Ternium S.a Intrinsic Stock Value – Ternium S.A. to Reveal Earnings Results on April 25th

April 20, 2023

Trending News 🌥️

This announcement follows the close of trading on the New York Stock Exchange (NYSE), where Ternium ($NYSE:TX) holds a listing. Ternium is an integrated steel producer with operations in Argentina, Brazil, Colombia and Mexico. The company produces a wide range of steel solutions for a variety of applications, including automotive and construction uses.

It also operates metallurgical coal mines and iron ore mining operations. Investors will be eager to see how the company has performed in the first quarter, and what the outlook is for the rest of the year.

Stock Price

The stock opened at $42.9, but closed at $41.8, a decrease of 3.2% from its previous closing price of 43.2. This is the fourth consecutive day that the stock has been in the red and the third consecutive day of losses for the company. Investors will be closely watching to see if the company is able to turn its fortunes around. The company’s earnings report will provide investors with a better perspective on its financial performance and may help the stock to rebound in the coming days. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ternium S.a. More…

| Total Revenues | Net Income | Net Margin |

| 16.41k | 1.77k | 11.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ternium S.a. More…

| Operations | Investing | Financing |

| 2.75k | -1.32k | -1.02k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ternium S.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.49k | 3.72k | 60.34 |

Key Ratios Snapshot

Some of the financial key ratios for Ternium S.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.2% | 47.9% | 16.5% |

