SPECTRUM BRANDS Reports First Quarter FY2023 Earnings Results for Period Ending February 10, 2023

February 15, 2023

Earnings report

On December 31, 2022, SPECTRUM BRANDS ($NYSE:SPB) reported its earnings results for the first quarter of FY2023, ending February 10, 2023. Total revenue for the quarter was USD -20.9 million, a decrease of 354.9% year-over-year. This was due to market fluctuations and decreased consumer spending. Net income for the quarter was USD 713.3 million, a decline of 5.8% year-over-year. The decrease in net income is attributed to a decrease in operating margin due to increased costs of goods sold and higher overhead expenses.

Despite this decrease, the company said it was able to cut costs and improve efficiencies in order to reduce its net losses over the quarter. These increases were largely attributed to improved collections performance and more effective working capital management. SPECTRUM BRANDS is confident that the measures taken during the first quarter, along with continued cost containment efforts and cash management initiatives, will allow it to return to profitability in the upcoming quarters.

Price History

The company opened at $63.1 per share and closed the day with a price of $64.1, a 0.2% decrease from the prior closing price of $64.2. This was the first quarter of fiscal year 2023 to report earnings results, providing a better indication of the company’s expected performance over the course of the year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Spectrum Brands. More…

| Total Revenues | Net Income | Net Margin |

| 3.09k | 42.5 | -3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Spectrum Brands. More…

| Operations | Investing | Financing |

| 153.1 | -354.4 | 234.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Spectrum Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.77k | 4.53k | 30.07 |

Key Ratios Snapshot

Some of the financial key ratios for Spectrum Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.6% | -14.7% | 0.5% |

