Transaction Stock Fair Value – TRANSACTION Reports Positive Q2 FY2023 Earnings Results on April 14 2023

April 19, 2023

Earnings Overview

On April 14 2023, TRANSACTION ($TSE:7818) reported their financial results for the second quarter of FY2023 which ended on February 28 2023. Total revenue had risen by 34.2% year-on-year to JPY 740.9 million, while net income increased by 17.7%, amounting to JPY 5308.6 million.

Market Price

On April 14, 2023, TRANSACTION reported positive results for its second quarter of FY2023. On the same day, the company’s stock opened at JP¥1595.0 and closed at JP¥1541.0, down by 4.0% from last closing price of 1605.0. The positive earnings results came as a surprise to many analysts, as TRANSACTION had recorded losses in the previous quarter.

However, the company managed to turn things around and report healthy profits this quarter. These positive results have been attributed to the company’s cost-cutting efforts, as well as its focus on innovation and new business opportunities.

In addition, it has leveraged new technologies and digital capabilities to improve its efficiency and effectiveness. As a result of these efforts, TRANSACTION has achieved a higher level of competitiveness in the market. Overall, the company has managed to successfully report positive earnings results in the second quarter of FY2023, providing a much needed boost of confidence to its shareholders and investors. Going forward, TRANSACTION looks set to maintain its strong performance and continue its positive momentum. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transaction. More…

| Total Revenues | Net Income | Net Margin |

| 20.58k | 2.68k | 13.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transaction. More…

| Operations | Investing | Financing |

| 1.07k | -1.4k | -481.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transaction. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.87k | 3.81k | 483.23 |

Key Ratios Snapshot

Some of the financial key ratios for Transaction are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.1% | 22.6% | 19.7% |