| FCF Margin | ROE | ROA |

| 13.2% | 14.3% | 9.7% |

Analysis – Ternium S.a Intrinsic Stock Value

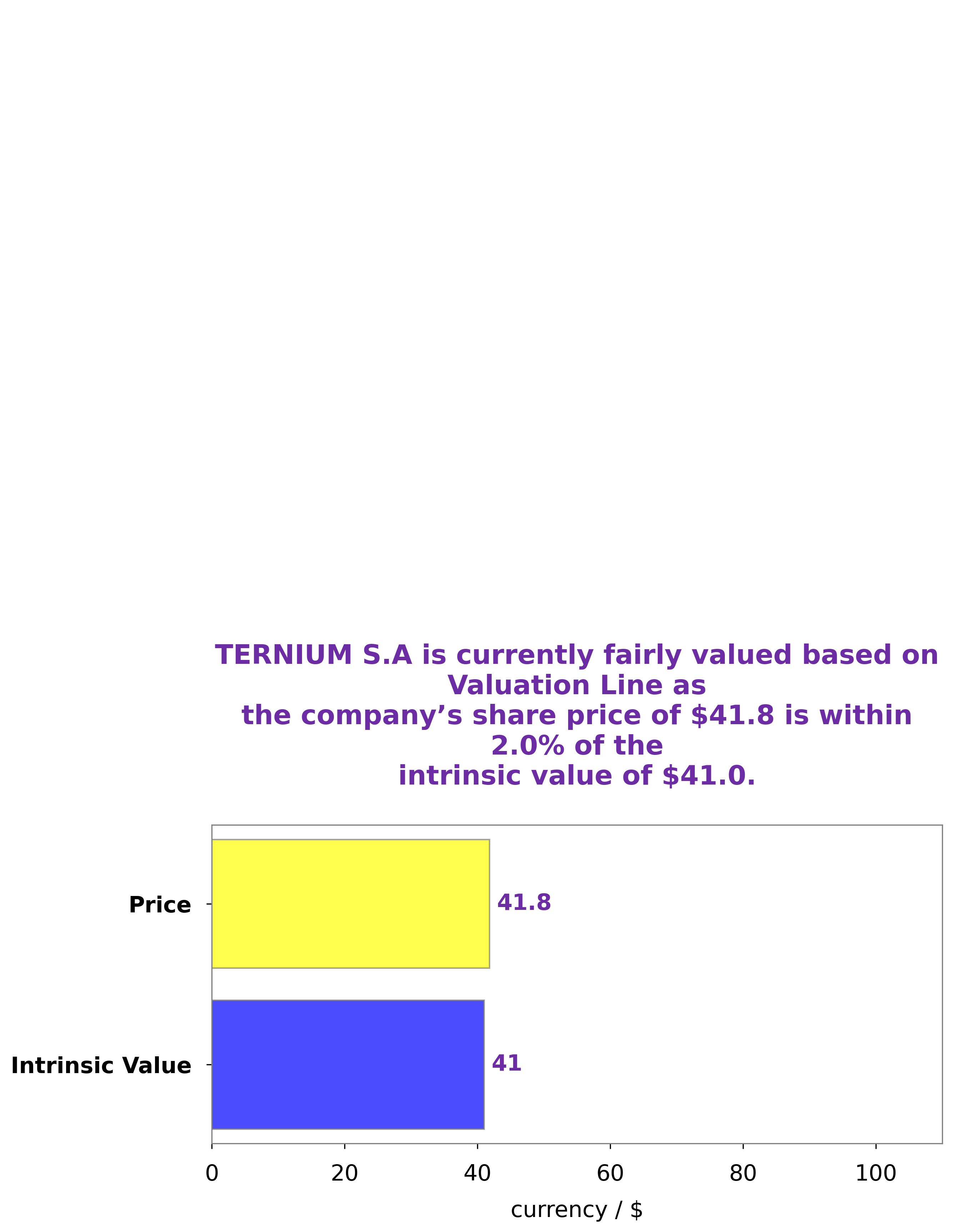

At GoodWhale, we recently conducted an analysis of the financials of TERNIUM S.A. and our proprietary Valuation Line determined that the intrinsic value of the share is around $41.0. Currently, the stock is traded at $41.8, making it just 1.9% overvalued. This indicates that TERNIUM S.A. is fairly priced at the moment. More…

Peers

In recent years, the Chinese steel industry has been undergoing a period of intense competition, with a number of major players vying for market share. Among them, Ternium SA has emerged as a key competitor, particularly in the production of high-quality steel products. The company has invested heavily in research and development in order to maintain its position as a leading player in the industry, and this has paid off in terms of both market share and profitability. While Ternium faces stiff competition from a number of other major Chinese steel producers, it is well-positioned to continue its growth in the years ahead.

– Lingyuan Iron & Steel Co Ltd ($SHSE:600231)

Lingyuan Iron & Steel Co Ltd is a Chinese steel producer with a market cap of $5.88B as of 2022. The company has a Return on Equity of -2.8%. Lingyuan Iron & Steel Co Ltd produces a variety of steel products including pipes, plates, and coils. The company has over 3,500 employees and operates in China, Europe, and the United States.

– Daehan Steel Co Ltd ($KOSE:084010)

Daehan Steel Co Ltd is a South Korean steel manufacturer. The company has a market cap of 232.09B as of 2022 and a Return on Equity of 28.52%. Daehan Steel Co Ltd is a leading manufacturer of steel products in South Korea. The company produces a wide range of steel products, including hot rolled coils, cold rolled coils, galvanized steel coils, and pre-painted steel coils.

– Xinjiang Ba Yi Iron & Steel Co Ltd ($SHSE:600581)

Xinjiang Ba Yi Iron & Steel Co Ltd is a Chinese steel company with a market cap of 5.72 billion as of 2022. The company has a Return on Equity of -24.16%. The company is involved in the production of iron and steel products.

Summary

Ternium S.A. is a major steel producer in Latin America and has recently announced their quarterly earnings results. Analysts are expecting a strong performance from the company due to higher global steel prices and increased demand for steel products. Investors should take note of Ternium’s stock price movement after the earnings announcement to get an indication of how the market is reacting to the results. The company’s earnings reports provide an insight into their financial health, which is important for long-term investors.

Moreover, investors need to consider Ternium’s capacity, economic conditions, and capital structure when making any investing decisions. It is also important to keep in mind that other factors such as political and macroeconomic conditions can affect Ternium’s stock price in the short term. Thus, investors should do their own research before investing in Ternium S.A.

Recent Posts