SYSCO CORPORATION Reports Fourth Quarter Financial Results for FY2023

August 20, 2023

🌥️Earnings Overview

SYSCO CORPORATION ($NYSE:SYY) released their financial results for the fourth quarter of FY2023, ending on June 30 2023, on August 1 2023. Year-over-year total revenue increased by 4.1%, amounting to USD 19728.2 million, and net income rose 43.9%, totaling USD 733.7 million.

Market Price

The company’s stock opened the day at $76.9, and closed at $76.2, down by 0.2% from their last closing price of $76.3. The dividend represents a 3% improvement over the previous year’s dividend payout. The company is expected to continue to benefit from its consistent focus on efficiency and cost-cutting measures in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sysco Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 76.32k | 1.77k | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sysco Corporation. More…

| Operations | Investing | Financing |

| 2.87k | -784.61 | -2.06k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sysco Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 22.82k | 20.78k | 3.98 |

Key Ratios Snapshot

Some of the financial key ratios for Sysco Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.0% | 59.5% | 3.7% |

| FCF Margin | ROE | ROA |

| 2.7% | 98.1% | 7.7% |

Analysis

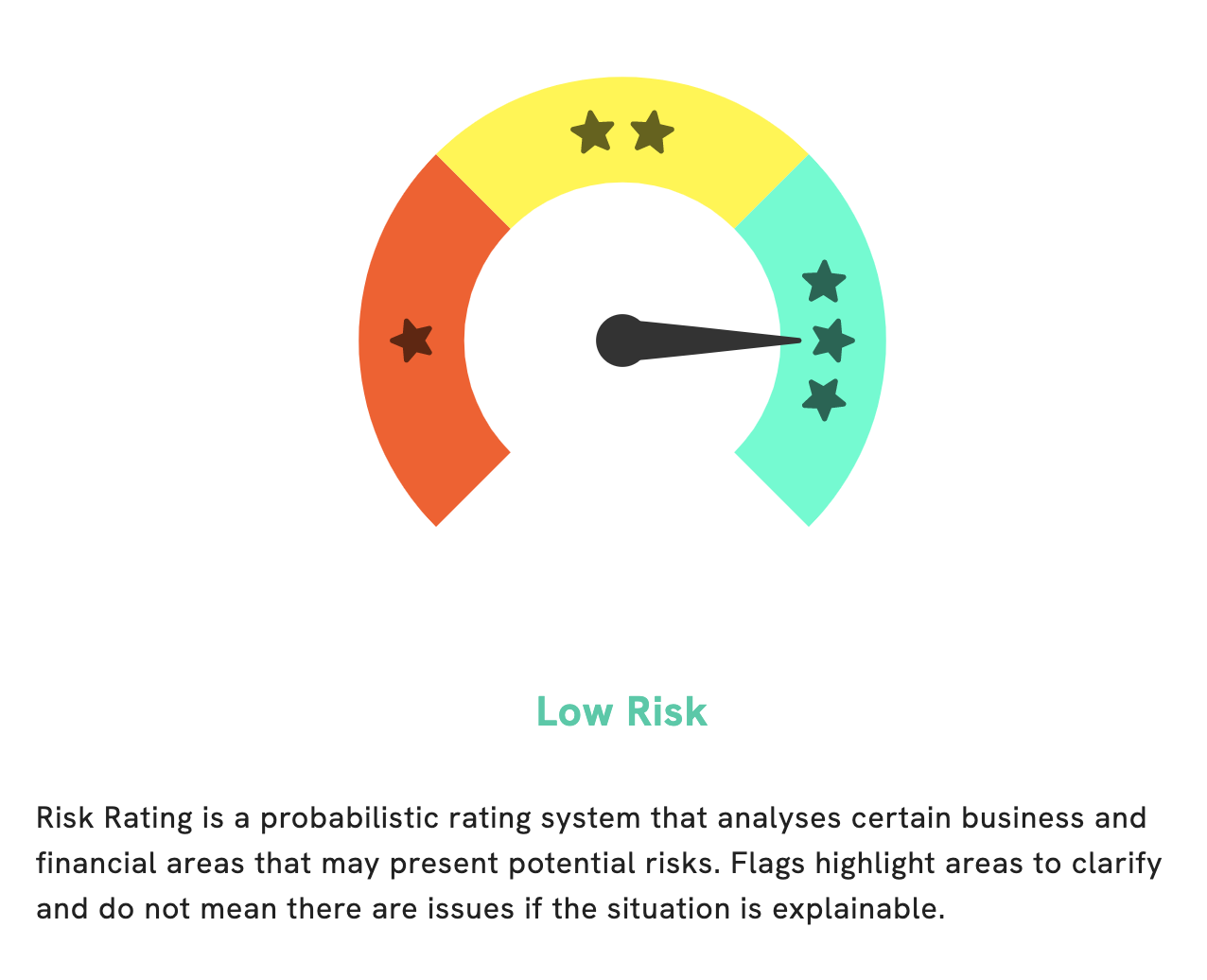

GoodWhale has conducted an analysis of SYSCO CORPORATION’s financials and based on its Risk Rating, SYSCO CORPORATION is deemed as a low risk investment in terms of financial and business aspects. Despite the low risk rating, our analysis has also detected one risk warning in non-financial aspects. If you are interested to know more about this warning, please register on GoodWhale.com to check it out. We are more than happy to provide you with further information. More…

Peers

Sysco Corp is in competition with US Foods Holding Corp, Performance Food Group Co, Sligro Food Group NV. Sysco is the largest foodservice distributor in North America with a market share of approximately 22 percent. The company operates approximately 330 distribution facilities serving approximately 425,000 customers.

– US Foods Holding Corp ($NYSE:USFD)

With a market cap of $6.65 billion as of 2022, US Foods Holding Corp is a foodservice distribution company that offers a broad range of food and non-food products to customers in the United States. The company operates through three segments: Foodservice, Retail, and E-commerce. The Foodservice segment provides products and services to restaurants, hotels, healthcare facilities, government entities, and educational institutions. The Retail segment offers products through a network of retail grocery stores, including supermarkets, supercenters, and convenience stores. The E-commerce segment provides products and services through an online platform.

– Performance Food Group Co ($NYSE:PFGC)

In 2022, Performance Food Group Co had a market cap of 8.2B and a ROE of 6.73%. The company is a foodservice distributor that delivers food and related products to restaurants, schools, healthcare facilities, and other customers in the United States.

– Sligro Food Group NV ($LTS:0MKM)

Sligro Food Group NV is a Dutch food retailing and wholesale company. The company has a market cap of 650.19M as of 2022 and a Return on Equity of 8.07%. Sligro Food Group NV is involved in the food retailing and wholesale business. The company operates supermarkets, hypermarkets, and convenience stores in the Netherlands, Belgium, and Luxembourg.

Summary

SYSCO Corporation had a strong fourth quarter, ending June 30 2023, with total revenue rising 4.1% year over year to USD 19728.2 million and net income increasing 43.9% to USD 733.7 million. This indicates that SYSCO has been able to capitalize on a positive economic environment and grow despite the challenging climate of the last few years. Investors looking to benefit from SYSCO’s success should evaluate the company’s fundamentals to determine whether it is an attractive long-term investment. A close examination of their financial statements, management team, and competitive landscape will help investors determine the most profitable strategy for investing in SYSCO.

Recent Posts