| FCF Margin | ROE | ROA |

| 4.5% | 18.5% | 14.2% |

Analysis – Transaction Stock Fair Value

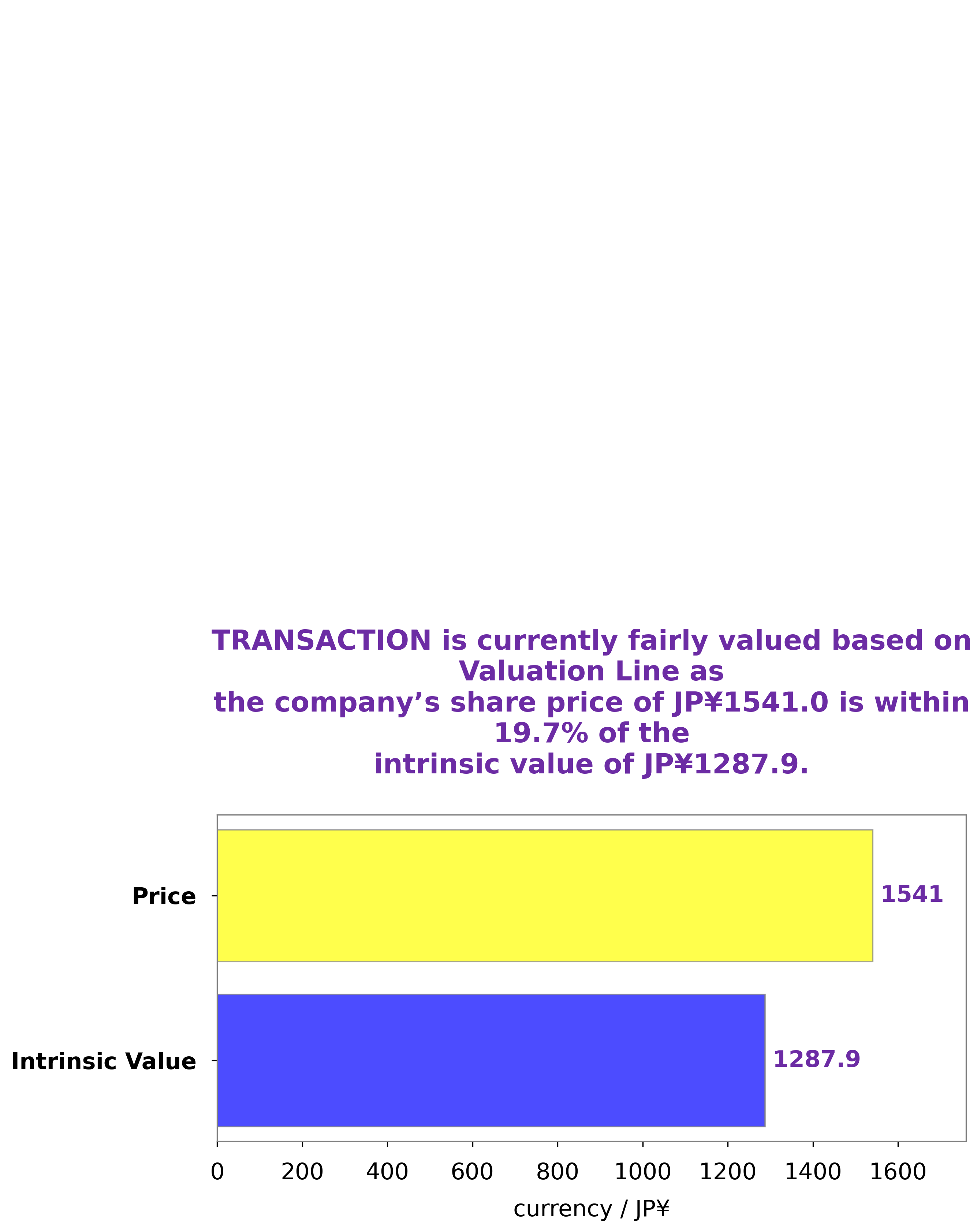

At GoodWhale, we have conducted a financial analysis of TRANSACTION to determine its intrinsic value. Our proprietary Valuation Line has calculated the intrinsic value of TRANSACTION share to be approximately JP¥1287.9. We find that the current stock price of JP¥1541.0 is fair, but it is overvalued by 19.7%. In other words, investors can expect returns from TRANSACTION stock to be slightly lower than the market rate. More…

Peers

The competition between TRANSACTION Co Ltd and its competitors is fierce and ongoing. Four notable competitors include Fayenceries de Sarreguemines, Chongqing Baiya Sanitary Products Co Ltd, and Seihyo Co Ltd, all of whom are vying for the top spot in the industry. While each of these companies have their own unique strategies and offerings, TRANSACTION Co Ltd is determined to come out on top.

– Fayenceries de Sarreguemines ($LTS:0NAE)

Fayenceries de Sarreguemines is a French manufacturer of ceramic tableware and decorative objects. The company has a market cap of 4.41 million as of 2023, which indicates that it is a small to mid-sized enterprise. The company has experienced steady growth since its inception in 1797, and today produces a wide range of ceramic products for both domestic and international markets. It is known for its quality craftsmanship, having produced several iconic pieces such as the green-and-white striped majolica plates, which are especially popular in France. The company also works with renowned designers to create unique pieces for the modern home.

– Chongqing Baiya Sanitary Products Co Ltd ($SZSE:003006)

Chongqing Baiya Sanitary Products Co Ltd is a Chinese manufacturer and distributor of hygiene and sanitation products. The company has a market cap of 6.57 billion, as of 2023, making it one of the largest and most successful companies in this sector. It also has a Return on Equity (ROE) of 10.18%, indicating that the company is generating significant profits from its shareholders’ investments. With its innovative products, wide distribution network and strong financial performance, Chongqing Baiya Sanitary Products Co Ltd is well-positioned to continue to grow and expand its market share.

– Seihyo Co Ltd ($TSE:2872)

Seihyo Co Ltd is a Japanese company that specializes in the manufacture of energy efficient lighting and other electrical products. The company has a market capitalization of 5.97 billion as of 2023, which makes it one of the largest companies in the industry. Additionally, Seihyo Co Ltd has a Return on Equity of 0.18%. This indicates that the company is able to generate profit efficiently, which is indicative of strong management and financial stability.

Summary

Investors in TRANSACTION were likely disappointed when the company reported its earnings results for the second quarter of FY2023 on April 14 2023. Total revenue was JPY 740.9 million, a 34.2% increase from the same period a year prior, and net income rose 17.7% to JPY 5308.6 million.

However, despite these encouraging figures, the stock price dropped on the same day. Analysts suggest that investors were expecting greater growth, which could indicate that TRANSACTION may be facing challenges in the near future. It remains to be seen whether the company can turn the situation around, but investors should do their due diligence before investing in TRANSACTION.

Recent Posts