilot training, and engineering support.

– Nikola Corp ($NASDAQ:NKLA)

Nikola Corporation is an American electric vehicle and clean energy company founded in 2015. It is headquartered in Phoenix, Arizona. The company designs and manufactures zero-emission vehicles, vehicle components, energy storage systems, and electric vehicle drivetrains. It also develops electric vehicle infrastructure solutions. Nikola Corporation’s market cap is 1.37B as of 2022. The company has a Return on Equity of -76.12%.

– ANE (Cayman) Inc ($SEHK:09956)

Cayman Islands-based CAYMAN (Cayman) Inc is a holding company that, through its subsidiaries, provides investment management and advisory services. The company has a market cap of 2.46B as of 2022 and a return on equity of 16.69%. CAYMAN (Cayman) Inc’s subsidiaries include Cayman Management Ltd, a registered investment advisor; and Cayman Insurance Ltd, a captive insurance company.

Summary

TUSIMPLE HOLDINGS reported poor Q2 earnings results for the period ending June 30 2023. Total revenue for the quarter was significantly lower than the previous year, and net income was -78.0 million versus -108.6 million a year prior. Despite the dismal results, investor sentiment was positive with the stock price rising on the release of the earnings report.

Analysts believe this could be due to optimism regarding the company’s long-term outlook and potential for future growth. Ultimately, investors should take a closer look at TUSIMPLE HOLDINGS’ overall performance before making any investment decisions.

Recent Posts