| FCF Margin | ROE | ROA |

| 3.0% | 0.7% | 0.2% |

Analysis

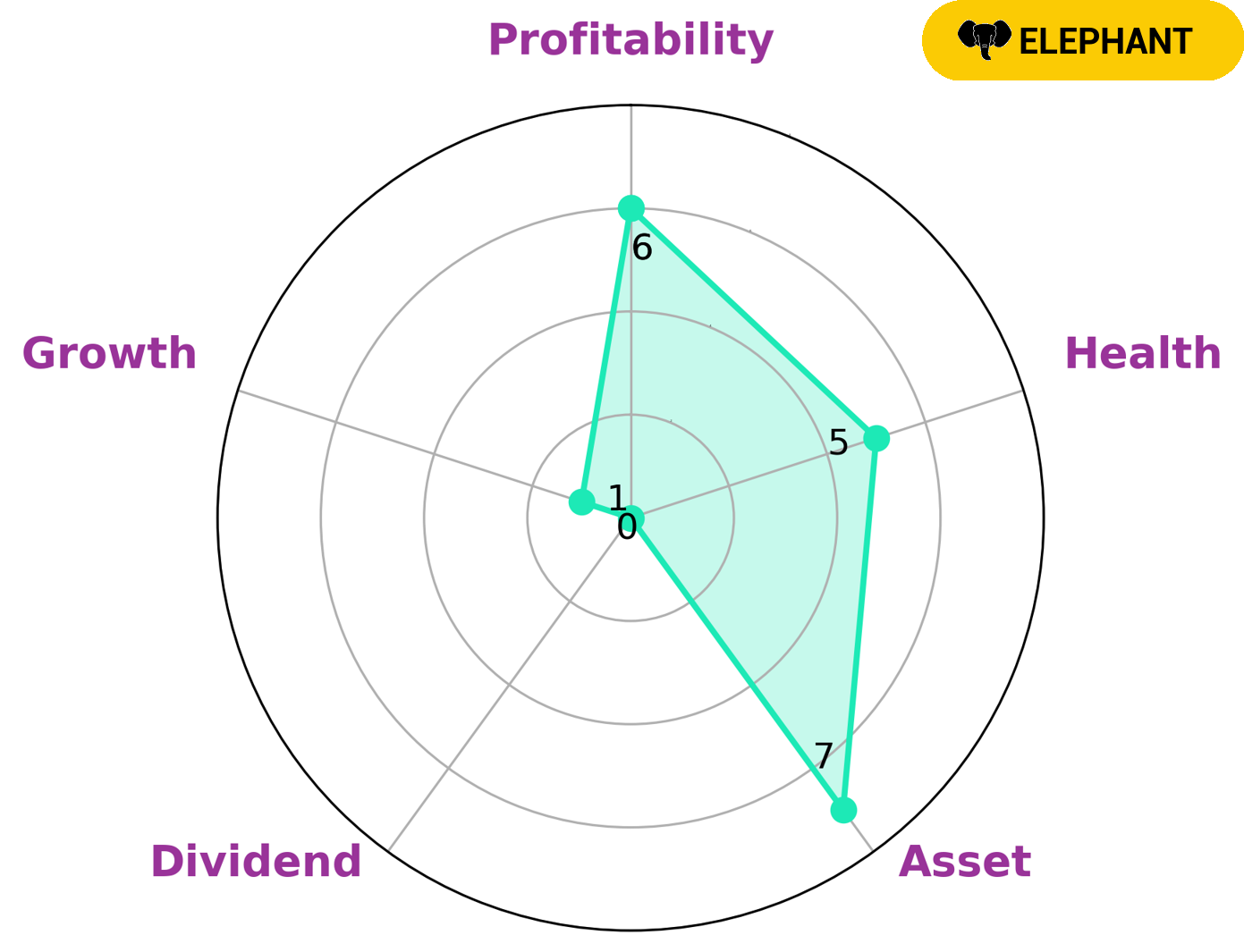

GoodWhale’s analysis of SPECTRUM BRANDS reveals that it is strong in asset, medium in profitability and weak in dividend and growth. This indicates that SPECTRUM BRANDS is classified as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. Our star chart analysis further reveals that the company has an intermediate health score of 5/10 considering its cashflows and debt. This suggests that SPECTRUM BRANDS is likely to safely ride out any crisis without the risk of bankruptcy. From an investment standpoint, SPECTRUM BRANDS may be attractive to long-term investors looking for a company with a stable asset base and a moderate return on investment. The company may also be appealing to investors who are confident in the company’s ability to weather any market downturns without incurring significant losses. More…

Peers

Despite the intense competition, Spectrum Brands Holdings Inc has been able to remain a top player in the industry by focusing on innovation, customer service, and providing high-quality products at competitive prices.

– Godrej Consumer Products Ltd ($BSE:532424)

Godrej Consumer Products Ltd is a leading Indian fast-moving consumer goods company, headquartered in Mumbai. It manufactures and markets a wide range of products across food, personal care, and home care segments. The company has a market cap of 937.97B as of 2023, which is indicative of its strong performance in the market. Its Return on Equity (ROE), which is an indicator of how effectively the company uses its shareholders’ equity to generate profits, is 10.44%. This high ROE reflects the company’s ability to generate profits for its shareholders.

– Ontex Group NV ($OTCPK:ONXYY)

Ontex Group NV is a leading global hygiene company with over 20 years of experience in the hygiene and personal care market. It is headquartered in Belgium and serves markets in Europe, Africa, Latin America, the Middle East, and Asia Pacific. The company’s market cap as of 2023 stands at 593.34M, indicating a strong financial standing in the market. Its Return on Equity (ROE) is -7.25%, which is a measure of how efficient the company utilizes its assets to generate profits. Ontex Group NV is engaged in the production, distribution and marketing of products such as baby diapers, adult incontinence products, feminine care products, and wet wipes.

– Henkel AG & Co KGaA ($OTCPK:HENOY)

Henkel AG & Co KGaA is a multinational consumer goods company based in Düsseldorf, Germany. It specializes in the production of laundry detergents, beauty care products, and adhesives, among other products. As of 2023, the company’s market capitalization was 28.76 billion euros. This figure reflects the company’s success in increasing shareholder value over the past year. Henkel’s return on equity (ROE) was 4.84%, which indicates that the company is efficiently utilizing its assets to generate a return. Henkel’s strong financial performance is testament to its business model and commitment to innovation.

Summary

Spectrum Brands reported a total revenue of -20.9 million USD for the quarter, which is a decrease of 354.9% compared to the same quarter last year. Net income for the quarter was 713.3 million USD, which is 5.8% lower compared to the same period last year. The significant decrease in total revenue indicates that investors should be cautious when considering investing in Spectrum Brands. Especially in the short-term, it is important for investors to carefully evaluate the performance of the company before investing.

Recent Posts