SYSCO CORPORATION Reports Fourth Quarter Earnings Results for FY2023

August 24, 2023

🌥️Earnings Overview

SYSCO CORPORATION ($NYSE:SYY) reported an impressive increase in its earnings results for the fourth quarter of FY2023, which concluded on June 30 2023. Revenue surged by 4.1% to USD 19728.2 million compared to the same quarter in the preceding year. Net income rose dramatically by 43.9% to USD 733.7 million on a year-over-year basis.

Stock Price

Their stock opened at $76.9 and closed at $76.2, down by 0.2% from the prior closing price of 76.3. SYSCO CORPORATION cited strong demand from their core customer base as a primary driver of revenue growth. Additionally, SYSCO’s digital transformation initiatives have been successful in helping to drive top-line growth and cost efficiencies. Overall, SYSCO’s results indicate that the company is continuing to grow despite the challenging macroeconomic environment, making it an attractive option for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sysco Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 76.32k | 1.77k | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sysco Corporation. More…

| Operations | Investing | Financing |

| 2.87k | -784.61 | -2.06k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sysco Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 22.82k | 20.78k | 3.98 |

Key Ratios Snapshot

Some of the financial key ratios for Sysco Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.0% | 59.5% | 3.7% |

| FCF Margin | ROE | ROA |

| 2.7% | 98.1% | 7.7% |

Analysis

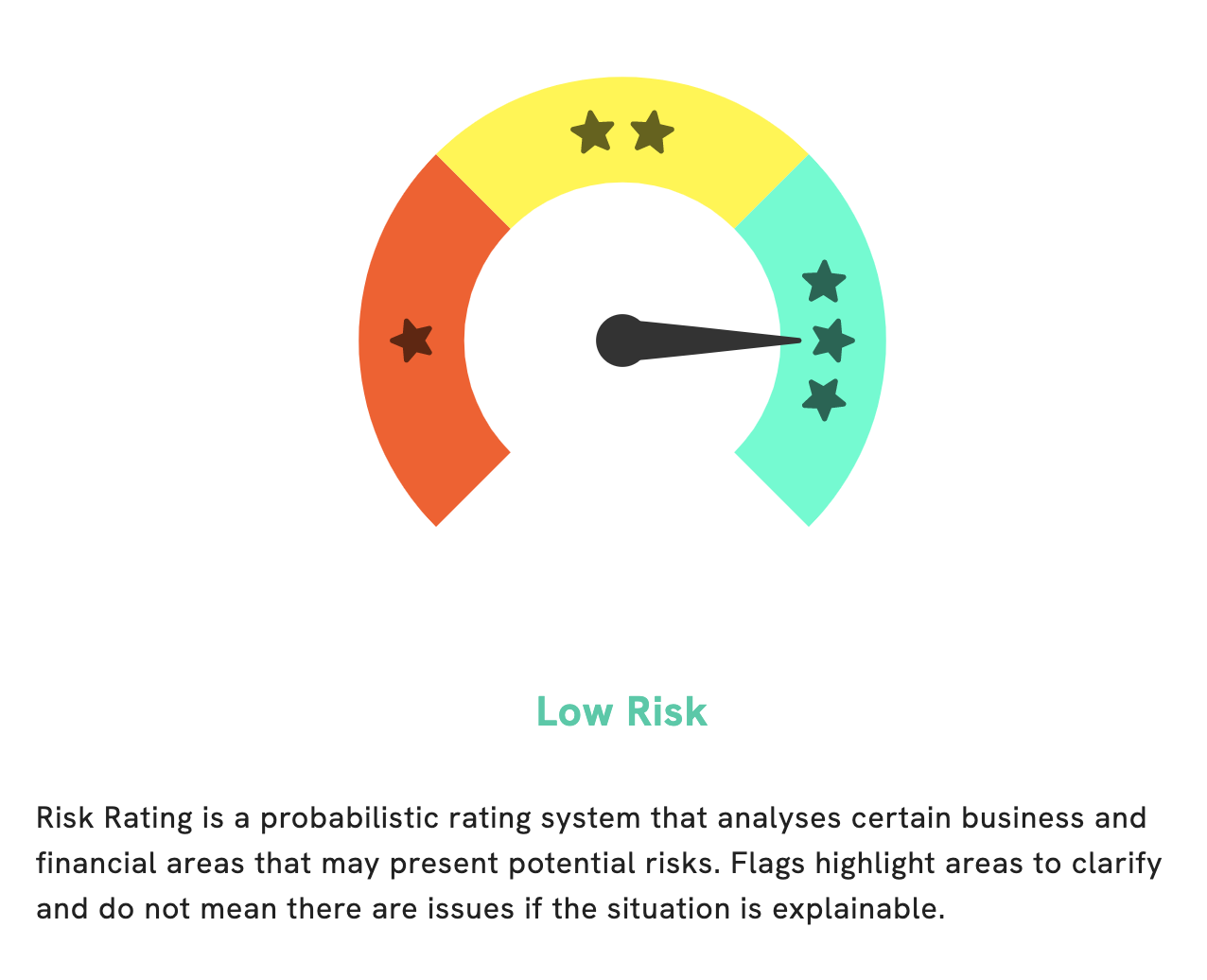

At GoodWhale, we recently conducted an analysis of SYSCO CORPORATION‘s wellbeing. We assessed the company in terms of financial and business aspects and determined that SYSCO CORPORATION is a low risk investment with a Risk Rating of 3. Moreover, while conducting our analysis, we detected one risk warning in the non-financial category. To access this information, we invite you to register with us here at GoodWhale. We hope you take the opportunity to assess SYSCO CORPORATION’s wellbeing in full detail. GoodWhale wishes you the best of luck in your investment decisions. More…

Peers

Sysco Corp is in competition with US Foods Holding Corp, Performance Food Group Co, Sligro Food Group NV. Sysco is the largest foodservice distributor in North America with a market share of approximately 22 percent. The company operates approximately 330 distribution facilities serving approximately 425,000 customers.

– US Foods Holding Corp ($NYSE:USFD)

With a market cap of $6.65 billion as of 2022, US Foods Holding Corp is a foodservice distribution company that offers a broad range of food and non-food products to customers in the United States. The company operates through three segments: Foodservice, Retail, and E-commerce. The Foodservice segment provides products and services to restaurants, hotels, healthcare facilities, government entities, and educational institutions. The Retail segment offers products through a network of retail grocery stores, including supermarkets, supercenters, and convenience stores. The E-commerce segment provides products and services through an online platform.

– Performance Food Group Co ($NYSE:PFGC)

In 2022, Performance Food Group Co had a market cap of 8.2B and a ROE of 6.73%. The company is a foodservice distributor that delivers food and related products to restaurants, schools, healthcare facilities, and other customers in the United States.

– Sligro Food Group NV ($LTS:0MKM)

Sligro Food Group NV is a Dutch food retailing and wholesale company. The company has a market cap of 650.19M as of 2022 and a Return on Equity of 8.07%. Sligro Food Group NV is involved in the food retailing and wholesale business. The company operates supermarkets, hypermarkets, and convenience stores in the Netherlands, Belgium, and Luxembourg.

Summary

Investors in SYSCO CORPORATION have been rewarded with strong financial performance as the company reported its fourth quarter of FY2023 earning results. Total revenue rose 4.1% year-over-year to USD 19728.2 million and net income surged 43.9% to USD 733.7 million. This demonstrates the company’s ability to maintain positive momentum in its operations and deliver consistently impressive results over time. As a result, investors should be optimistic about the prospects of SYSCO going forward.

Recent Posts