STANTEC INC Reports Record Q4 Earnings for 2022-2023 Fiscal Year

March 13, 2023

Earnings Overview

On February 22 2023, STANTEC INC ($TSX:STN) reported its earnings results for the fourth quarter of fiscal year 2022, ending December 31 2022. Total revenue was CAD 73.5 million, a 342.8% increase compared to the same period of the previous year. The net income was CAD 1513.5 million, a 27.7% year-over-year increase.

Price History

On Wednesday, STANTEC INC reported its highest quarterly earnings in its 2022-2023 fiscal year. The firm opened at CA$71.9 and closed at CA$71.0, a decrease of 1.0% from the previous closing price of CA$71.7. The strong performance was supported by a strong project pipeline and increased demand for the firm’s services. This was largely due to an increase in infrastructure and commercial projects, as well as an increase in activity in the oil and gas sector.

This indicates that the firm is well-positioned to continue its performance into the next quarter and beyond. With a strong balance sheet and a diversified portfolio of services and projects, STANTEC INC is well-positioned for continued financial success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stantec Inc. More…

| Total Revenues | Net Income | Net Margin |

| 5.68k | 247 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stantec Inc. More…

| Operations | Investing | Financing |

| 304.3 | -73.8 | -296.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stantec Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.65k | 3.37k | 20.63 |

Key Ratios Snapshot

Some of the financial key ratios for Stantec Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 5.4% | 7.0% |

| FCF Margin | ROE | ROA |

| 4.0% | 11.0% | 4.4% |

Analysis

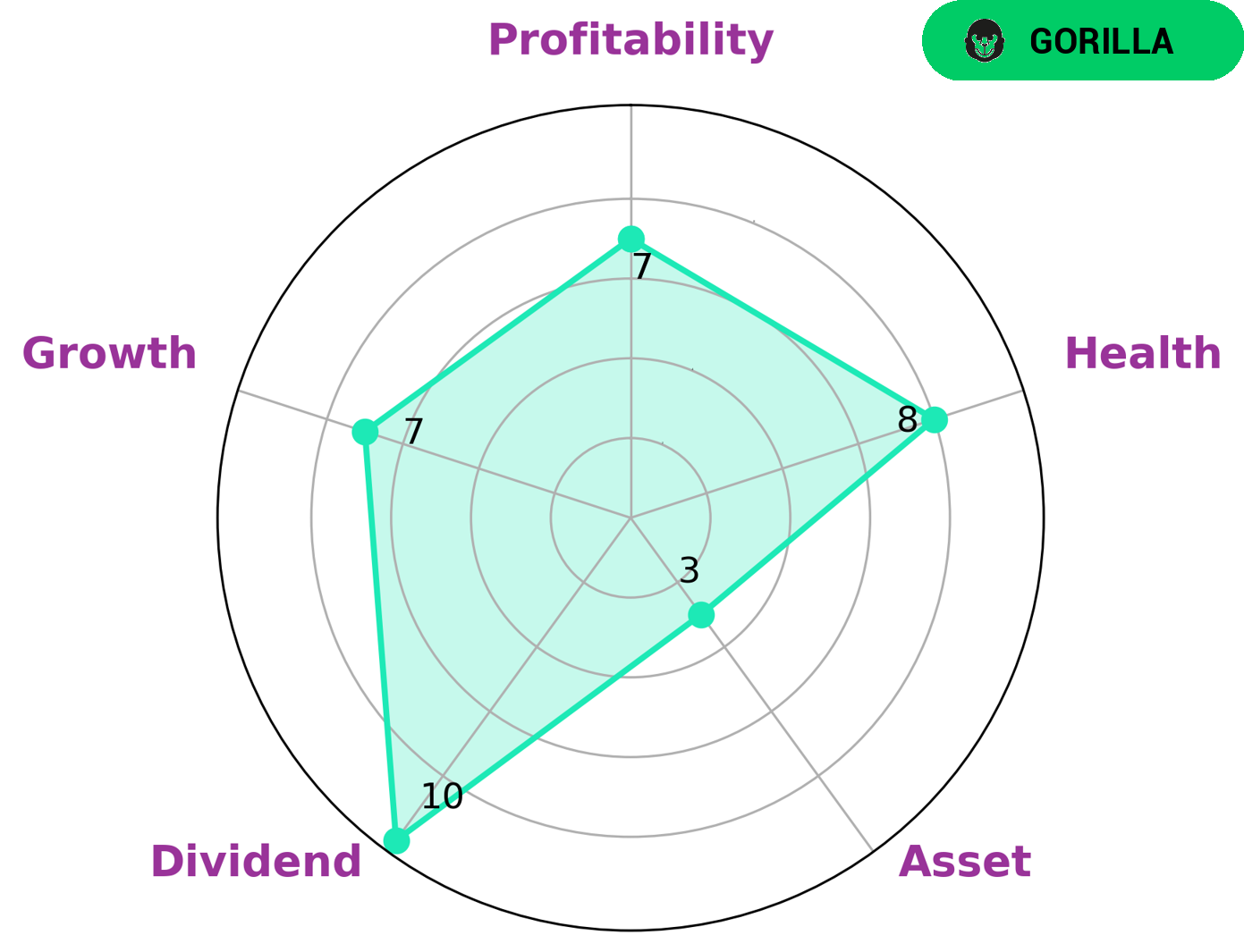

Our analysis of STANTEC INC‘s fundamentals has showed that the company is strong in dividend, growth, and profitability. However, it is weaker in terms of asset. Despite this, STANTEC INC still has a high health score of 8/10, which suggests that it is able to safely ride out any economic crisis without the risk of bankruptcy. Furthermore, our analysis has also indicated that STANTEC INC is a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for a stable and reliable company with high dividend potential and strong competitive advantage may be interested in investing in STANTEC INC. The company is well-positioned to weather any economic crisis, due to its strong fundamentals and high health score. With its strong growth and profitability, STANTEC INC may be an attractive option for investors looking for a steady stream of returns. More…

Peers

The company has a strong presence in North America and Europe and has completed many large-scale projects. Stantec’s competitors include Team Consulting Engineering and Management PCL, JSTI Group, and Dhruv Consultancy Services Ltd. All of these companies are large, well-established firms with a strong track record in the engineering and construction industry.

– Team Consulting Engineering and Management PCL ($SZSE:300284)

With a market cap of 7.2B as of 2022 and a return on equity of 5.66%, JSTI Group is a publicly traded company that provides various services including but not limited to engineering, construction, and project management. The company has a wide range of clients including government agencies and private companies. JSTI Group has been in business for over 50 years and has a strong reputation in the engineering and construction industry.

– JSTI Group ($BSE:541302)

Dhruv Consultancy Services Ltd is an engineering consultancy firm based in India. The company has a market capitalisation of 889.15 million as of 2022 and a return on equity of 10.73%. The company provides engineering and project management services to clients in the oil and gas, power, and infrastructure sectors. The company has offices in Mumbai, Delhi, Pune, and Bangalore.

Summary

STANTEC INC had a very successful end to their fiscal year 2022, reporting total revenue of CAD 73.5 million, representing a 342.8% increase compared to the same period of the previous year. Net income also increased year over year by 27.7%, up to CAD 1513.5 million. This performance is a positive sign for potential investors, indicating STANTEC INC’s strong financial health as well as strong potential for future growth. Investors should consider STANTEC INC as an attractive investment option given their impressive financial performance and growth prospects.

Recent Posts