Teekay Tankers Intrinsic Stock Value – TEEKAY TANKERS Reports Financial Earnings Results for Q2 FY2023

August 14, 2023

🌥️Earnings Overview

On June 30 2023, TEEKAY TANKERS ($NYSE:TNK) released their financial earnings results for the second quarter of FY2023, revealing a 52.9% year-over-year increase in total revenue to USD 370.6 million. Net income came in at an impressive USD 151.2 million, a significant increase from the 28.6 million recorded in the same quarter of the previous year.

Share Price

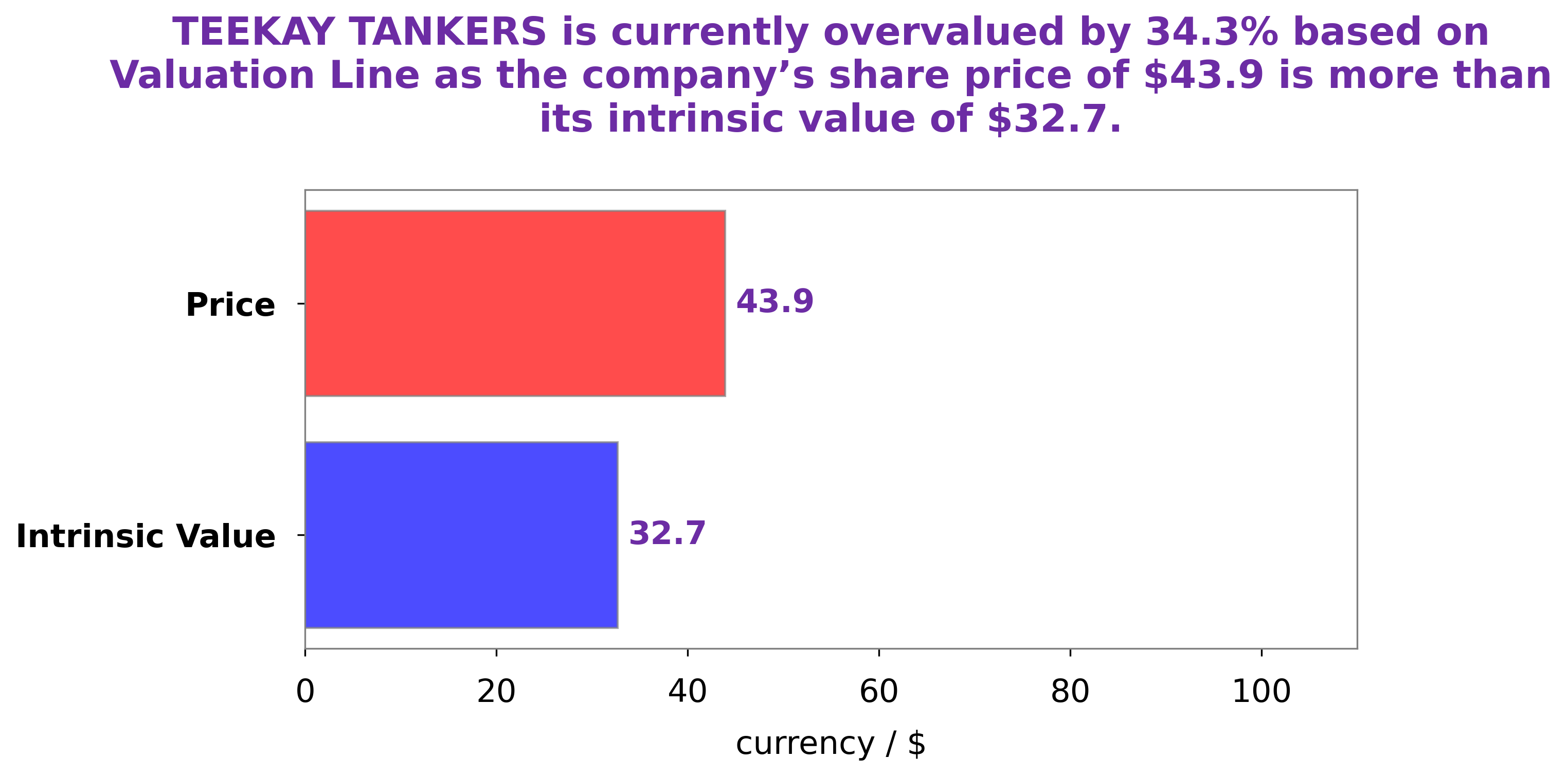

The stock opened at $44.5 and closed at $43.9, showing a slight decrease of 0.5% from the previous closing price of 44.1. These results show that despite rising operational costs, TEEKAY TANKERS is still able to remain profitable and is on the right track to continue growing as a company. Furthermore, the company’s share price has continued to remain steady, indicating that investors are confident in the company’s long-term prospects. Overall, this report bodes well for the future of the company and provides a good outlook for its share price going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Teekay Tankers. More…

| Total Revenues | Net Income | Net Margin |

| 1.41k | 535.09 | 37.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Teekay Tankers. More…

| Operations | Investing | Financing |

| 561.62 | 16.31 | -470.29 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Teekay Tankers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.78k | 431.03 | 39.67 |

Key Ratios Snapshot

Some of the financial key ratios for Teekay Tankers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.1% | 22.8% | 41.3% |

| FCF Margin | ROE | ROA |

| 39.0% | 28.2% | 20.5% |

Analysis – Teekay Tankers Intrinsic Stock Value

At GoodWhale, we have conducted an analysis of TEEKAY TANKERS‘ wellbeing. Our proprietary Valuation Line has calculated the fair value of the TEEKAY TANKERS share to be around $32.7. Currently, the stock is being traded at $43.9, which means that it is overvalued by 34.4%. We believe that investors should be aware of the overvaluation before making any decision. More…

Peers

The company operates a fleet of product and crude tankers, providing seaborne transportation of crude oil and refined petroleum products under long-term, medium-term, and spot-market contracts with major oil companies, national oil companies, and other independent oil companies and traders. Teekay Tankers is a publicly traded, Bermuda-based limited partnership formed in December 2007. The company is a subsidiary of Teekay Corporation. Teekay Tankers’ competitors include GasLog Partners LP, Genesis Energy LP, and Teekay Corp.

