TME Intrinsic Stock Value – TENCENT MUSIC ENTERTAINMENT Reports Positive Financial Results for Q1 of FY2023.

May 23, 2023

Earnings Overview

On May 16 2023, TENCENT MUSIC ENTERTAINMENT ($NYSE:TME) reported their financial results for the first quarter of FY2023, ending March 31 2023. The total revenue was CNY 7004.0 million, showing an increase of 5.4% from the same period of the previous year. Moreover, net income rose 88.5% to CNY 1148.0 million.

Market Price

Despite the stock price dip, TENCENT MUSIC ENTERTAINMENT reported a positive overall performance, with significant growth in revenue, net income, and earnings per share. This quarter also marked the first quarter in which TENCENT MUSIC ENTERTAINMENT has reported positive earnings per share. TENCENT MUSIC ENTERTAINMENT attributes this positive performance to strong growth in its music streaming services and subscription services across its various platforms.

Additionally, the company has seen increased engagement across its core areas, with customers spending more time on the platform and engaging with more content than ever before. TENCENT MUSIC ENTERTAINMENT is confident that this quarter’s performance marks a positive sign for the company’s future growth and profitability. They believe that their focus on developing innovative products and services will continue to drive growth in revenue and profitability in the coming quarters of fiscal year 2023. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TME. More…

| Total Revenues | Net Income | Net Margin |

| 28.7k | 4.22k | 14.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TME. More…

| Operations | Investing | Financing |

| 6.84k | -306 | -3.1k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TME. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 69.11k | 17.05k | 29.71 |

Key Ratios Snapshot

Some of the financial key ratios for TME are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.3% | 1.8% | 17.8% |

| FCF Margin | ROE | ROA |

| 20.2% | 6.5% | 4.6% |

Analysis – TME Intrinsic Stock Value

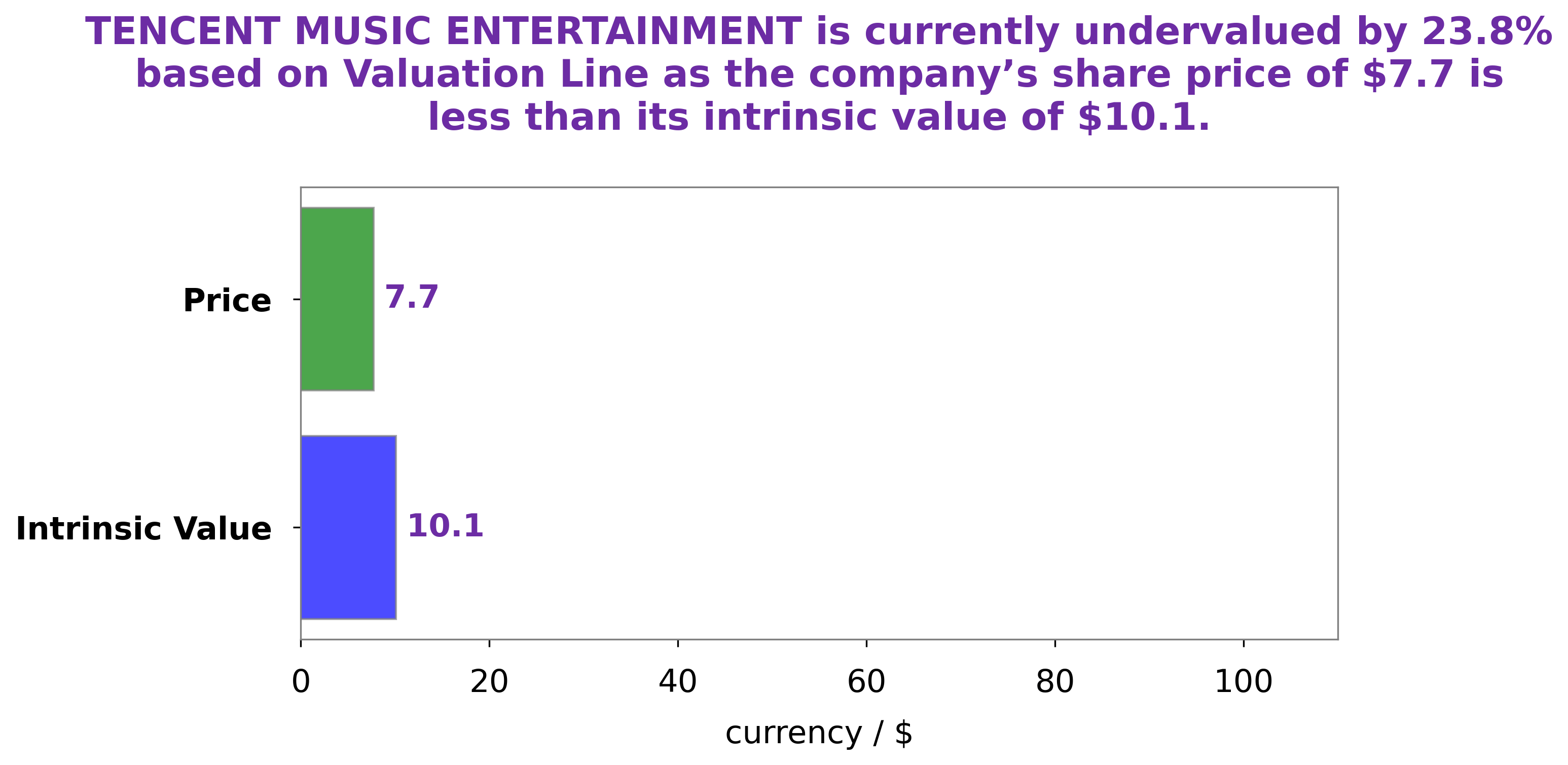

At GoodWhale, we have been investigating the fundamentals of TENCENT MUSIC ENTERTAINMENT to provide an analysis for our clients. After an in-depth review of the company’s financials, we have determined that the intrinsic value of TENCENT MUSIC ENTERTAINMENT shares is around $10.1, as calculated by our proprietary Valuation Line. Currently, however, TENCENT MUSIC ENTERTAINMENT shares are being traded at $7.7 – a 23.6% discount to the intrinsic value. This means that the stock is currently undervalued and presents an opportunity for investors. More…

Summary

Tencent Music Entertainment reported strong first quarter financial results for FY2023, with total revenue increasing 5.4% year-on-year and net income climbing 88.5%. Despite this, the company’s stock price fell on the same day, indicating investor skepticism about the sustainability of its impressive performance. Analysts suggest that investors should consider Tencent Music Entertainment’s diversified product portfolio, strong promotional capabilities and relationships with other platforms to evaluate the company’s long-term potential. They should also take into account the industry’s competitive landscape and potential regulatory changes that may affect Tencent Music Entertainment’s future prospects.

Recent Posts