– GasLog Partners LP ($NYSE:GLOP)

As of 2022, GasLog Partners LP has a market cap of 422.38M and a Return on Equity of 1.47%. The company is involved in the ownership, operation, and management of liquefied natural gas carriers.

– Genesis Energy LP ($NYSE:GEL)

Genesis Energy, LP is a publicly traded midstream energy company with operations in the Gulf Coast and Rocky Mountain regions of the United States. The company’s market capitalization is $1.25 billion as of 2022, and its return on equity is 10.05%. Genesis Energy’s business is focused on the transportation, storage, and marketing of crude oil, natural gas liquids, and refined products. The company also owns and operates a network of pipelines and terminals.

– Teekay Corp ($NYSE:TK)

Teekay Corporation is a international provider of marine transportation, shipping services, and energy production. The company operates a diversified fleet of over 200 vessels that provide crude oil, natural gas, and liquefied natural gas transportation services to major oil and gas companies, utilities, and other industries. Teekay also has a majority ownership stake in a number of shipyards, which allows the company to control the construction and delivery of new vessels. In addition to its shipping operations, Teekay owns and operates a number of offshore oil and gas production assets.

Teekay’s market capitalization is $396.28 million as of 2022. The company’s return on equity is -10.2%. Teekay Corporation is a international provider of marine transportation, shipping services, and energy production. The company operates a diversified fleet of over 200 vessels that provide crude oil, natural gas, and liquefied natural gas transportation services to major oil and gas companies, utilities, and other industries. Teekay also has a majority ownership stake in a number of shipyards, which allows the company to control the construction and delivery of new vessels. In addition to its shipping operations, Teekay owns and operates a number of offshore oil and gas production assets.

Summary

TEEKAY TANKERS has experienced a significant growth in its financial performance, with total revenue for the second quarter in FY2023 rising to USD 370.6 million, a 52.9% improvement from the same period in the previous year. Net income increased significantly as well, from 28.6 million to 151.2 million. This signals a strong and positive outlook for investors in TEEKAY TANKERS, with the company poised to deliver increasing returns over time. As such, TEEKAY TANKERS represents a solid investment opportunity for those looking to capitalize on its current and future growth.

Recent Posts